A Sacramento California Charitable Gift Annuity is a philanthropic vehicle that allows individuals to donate money or assets to a charitable organization based in Sacramento, California, while receiving regular fixed payments for life. This type of annuity provides a win-win situation by benefiting both the donor and the charitable institution. Charitable Gift Annuities are structured arrangements where donors transfer their assets, such as cash, securities, or real estate, to a charitable organization. In return, the donor receives a guaranteed fixed income for life or a specific term, which is typically higher than the returns from other investment options. The donor also enjoys immediate tax benefits, such as an income tax deduction based on the charitable gift portion. By establishing a Sacramento California Charitable Gift Annuity, donors support causes they care about, such as education, healthcare, the environment, or community development in the Sacramento area. The charitable organization utilizes the donated funds to further its mission and make a positive impact on the community or specific projects in Sacramento. Sacramento California Charitable Gift Annuities offer flexibility in terms of the donation amount, payout rate, and the timing of payments. Donors can choose to receive payments immediately or defer them to a later date, making it a useful tool for retirement planning. In addition to regular payments, donors may also benefit from potential capital gains tax savings, depending on the assets donated. There are various types of Sacramento California Charitable Gift Annuities available to donors, including single-life annuities, which provide payments to a single individual, and joint-life annuities, which allow payments to two individuals (typically spouses). These options provide versatility based on the donor's specific requirements and goals. Overall, a Sacramento California Charitable Gift Annuity presents a mutually beneficial opportunity for individuals seeking to support charitable causes in Sacramento while ensuring financial security for themselves or their loved ones. By leveraging the tax advantages and income potential, donors can make a meaningful impact in their community for years to come.

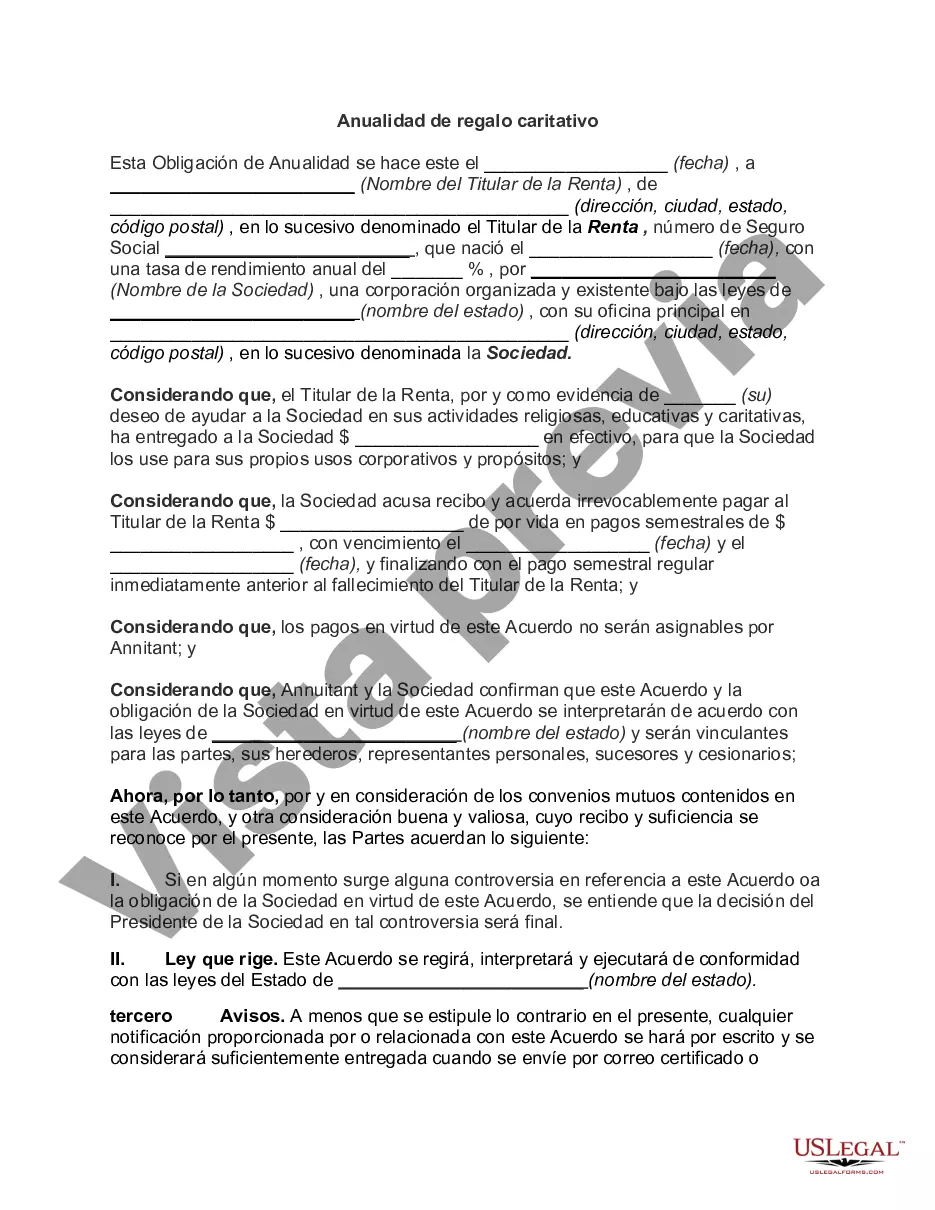

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Sacramento California Anualidad De Regalo Caritativo?

Preparing papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Sacramento Charitable Gift Annuity without professional assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Sacramento Charitable Gift Annuity on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Sacramento Charitable Gift Annuity:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!