A San Diego California Charitable Gift Annuity refers to a philanthropic financial tool that allows individuals to support charitable causes in San Diego while receiving a guaranteed stream of income for life. It is a mutually beneficial arrangement where donors can make a significant impact on charitable organizations in San Diego, while also receiving financial benefits. A Charitable Gift Annuity involves transferring assets such as cash, securities, or real estate to a charitable organization in San Diego, which in turn agrees to make fixed annuity payments to the donor for their lifetime. These payments are typically based on the donor's age, with older individuals receiving higher annuity rates. The annuity payments received through a Charitable Gift Annuity can provide donors with a consistent income stream, which may be particularly appealing to individuals who are seeking reliable financial support during their retirement years. Donors also benefit from various tax advantages, including a charitable income tax deduction and potential reduction in capital gains taxes. In San Diego, there may be different types of Charitable Gift Annuities available, including immediate and deferred options. An immediate gift annuity provides regular income payments to the donor starting immediately after the gift is made. On the other hand, a deferred gift annuity allows donors to make contributions now and defer the start of annuity payments to a later date, typically to align with their retirement needs. By designating San Diego as the beneficiary of a Charitable Gift Annuity, individuals can make a positive impact on a variety of causes in the region. These include but are not limited to youth programs, education initiatives, healthcare services, environmental conservation, arts and culture, and social welfare programs. In summary, a San Diego California Charitable Gift Annuity enables philanthropically inclined individuals to contribute to the betterment of their community while enjoying the financial benefits of a reliable income stream. The opportunity to support a cause close to their heart in San Diego through an annuity arrangement can be an excellent way for individuals to leave a lasting legacy and make a difference in the lives of others.

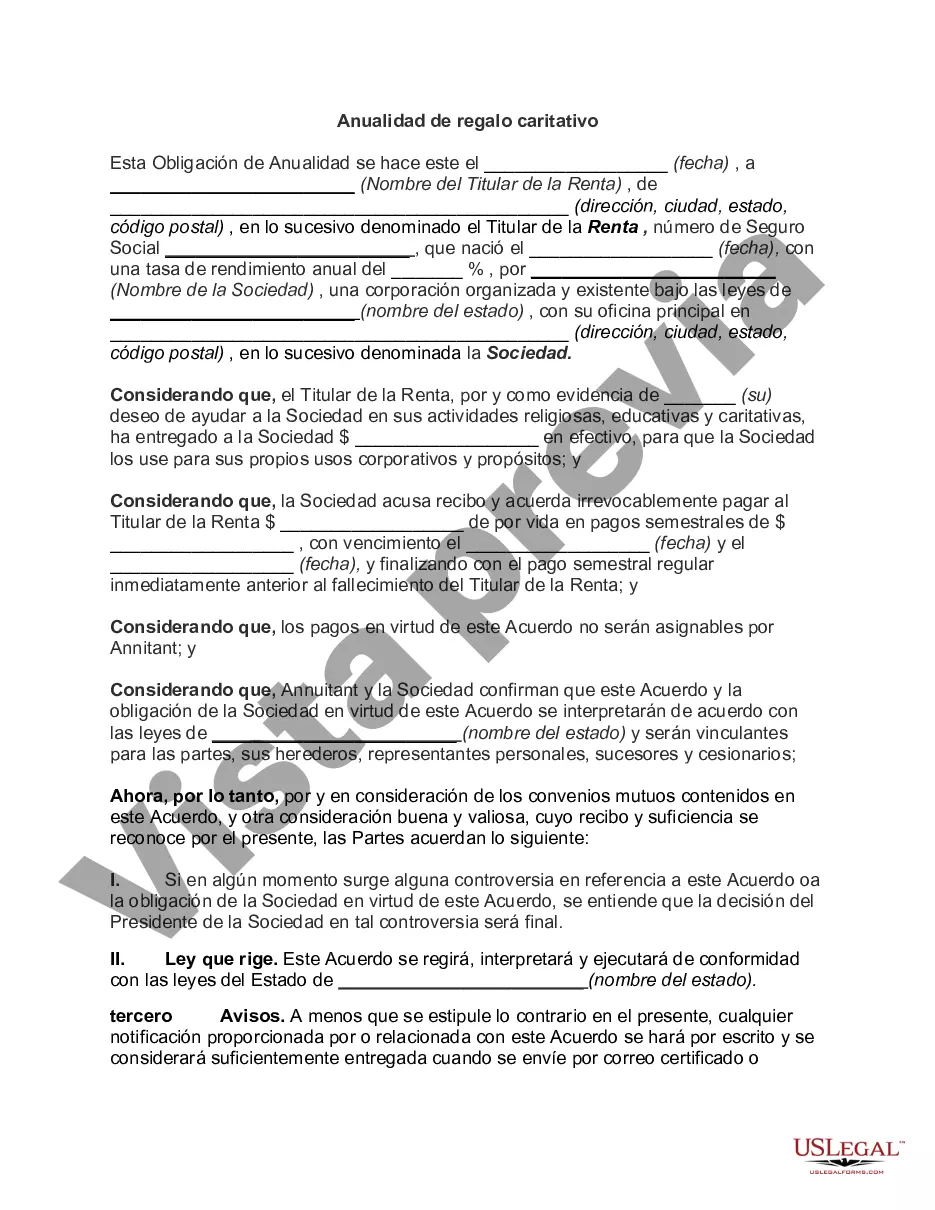

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out San Diego California Anualidad De Regalo Caritativo?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, finding a San Diego Charitable Gift Annuity meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the San Diego Charitable Gift Annuity, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your San Diego Charitable Gift Annuity:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Charitable Gift Annuity.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!