Tarrant Texas Charitable Gift Annuity is a unique financial planning tool that provides individuals an opportunity to make a charitable donation while securing a steady income stream for themselves or their loved ones. It is a mutually beneficial arrangement where a donor transfers assets to a qualified charitable organization like Tarrant Texas to establish a charitable gift annuity. A Tarrant Texas Charitable Gift Annuity offers several key advantages, making it an attractive option for philanthropically inclined individuals. First and foremost, it allows donors to support causes they care about deeply, as the gift goes directly to Tarrant Texas, which uses it to fund its various charitable programs and initiatives. This enables donors to have a lasting impact on their community and beyond. In return for the donation, Tarrant Texas promises to pay the donor a fixed income for life, providing a reliable and stable source of income. The annuity payments are determined based on various factors such as the age of the donor at the time of the gift, the total amount of the donation, and prevailing interest rates. This ensures that the donor can enjoy a predictable income stream that is not affected by market fluctuations. Moreover, donors can also benefit from significant tax advantages through a Tarrant Texas Charitable Gift Annuity. A portion of the donation is typically tax-deductible, potentially reducing the donor's income tax liability. Additionally, a portion of the annuity income received may be tax-free, further enhancing the financial benefits of this charitable giving strategy. It's important to note that there are different types of Charitable Gift Annuities available to donors in Tarrant Texas. These include immediate charitable gift annuities, where the annuity payments start right away, and deferred charitable gift annuities, where the annuity payments are delayed until a later specified date. Donors can choose the type that best suits their financial goals and circumstances. When considering a Tarrant Texas Charitable Gift Annuity, individuals should consult with a qualified financial advisor to discuss their specific situation, goals, and potential tax implications. The advisor can guide them in understanding the various options available and help them structure a gift annuity that aligns with their philanthropic and financial objectives. In conclusion, a Tarrant Texas Charitable Gift Annuity is a powerful tool that combines philanthropy with financial planning. By making a charitable donation, individuals can support Tarrant Texas's charitable endeavors while enjoying a reliable income stream and potentially receiving tax benefits. It is a win-win solution for those seeking to make a lasting impact while securing their financial future.

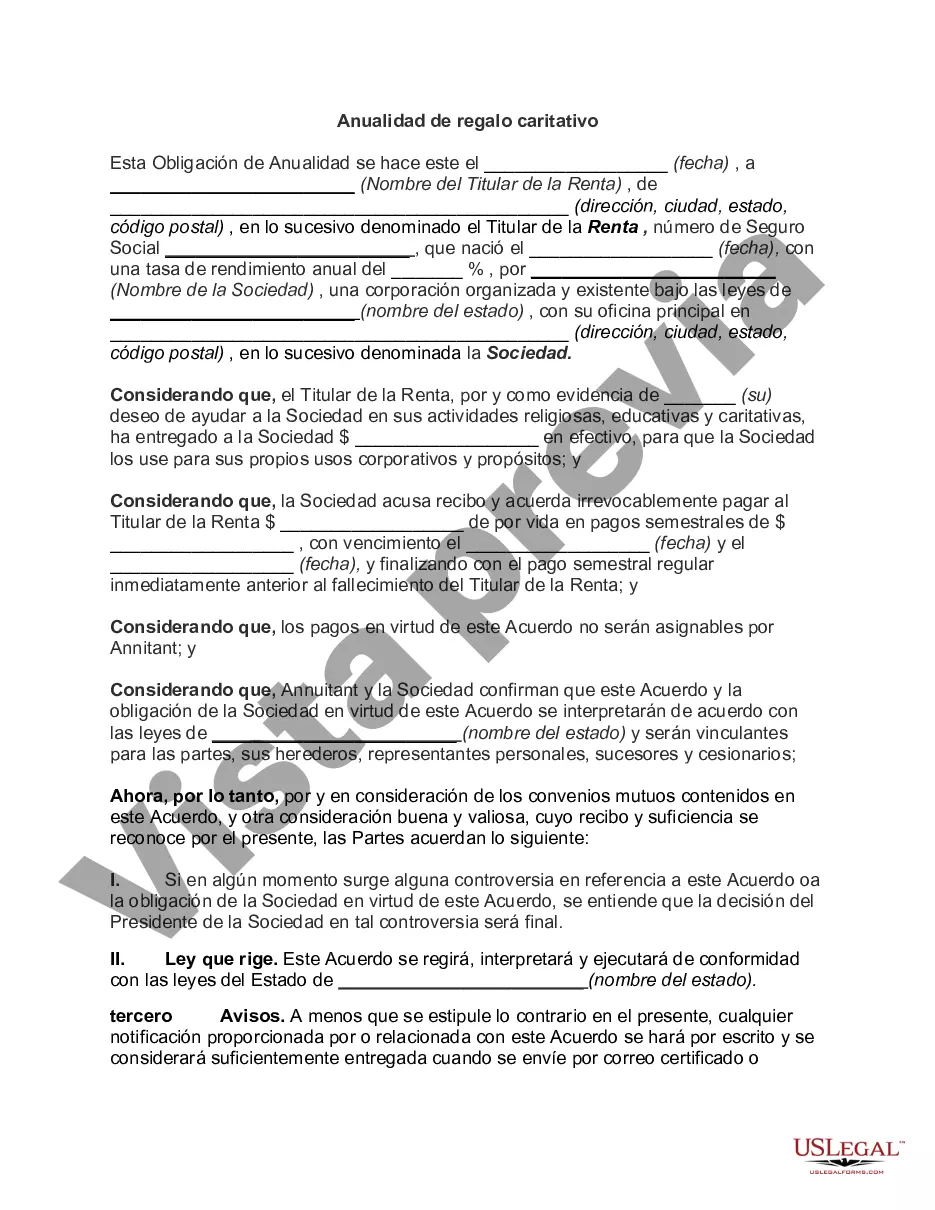

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Tarrant Texas Anualidad De Regalo Caritativo?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Tarrant Charitable Gift Annuity is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Tarrant Charitable Gift Annuity. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Charitable Gift Annuity in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!