Travis Texas Charitable Gift Annuity is a financial tool designed for individuals who intend to make a donation to a charitable organization while also seeking to secure a steady income stream for their retirement. This charitable giving option allows donors to make a significant impact on the causes they care about while enjoying various financial benefits. A Travis Texas Charitable Gift Annuity involves transferring assets, such as cash or appreciated securities, to a charitable organization, typically a nonprofit institution or a foundation. In return, the donor receives a fixed income for life, which is partially tax-free. The annuity payments are based on the donor's age, the gift amount, and the payment rate set by the organization. This type of charitable gift annuity offers several advantages. Firstly, it enables donors to support their favorite charitable causes while receiving a guaranteed income stream, providing financial security during retirement. Secondly, donors may also benefit from a charitable income tax deduction, allowing them to potentially reduce their income tax liability. Additionally, part of the annuity income may be tax-free due to the favorable tax treatment of such annuities. Travis Texas Charitable Gift Annuity offers various options tailored to donors' specific preferences and financial goals. Some of its types include: 1. Single Life Annuity: This type of gift annuity provides an income stream for a single individual until their passing. 2. Joint Life Annuity: A joint life annuity extends benefits to two individuals, typically spouses or partners. The income continues for as long as either individual lives. 3. Deferred Annuity: In a deferred gift annuity, income payments are postponed until a designated future date. This option can be ideal for those planning ahead for planned retirement, estate planning, or maximizing tax benefits. 4. Flexible Annuity: This annuity allows for customized options, giving donors the flexibility to structure annuity payments to meet their specific needs and preferences. It is essential for potential donors to consult with financial advisors or estate planning professionals to understand the specific details, benefits, and tax implications associated with Travis Texas Charitable Gift Annuity. By selecting the most suitable option, individuals can fulfill their philanthropic goals while securing a stable income for their future.

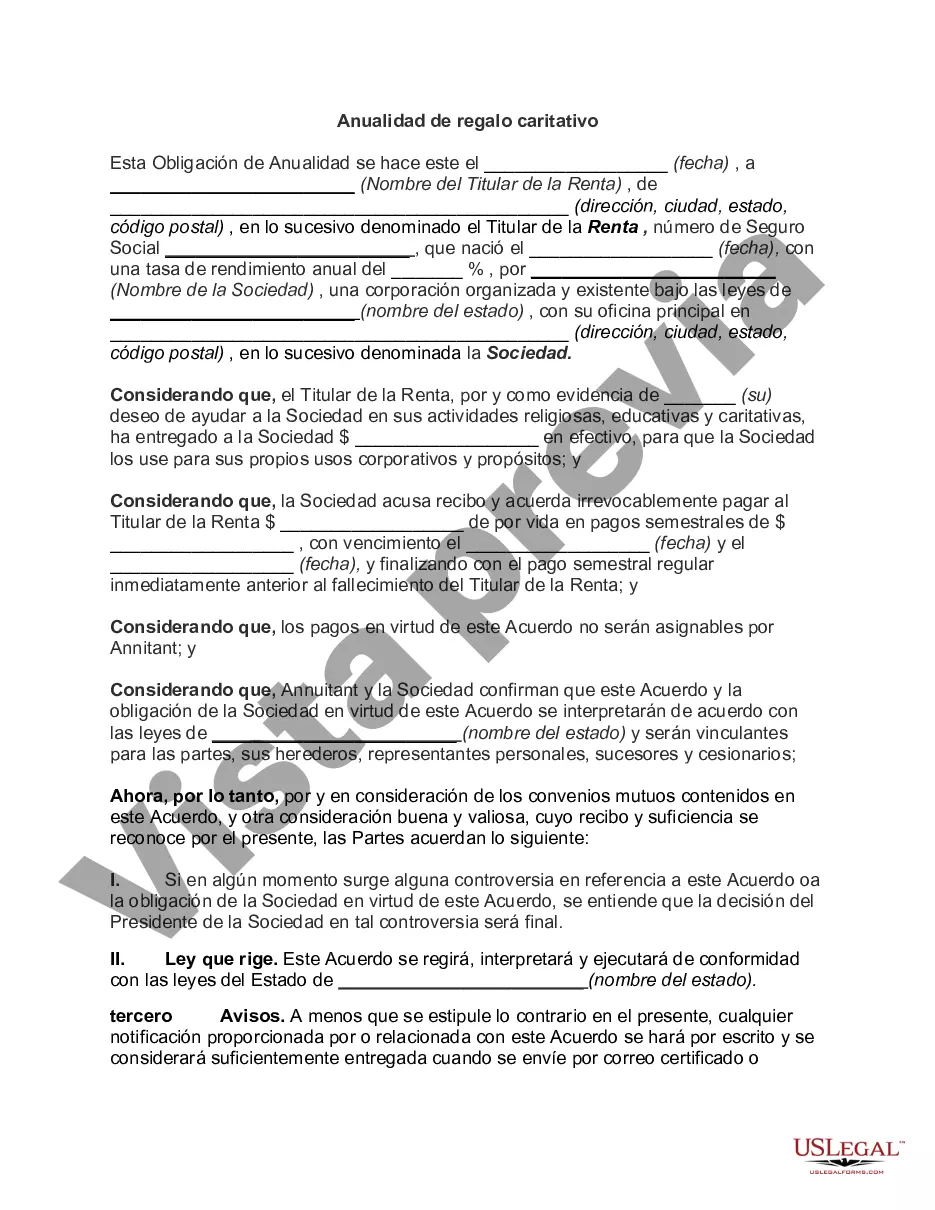

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Travis Texas Anualidad De Regalo Caritativo?

If you need to get a trustworthy legal document provider to find the Travis Charitable Gift Annuity, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to find and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Travis Charitable Gift Annuity, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Travis Charitable Gift Annuity template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Travis Charitable Gift Annuity - all from the convenience of your home.

Join US Legal Forms now!