Collin Texas Specific Guaranty

Description

How to fill out Specific Guaranty?

Whether you intend to launch your venture, engage in an agreement, request your identification renewal, or handle family-related legal matters, you must prepare specific documentation that complies with your local statutes and regulations.

Finding the correct documents can require a significant amount of time and effort unless you utilize the US Legal Forms library.

The platform offers users more than 85,000 professionally created and authenticated legal documents for any personal or business scenario. All files are categorized by state and purpose, making it quick and easy to select a form such as Collin Specific Guaranty.

The forms provided by our website are reusable. With an active subscription, you can access all of your previously acquired documents whenever necessary in the My documents section of your profile. Stop wasting time on a perpetual search for the latest formal documentation. Register for the US Legal Forms platform and maintain your paperwork orderly with the most extensive online form collection!

- Ensure the template matches your specific needs and state law stipulations.

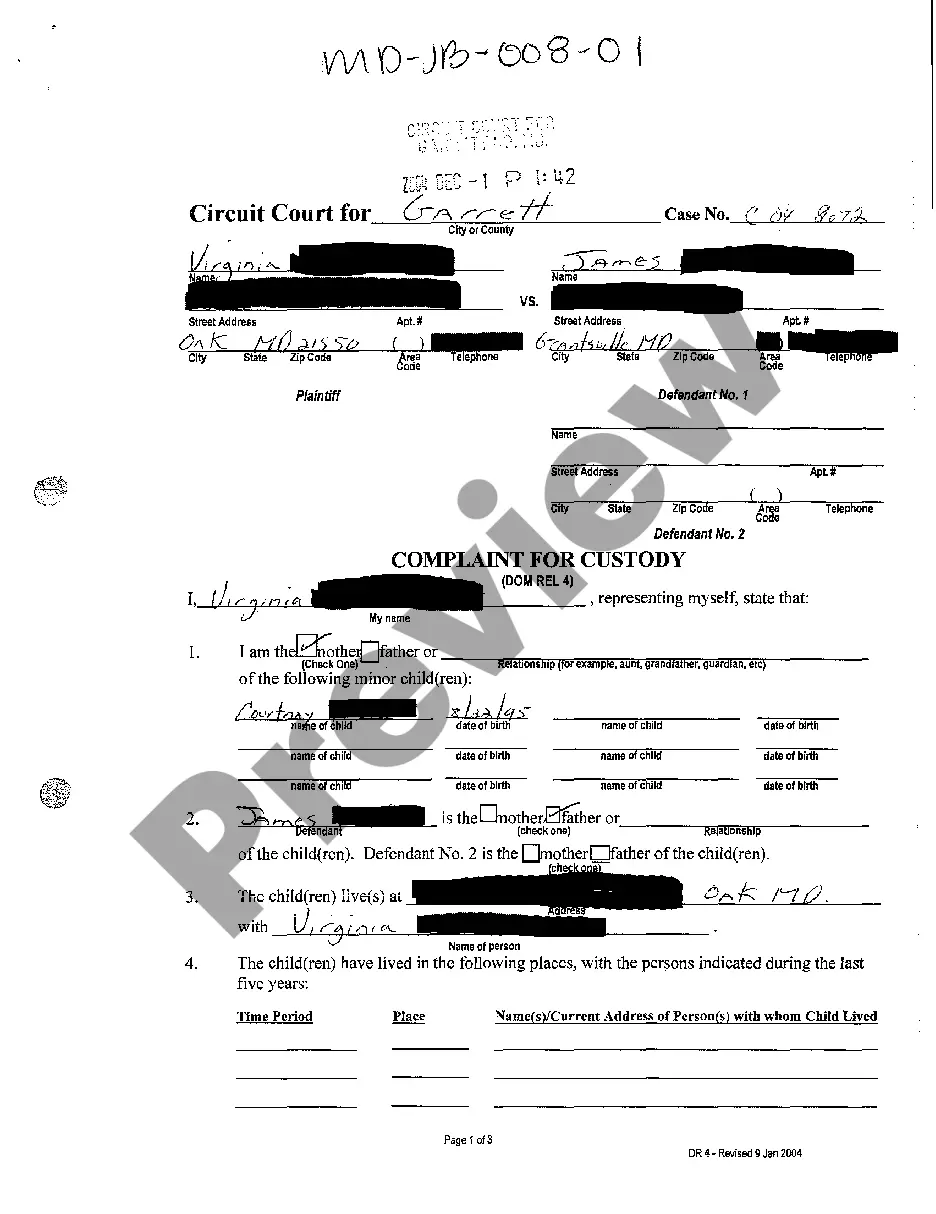

- Review the form description and check the Preview if available on the page.

- Utilize the search function specifying your state above to find another template.

- Click Buy Now to obtain the document once you identify the right one.

- Choose the subscription plan that best fits your requirements to continue.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Collin Specific Guaranty in your desired file format.

- Print the document or fill it out and sign it electronically using an online editor to save time.

Form popularity

FAQ

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

Guaranty is only used as a noun, where it means a promise to pay money if another party does not....For example, The bank requires a binding guaranty from a separate cosigner. A person who signs a guaranty is a guarantor. I regret signing the guaranty for your car; I should have known you would lose your job.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

ANSWER: Guarantee, the broader and more common term, is both a verb and a noun. The narrower term, guaranty, today appears mostly in banking and other financial contexts; it seldom appears in nonlegal writing. Guarantee, vb. 1.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

A person who acts as a guarantor under a GUARANTEE. GUARANTY, contracts. A promise made upon a good consideration, to answer for the payment of some debt, or the performance of some duty, in case of the failure of another person, who is, in the first instance, liable to such payment or performance.

Here, you are saying that you cannot promise that it should be on 9 o'clock. Try something like: I think by 9 o'clock, but I can't guarantee it. The implication is that you are saying: I think we should leave by 9 o'clock, but I can't guarantee that that is correct

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

1 : a promise that something will be or will happen as stated a guarantee against defects. 2 : something given as a promise of payment : security. guarantee. verb. guaranteed; guaranteeing.

Noun, plural guar·an·ties.