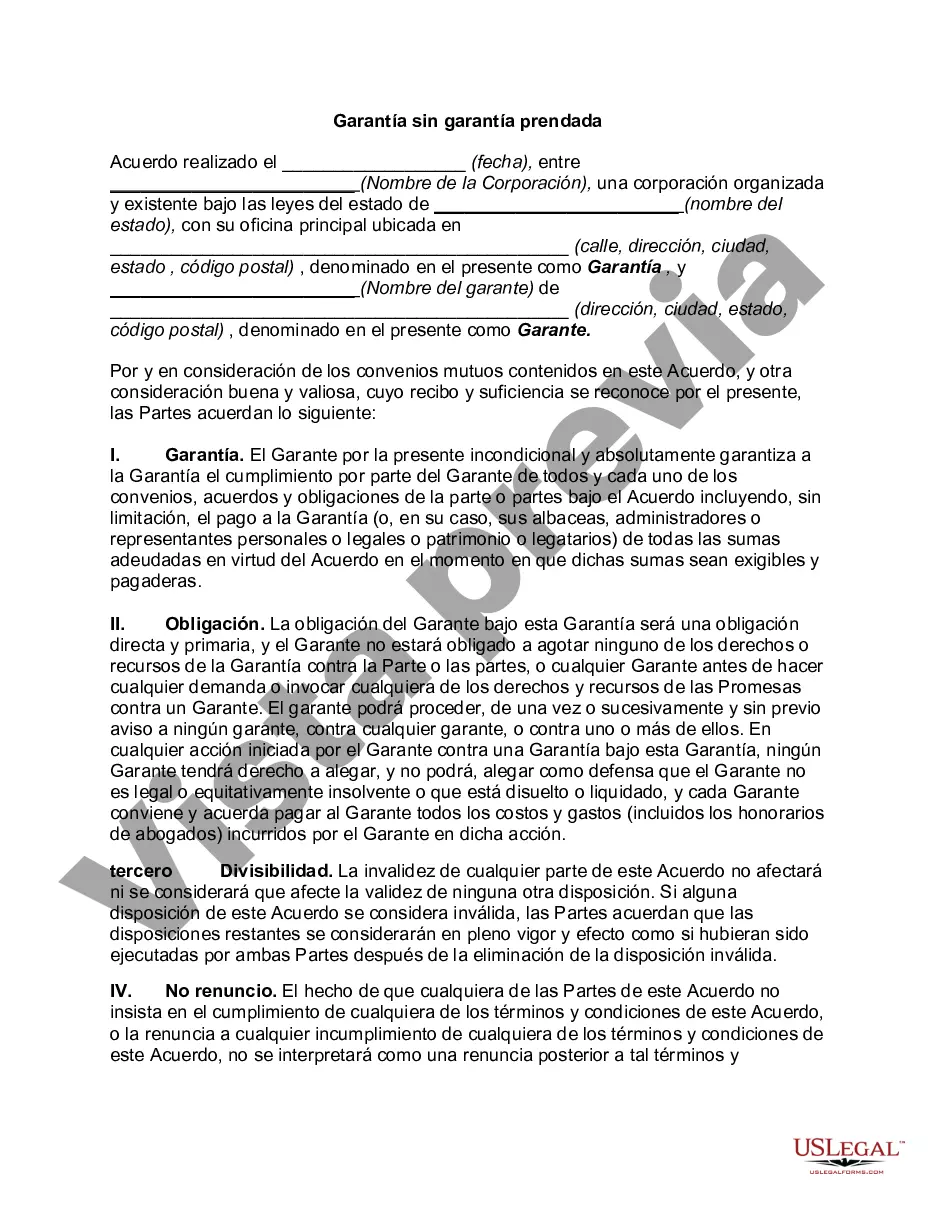

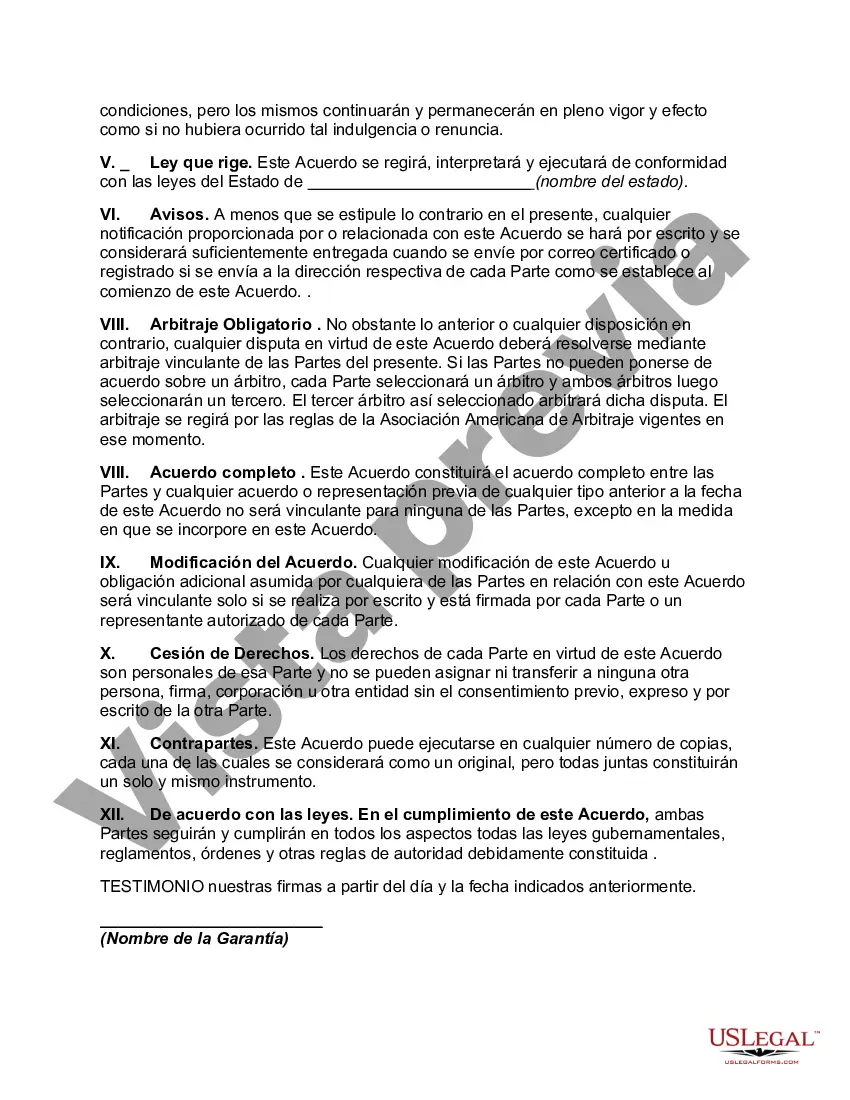

Cuyahoga Ohio Guaranty without Pledged Collateral is a type of financial service offered in Cuyahoga County, Ohio, where individuals or businesses can obtain a guarantee for a loan without having to provide any pledged collateral. This type of guaranty can be useful for borrowers who might not have sufficient assets to secure a loan through traditional means. The Cuyahoga Ohio Guaranty without Pledged Collateral is governed by specific regulations and guidelines set by financial institutions in Cuyahoga County. These guarantees are typically provided by specialized agencies or government entities to help stimulate economic growth, encourage entrepreneurship, and support small businesses in the region. By offering a guaranty without the requirement of pledged collateral, financial institutions aim to support borrowers who have strong business plans or creditworthiness but lack adequate collateral assets. This enables entrepreneurs and businesses to access the necessary funds to start or expand their operations, promoting economic development and job creation in Cuyahoga County. There are various types of Cuyahoga Ohio Guaranty without Pledged Collateral programs available to meet specific needs and circumstances. Some popular variations include: 1. Small Business Administration (SBA) Guaranty: The SBA offers loan guaranty programs that support small businesses in Cuyahoga County. These programs provide lenders with a partial guaranty on loans made to eligible borrowers, thereby reducing the risk and encouraging lenders to provide financing without requiring pledged collateral. 2. Community Development Financial Institutions (Chris): Chris are specialized financial institutions that provide financial products and services to underserved communities, including Cuyahoga County. They may offer guaranty programs that do not require pledged collateral, with a focus on promoting economic and community development in disadvantaged areas. 3. Nonprofit and Government-Backed Guaranty Programs: In addition to SBA and Chris, there may be other nonprofit organizations or government-backed initiatives in Cuyahoga County that provide similar guaranty programs. These programs aim to support specific sectors or populations, such as women-owned businesses, minority entrepreneurs, or green initiatives. It is important for borrowers interested in Cuyahoga Ohio Guaranty without Pledged Collateral programs to research and understand the specific requirements, terms, and conditions of each program. Lenders or guarantors typically assess the borrower's creditworthiness, business plan, and repayment ability to determine eligibility for the guaranty. Overall, Cuyahoga Ohio Guaranty without Pledged Collateral programs offer valuable financial support to individuals and businesses in Cuyahoga County, opening doors to economic opportunities and growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Garantía sin garantía prendada - Guaranty without Pledged Collateral

Description

How to fill out Cuyahoga Ohio Garantía Sin Garantía Prendada?

Draftwing forms, like Cuyahoga Guaranty without Pledged Collateral, to take care of your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for various scenarios and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Cuyahoga Guaranty without Pledged Collateral form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Cuyahoga Guaranty without Pledged Collateral:

- Ensure that your document is compliant with your state/county since the rules for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Cuyahoga Guaranty without Pledged Collateral isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our website and download the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Entendemos como garantia prendaria aquella accion por la cual una persona obtiene un prestamo, a contrapartida del cual deja como deposito y garantia durante un tiempo determinado una prenda o aval que sea de su actual propiedad.

A continuacion hacemos una breve referencia a los principales tipos de garantias: GARANTIA DE LICITACION.GARANTIA DE CUMPLIMIENTO / GARANTIA DE FUNCIONAMIENTO.GARANTIA DE MANTENIMIENTO.DOWN PAYMENT / GARANTIA DE PAGO ANTICIPADO.GARANTIA DE PAGO.GARANTIA DE RETENCION DE FONDOS.

Credito que te permite obtener dinero en efectivo dejando en garantia un certificado de Deposito a plazo, cuentas de ahorros o por un Fondo Mutuo de Renta fija.

1. adj. Perteneciente o relativo a la prenda . Mercancia prendaria .

La garantia se tendra por constituida a la firma del contrato, surtiendo efectos entre las partes desde la fecha de su celebracion. Articulo 366. La prenda sin transmision de posesion surtira efectos contra terceros a partir de la fecha de su inscripcion en el registro.

La prenda, es por tanto, una garantia especifica que el deudor otorga a favor del acreedor, con el objeto de que este ultimo pueda tener seguridad de hacer efectivo su credito con cargo a la garantia otorgada.

Las garantias se pueden ejecutar ante el juez civil correspondiente o ante la Superintendencia de Sociedades, a prevencion, para las entidades sometidas a su vigilancia. hay entrega es posible solicitar la aprehension y entrega del bien. El valor garantizado sera el del avaluo del bien.

Extincion del contrato de prenda Extinguido lo principal se extingue lo accesorio, ya sea por: nulidad, rescision, confusion, dacion en pago, pago, prescripcion, novacion, compensacion, perdida de la cosa.

Articulo 352. - Podra garantizarse con prenda sin transmision de posesion cualquier obligacion, con independencia de la actividad preponderante a la que se dedique el deudor. Articulo 353. - Pueden ser dados en prenda sin transmision de posesion, toda clase de derechos y bienes muebles.