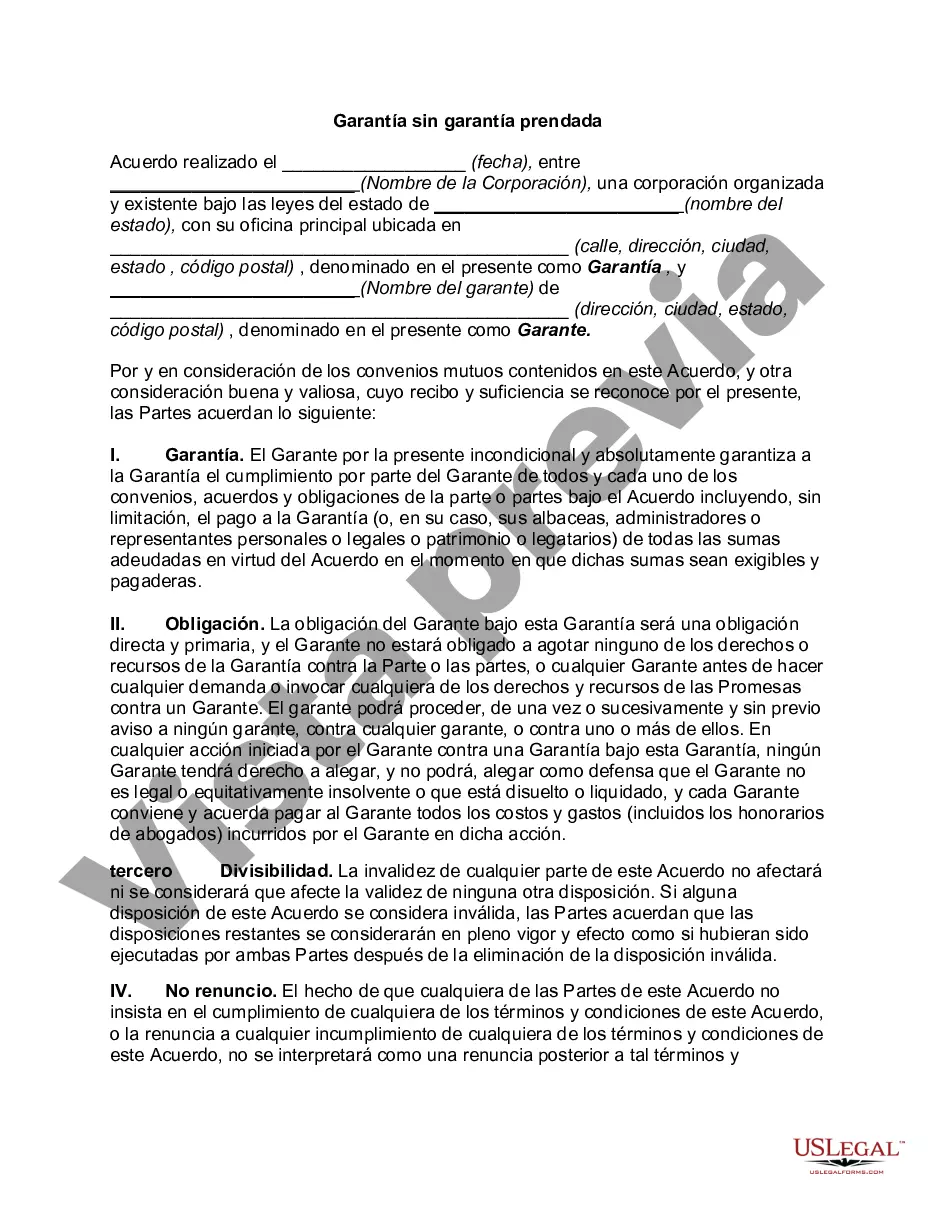

Miami-Dade Florida Guaranty Without Pledged Collateral is a financial service offered to businesses and individuals by the local government of Miami-Dade County in Florida. This program provides a guarantee on loans without the requirement of collateral. It aims to support and promote economic growth within the county by assisting businesses and individuals with their financial needs. The Miami-Dade Florida Guaranty Without Pledged Collateral program is a valuable resource for entrepreneurs, small businesses, and startups who may not have sufficient collateral to secure traditional loans. By providing a guarantee, the county government helps to reduce the risk for financial institutions, making it easier for these businesses to access the capital they require. This program allows borrowers to secure funding for various purposes, such as business expansion, working capital, equipment purchase, marketing campaigns, or even real estate ventures. Key benefits of the Miami-Dade Florida Guaranty Without Pledged Collateral program include easier access to capital, reduced borrowing costs, and increased financial stability for borrowers. Since collateral is not required, businesses or individuals with valuable assets but prefer not to pledge them can also benefit from this program. Moreover, the guarantee provided by the county government enhances the credibility of borrowers, increasing their chances of loan approval. There are different types of Miami-Dade Florida Guaranty Without Pledged Collateral programs available, designed to cater to specific needs and situations. Some of these variations include: 1. Small Business Guaranty: This program aims to support small businesses in Miami-Dade County by providing a guarantee on loans without the need for collateral. It encourages entrepreneurship and assists local businesses in their growth and expansion endeavors. 2. Start-Up Loan Guaranty: As the name suggests, this program specifically targets start-up businesses without a substantial operating history or existing collateral. It offers support to entrepreneurs in the early stages of their ventures by ensuring access to necessary funds. 3. Women and Minority-Owned Business Guaranty: This variant of the program is designed to promote women and minority-owned businesses within Miami-Dade County. It provides financial assistance to these underrepresented groups, supporting their growth and economic empowerment. 4. Real Estate Development Guaranty: This program focuses on real estate ventures, whether commercial, residential, or mixed-use. It offers a guarantee on loans used for property acquisition, development, construction, or renovation, without the requirement of pledged collateral. In summary, the Miami-Dade Florida Guaranty Without Pledged Collateral program provides a valuable financial support system for businesses and individuals alike. It eliminates the barrier of collateral requirements, enabling easier access to capital for various purposes. By offering different types of guarantees, the program caters to the specific needs of small businesses, startups, women and minority-owned ventures, and real estate development projects, fostering economic growth and stability within Miami-Dade County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Garantía sin garantía prendada - Guaranty without Pledged Collateral

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-1340745BG

Format:

Word

Instant download

Description

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan. This means that the borrower still retains the ownership of the property, but the lender has a claim against it.

Miami-Dade Florida Guaranty Without Pledged Collateral is a financial service offered to businesses and individuals by the local government of Miami-Dade County in Florida. This program provides a guarantee on loans without the requirement of collateral. It aims to support and promote economic growth within the county by assisting businesses and individuals with their financial needs. The Miami-Dade Florida Guaranty Without Pledged Collateral program is a valuable resource for entrepreneurs, small businesses, and startups who may not have sufficient collateral to secure traditional loans. By providing a guarantee, the county government helps to reduce the risk for financial institutions, making it easier for these businesses to access the capital they require. This program allows borrowers to secure funding for various purposes, such as business expansion, working capital, equipment purchase, marketing campaigns, or even real estate ventures. Key benefits of the Miami-Dade Florida Guaranty Without Pledged Collateral program include easier access to capital, reduced borrowing costs, and increased financial stability for borrowers. Since collateral is not required, businesses or individuals with valuable assets but prefer not to pledge them can also benefit from this program. Moreover, the guarantee provided by the county government enhances the credibility of borrowers, increasing their chances of loan approval. There are different types of Miami-Dade Florida Guaranty Without Pledged Collateral programs available, designed to cater to specific needs and situations. Some of these variations include: 1. Small Business Guaranty: This program aims to support small businesses in Miami-Dade County by providing a guarantee on loans without the need for collateral. It encourages entrepreneurship and assists local businesses in their growth and expansion endeavors. 2. Start-Up Loan Guaranty: As the name suggests, this program specifically targets start-up businesses without a substantial operating history or existing collateral. It offers support to entrepreneurs in the early stages of their ventures by ensuring access to necessary funds. 3. Women and Minority-Owned Business Guaranty: This variant of the program is designed to promote women and minority-owned businesses within Miami-Dade County. It provides financial assistance to these underrepresented groups, supporting their growth and economic empowerment. 4. Real Estate Development Guaranty: This program focuses on real estate ventures, whether commercial, residential, or mixed-use. It offers a guarantee on loans used for property acquisition, development, construction, or renovation, without the requirement of pledged collateral. In summary, the Miami-Dade Florida Guaranty Without Pledged Collateral program provides a valuable financial support system for businesses and individuals alike. It eliminates the barrier of collateral requirements, enabling easier access to capital for various purposes. By offering different types of guarantees, the program caters to the specific needs of small businesses, startups, women and minority-owned ventures, and real estate development projects, fostering economic growth and stability within Miami-Dade County.

Free preview