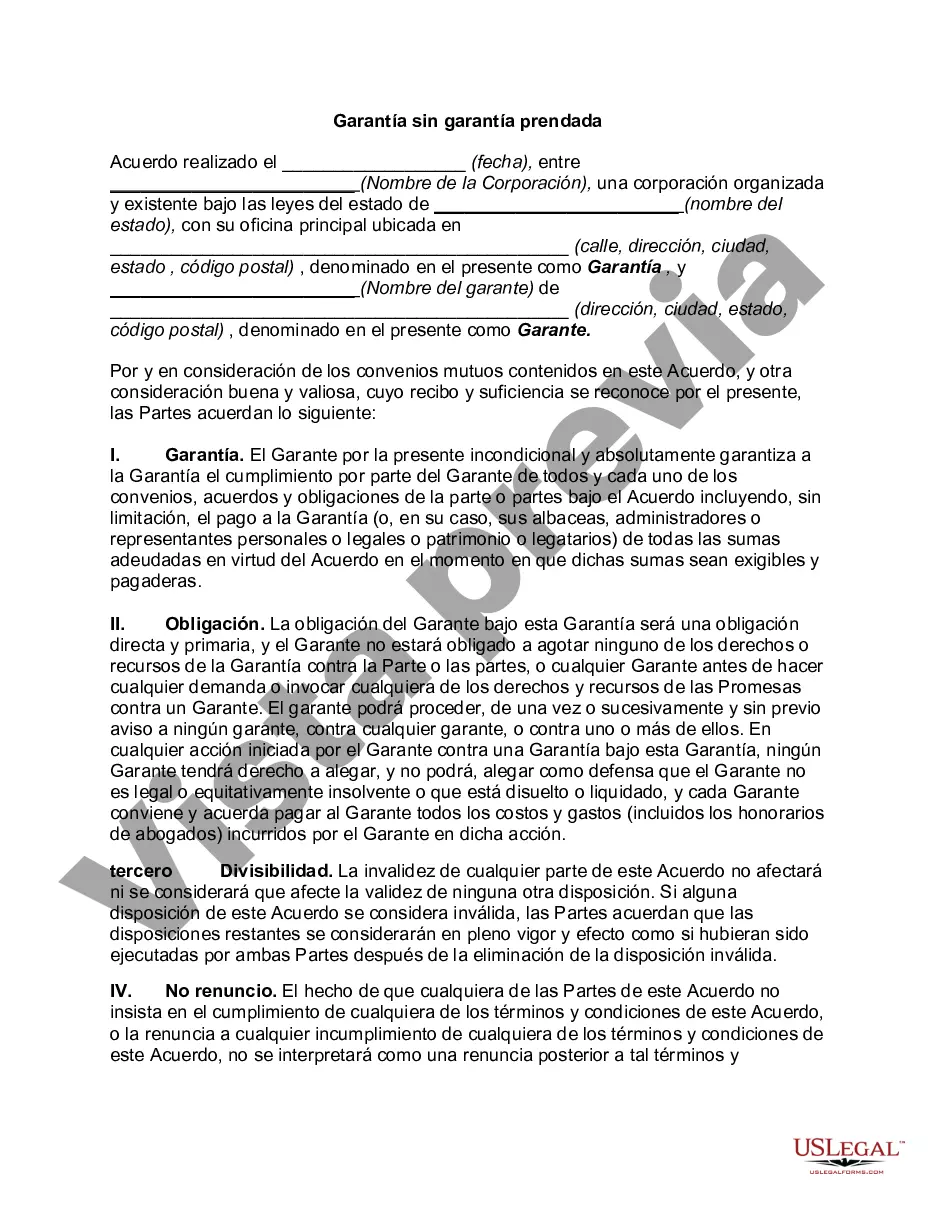

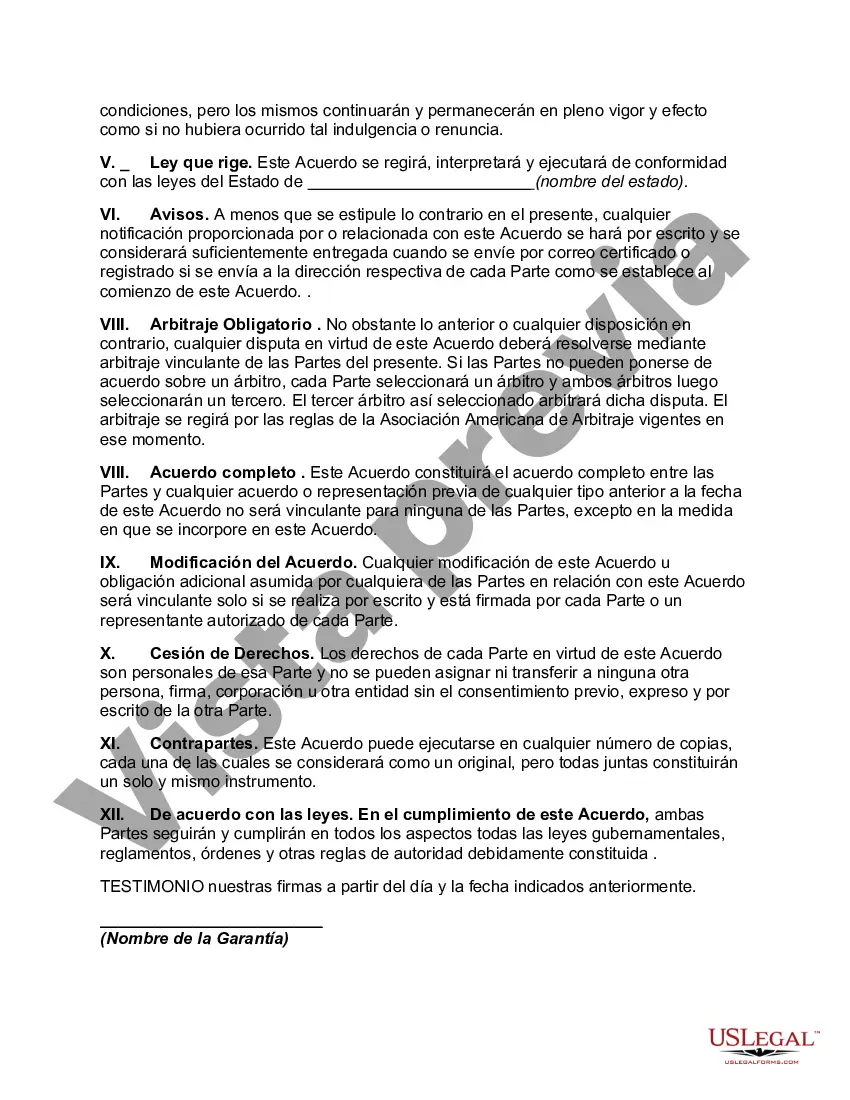

Phoenix Arizona Guaranty without Pledged Collateral is a financial service that provides a guarantee for loans without requiring the borrower to offer any collateral as security. This type of guaranty is particularly beneficial for individuals or businesses who may not possess sufficient assets to pledge as collateral, but still need financial support. This innovative guaranty option in Phoenix, Arizona aims to mitigate the risk for lenders while enabling borrowers to obtain financing for various purposes, such as starting a new business, expanding existing operations, or investing in personal projects. By eliminating the need for collateral, this guaranty provides opportunities for those who may have limited assets but possess strong creditworthiness and repayment capacity. The Phoenix Arizona Guaranty without Pledged Collateral includes different types to cater to the diverse needs of borrowers: 1. Personal Loans: Individuals seeking financial assistance for personal expenses, such as debt consolidation, medical bills, or home improvements, can benefit from this type of guaranty. It allows borrowers with good credit scores to secure loans without pledging their personal assets. 2. Small Business Loans: Entrepreneurs and small business owners in Phoenix, Arizona, can access funds for their ventures through this guaranty. Whether it's for working capital, purchasing equipment, or expanding operations, the guaranty provides a safety net for lenders and facilitates access to capital for borrowers without collateral. 3. Start-up Funding: Start-ups often face challenges in securing funding due to the absence of significant assets to offer as collateral. The Guaranty without Pledged Collateral in Phoenix, Arizona, benefits start-ups by allowing them to obtain loans based on their business feasibility, projected profitability, and creditworthiness rather than tangible collateral. 4. Real Estate Development: Real estate developers and investors can utilize this guaranty option for funding their projects and property acquisitions without tying up their personal or other assets as collateral. This type of guaranty enhances opportunities for real estate development, stimulating growth in the Phoenix market. In conclusion, Phoenix Arizona Guaranty without Pledged Collateral is a valuable financial tool that expands access to loans for individuals, entrepreneurs, small businesses, start-ups, and real estate developers. By eliminating the requirement for collateral, this unique guaranty allows borrowers to obtain funds based on creditworthiness and repayment ability, supporting economic growth and innovation in Phoenix, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Garantía sin garantía prendada - Guaranty without Pledged Collateral

Description

How to fill out Phoenix Arizona Garantía Sin Garantía Prendada?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Phoenix Guaranty without Pledged Collateral, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Phoenix Guaranty without Pledged Collateral from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Phoenix Guaranty without Pledged Collateral:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!