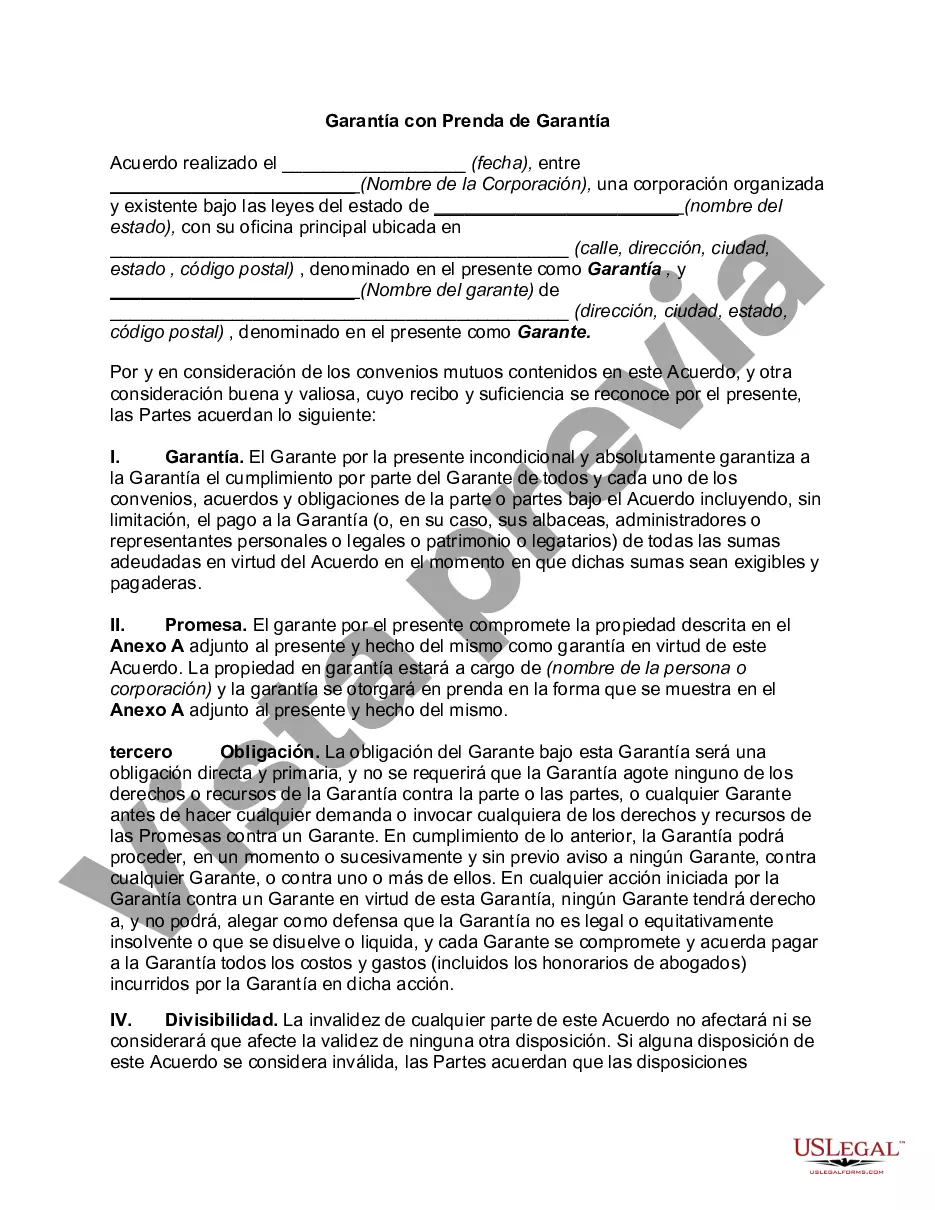

Harris Texas Guaranty with Pledged Collateral is a type of financial agreement that involves a guarantee on a loan or debt with collateral provided as security by the guarantor. This guarantee is specific to loans and debts within the state of Texas. In this type of agreement, Harris Texas acts as the guarantor, ensuring that the borrower will fulfill their financial obligations to the lender. The collateral pledged by the guarantor serves as a backup asset that can be seized by the lender in case of default. This provides an additional layer of protection for the lender's investment. The collateral can take various forms, including but not limited to real estate property, vehicles, stocks, bonds, or any other valuable asset that holds monetary value. By pledging collateral, the guarantor offers an assurance to the lender that their investment will be recovered, even if the borrower fails to repay the loan. Harris Texas Guaranty with Pledged Collateral is a commonly used arrangement in the lending industry, providing lenders with greater confidence and security when extending financial assistance to borrowers. By having collateral associated with the loan, lenders can mitigate the risks involved in lending to individuals or businesses who may have a higher likelihood of default. There may be different types of Harris Texas Guaranty with Pledged Collateral available depending on the specific requirements and circumstances. These types can vary based on the nature of the collateral, such as real estate mortgages, vehicle title loans, or securities-backed loans. Real Estate Mortgage: In this type, real estate property (residential or commercial) is pledged as collateral. If the borrower fails to repay the loan, the lender can foreclose and sell the property to recover their investment. Vehicle Title Loan: This type involves using a vehicle's title as collateral. If the borrower defaults, the lender has the right to repossess the vehicle and sell it to recoup their monetary loss. Securities-Backed Loan: In this arrangement, the borrower pledges their securities, such as stocks, bonds, or mutual funds, as collateral. If the borrower fails to meet their obligations, the lender can liquidate the securities to recover the owed amount. These are just a few examples of the types of Harris Texas Guaranty with Pledged Collateral that exist in the lending industry. Each type offers lenders a specific level of security while providing borrowers with an opportunity to obtain financing, even if their creditworthiness might otherwise hinder their chances of approval.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Garantía con Prenda de Garantía - Guaranty with Pledged Collateral

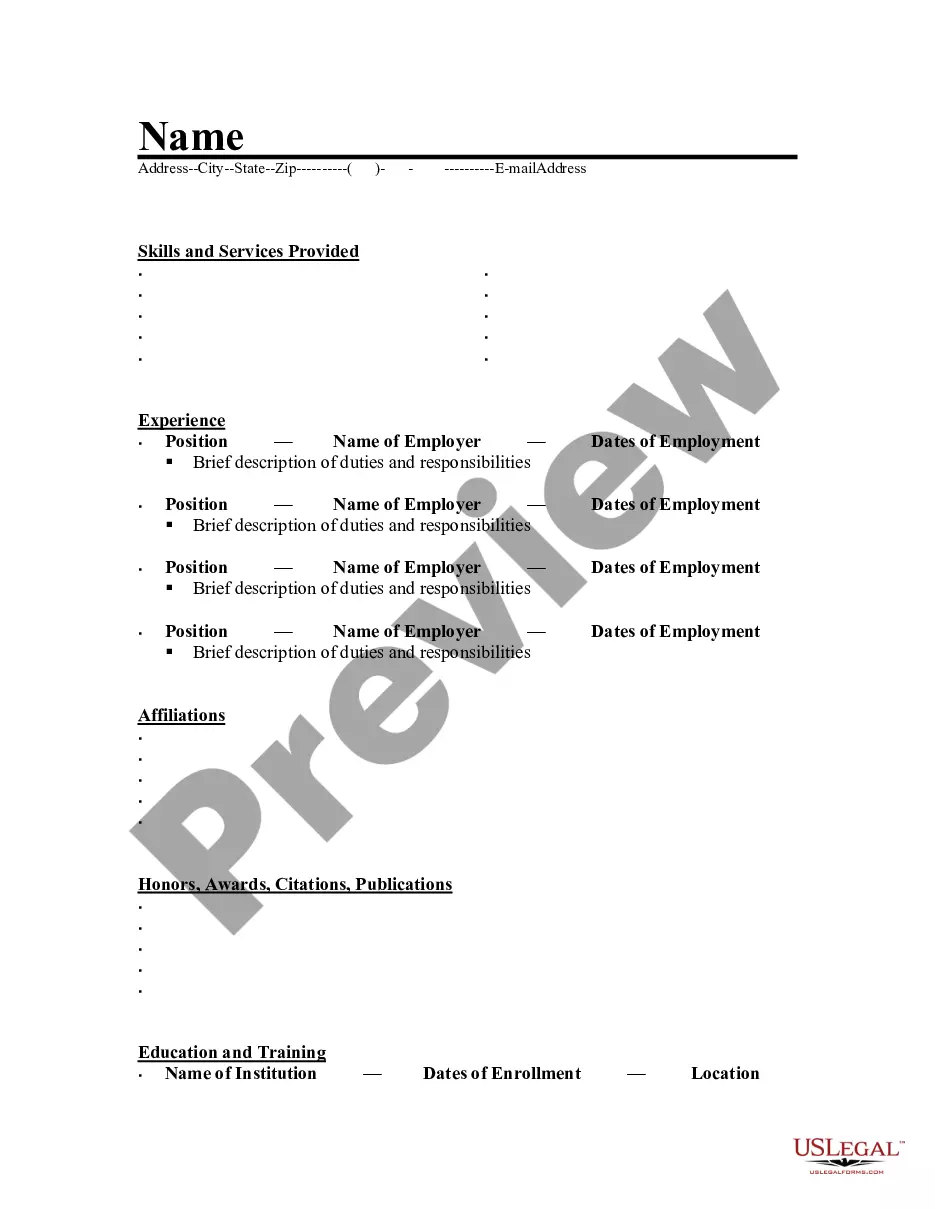

Description

How to fill out Harris Texas Garantía Con Prenda De Garantía?

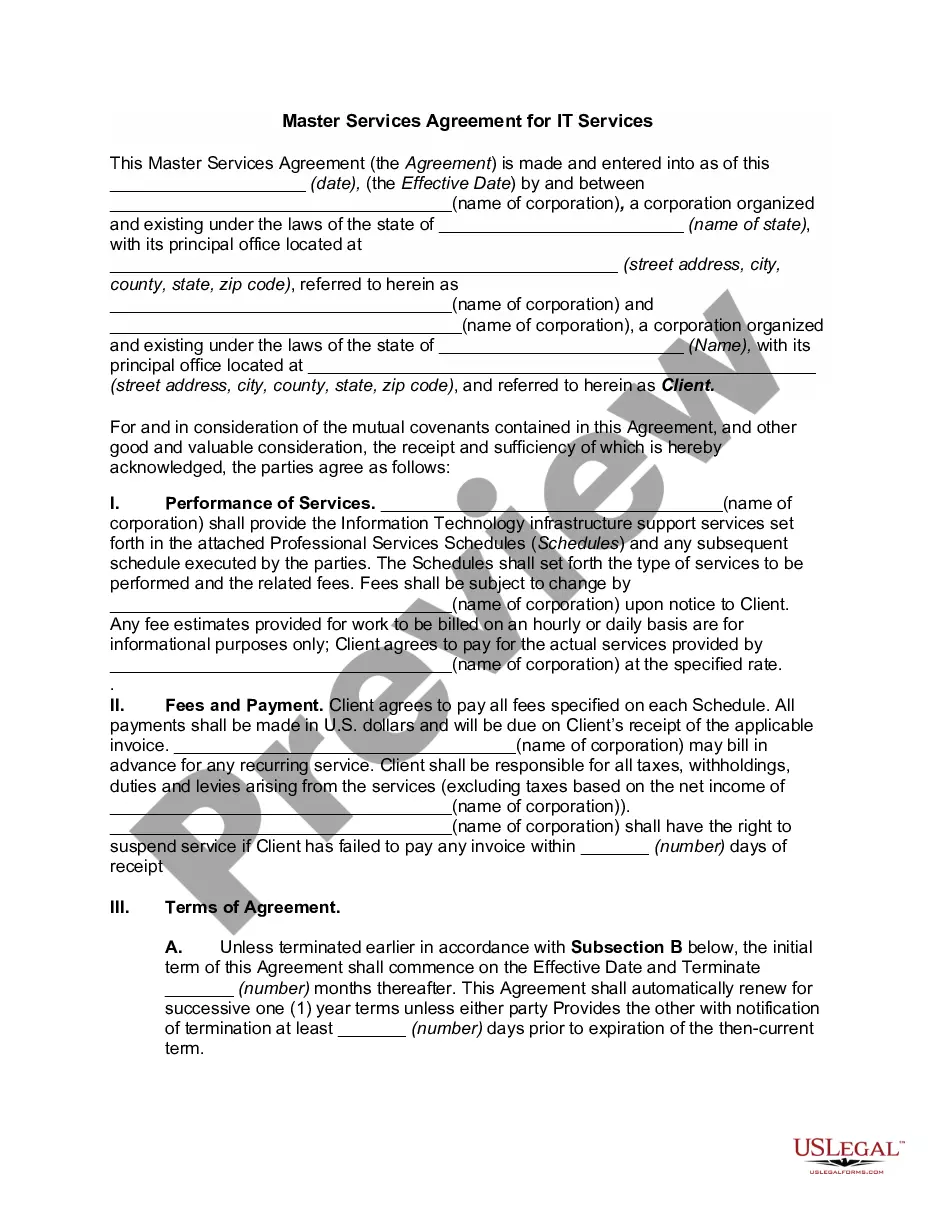

Preparing documents for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Harris Guaranty with Pledged Collateral without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Harris Guaranty with Pledged Collateral by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Harris Guaranty with Pledged Collateral:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a few clicks!