Maricopa Arizona Guaranty with Pledged Collateral is a type of financial agreement that provides security for lenders in the event of borrower default. This legal arrangement involves the borrower pledging collateral, which can be an asset of value, such as property or securities, to secure the repayment of a loan. The Maricopa Arizona Guaranty with Pledged Collateral is commonly used in various financial transactions, including personal loans, business loans, and mortgage loans. By pledging collateral, borrowers showcase their commitment to repay the loan, and in the case of default, lenders have the right to seize and sell the collateral to recover their funds. In Maricopa, Arizona, there are different types of Guaranty with Pledged Collateral, each serving specific purposes based on the nature of the loan. These types can include: 1. Real Estate Pledged Collateral: In this type, borrowers pledge their real estate property, such as a home or land, as collateral for the loan. Lenders hold a lien on the property until the loan is fully repaid. 2. Securities Pledged Collateral: Borrowers pledge their financial securities, like stocks, bonds, or mutual funds, to secure the loan. Lenders have the right to sell these securities if the borrower defaults on the loan. 3. Automobile Pledged Collateral: This type of collateral involves pledging a vehicle, such as a car, truck, or motorcycle, as security for the loan. Lenders can repossess and sell the vehicle to recover the loan amount if necessary. 4. Equipment or Machinery Pledged Collateral: Businesses may pledge their equipment or machinery as collateral to secure loans for expansion or operational purposes. Lenders can seize and sell these assets in case of default. It is important for both borrowers and lenders to thoroughly understand the terms of the Maricopa Arizona Guaranty with Pledged Collateral before entering into such an agreement. Borrowers should carefully consider their ability to repay the loan to avoid any potential loss of pledged collateral, while lenders should evaluate the value and marketability of the collateral to ensure adequate protection of their investment. In conclusion, Maricopa Arizona Guaranty with Pledged Collateral is a financial arrangement commonly used to enhance loan security. By pledging valuable assets as collateral, borrowers provide assurance to lenders, and in return, lenders can feel confident in their ability to recover their funds in case of default. Different types of collateral, such as real estate, securities, vehicles, and equipment, can be pledged depending on the nature of the loan, offering various options for both borrowers and lenders in Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Garantía con Prenda de Garantía - Guaranty with Pledged Collateral

Description

How to fill out Maricopa Arizona Garantía Con Prenda De Garantía?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Maricopa Guaranty with Pledged Collateral, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks associated with document completion simple.

Here's how you can purchase and download Maricopa Guaranty with Pledged Collateral.

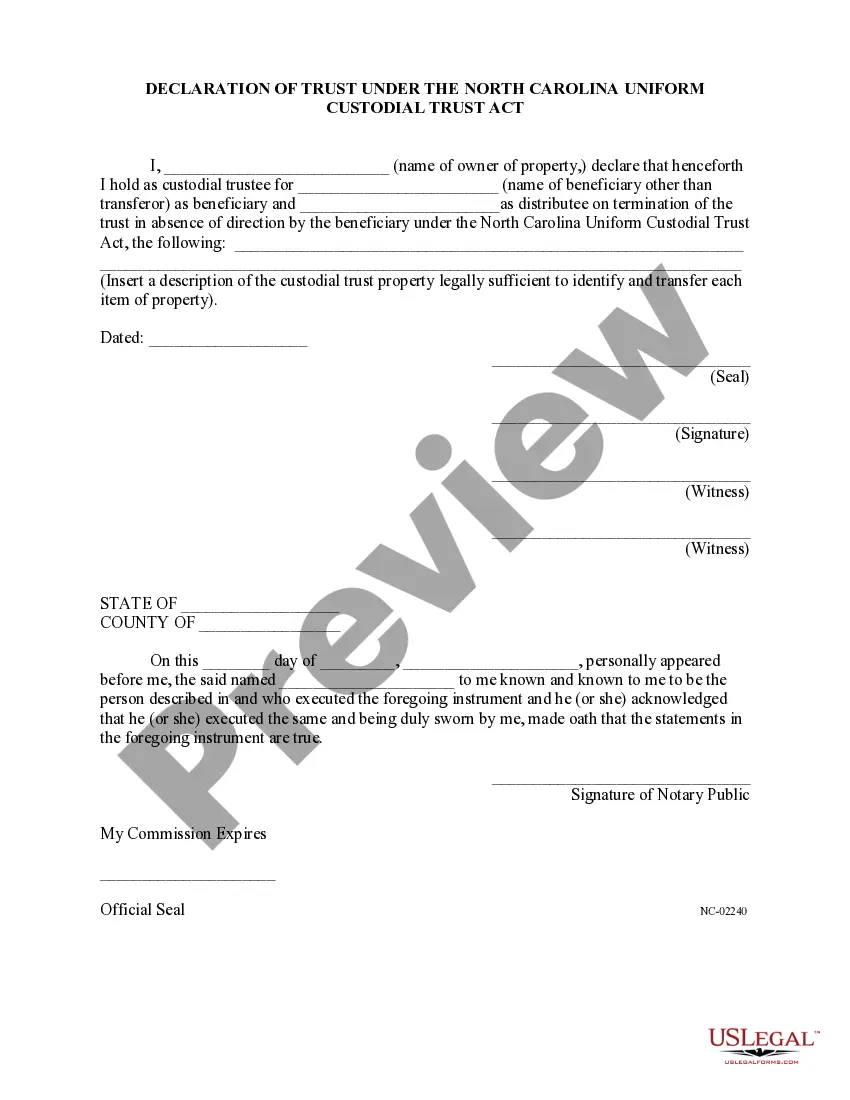

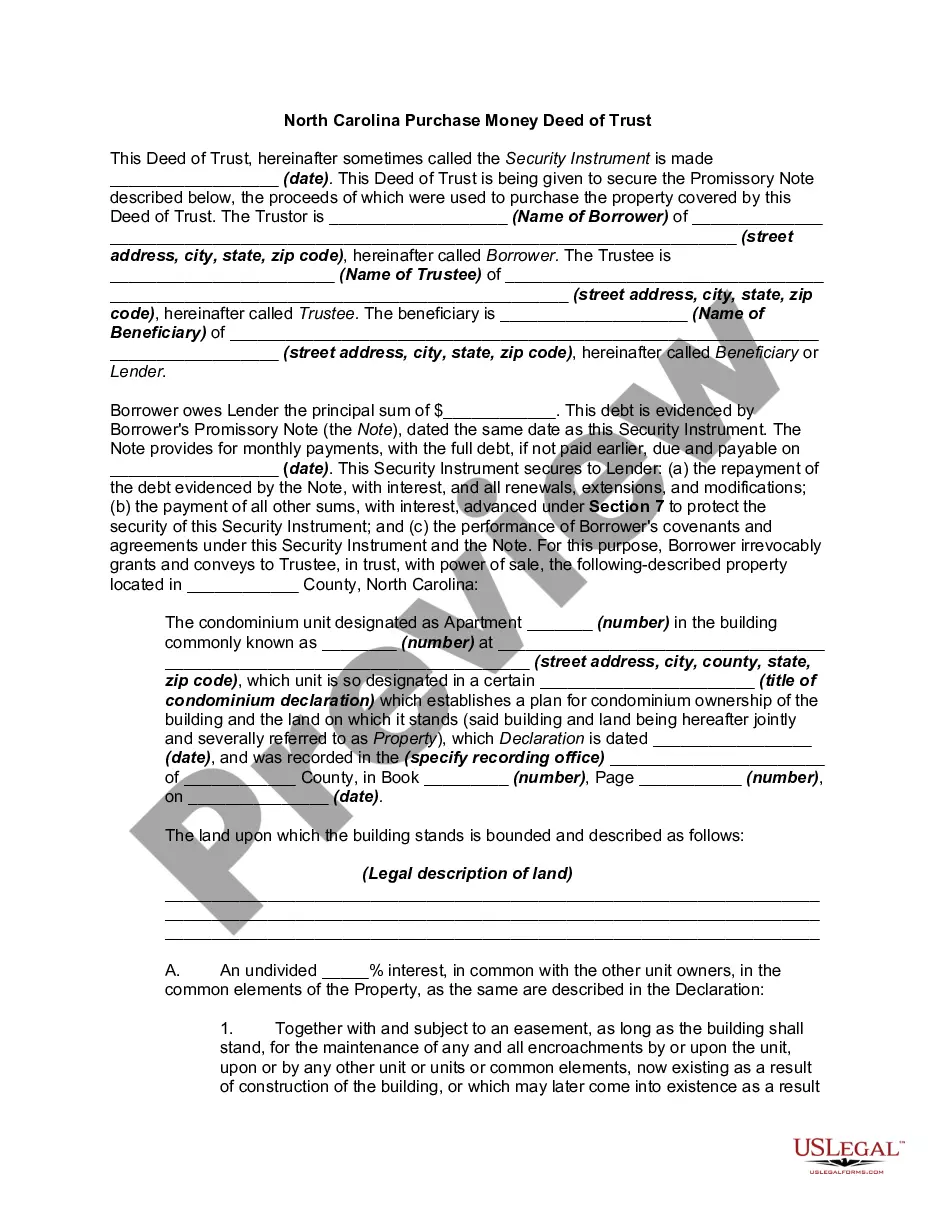

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Maricopa Guaranty with Pledged Collateral.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Guaranty with Pledged Collateral, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you need to cope with an exceptionally challenging situation, we advise using the services of a lawyer to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific paperwork effortlessly!