Nassau New York Garantía con Prenda de Garantía - Guaranty with Pledged Collateral

Description

How to fill out Garantía Con Prenda De Garantía?

A document routine consistently accompanies any legal action you undertake.

Starting a business, applying for or accepting a job offer, transferring ownership, as well as many other life circumstances necessitate that you prepare official documentation that varies across the nation.

This is why having everything organized in a single location is incredibly advantageous.

US Legal Forms represents the most extensive online archive of current federal and state-specific legal templates. Here, you can effortlessly find and obtain a document for any personal or business purpose used in your county, including the Nassau Guaranty with Pledged Collateral.

This is the simplest and most trustworthy method for acquiring legal documents. All templates offered by our library are professionally crafted and validated for compliance with local laws and regulations. Prepare your paperwork and manage your legal matters effectively with US Legal Forms!

- Finding forms on the site is remarkably easy.

- If you already have a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to store it on your apparatus.

- Afterward, the Nassau Guaranty with Pledged Collateral will be available for future use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, adhere to this brief guide to acquire the Nassau Guaranty with Pledged Collateral.

- Ensure you have accessed the appropriate page containing your local form.

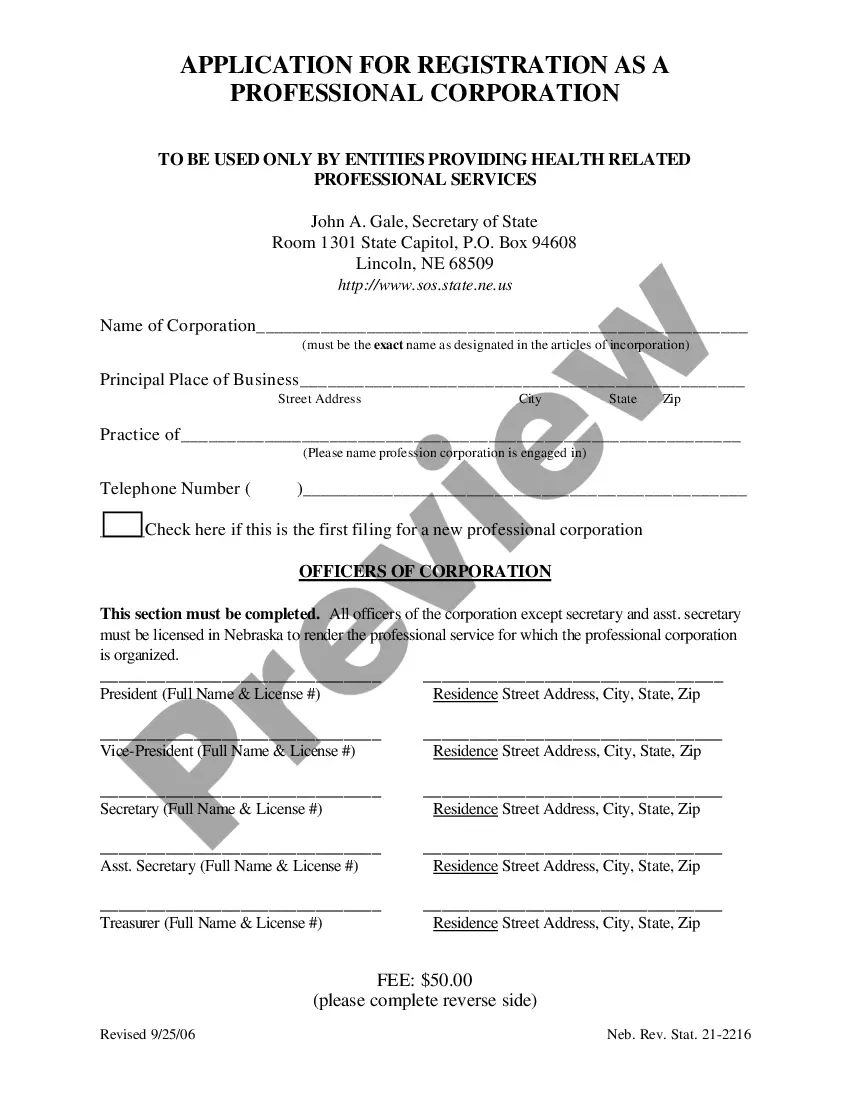

- Utilize the Preview mode (if available) and browse through the template.

- Examine the description (if present) to confirm the form meets your requirements.

- If the example does not suit you, search for another document using the search feature.

- Once you find the necessary template, click Buy Now.

- Choose the suitable subscription plan, then Log In or register for an account.

- Select the preferred payment method (via credit card or PayPal) to proceed.

Form popularity

FAQ

1. adj. Perteneciente o relativo a la prenda . Mercancia prendaria .

Es el tramite por medio del cual se registra en el historial fisico y electronico del vehiculo un contrato de prenda, el levantamiento del mismo o su modificacion.

Entendemos como garantia prendaria aquella accion por la cual una persona obtiene un prestamo, a contrapartida del cual deja como deposito y garantia durante un tiempo determinado una prenda o aval que sea de su actual propiedad.

CERTIFICO: Que el presente Contrato de PRENDA CON REGISTRO se inscribio bajo la numeracion indicada en el encabezamiento en el dia de la fecha en este Registro Seccional a cargo del autorizante. NRO2026202620262026202620262026202620262026. 2026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026.202620262026 DEUDOR.

La prenda es un derecho de garantia real que otorga al titular la posesion de una cosa mueble propiedad del pignorante, a fin de que, en caso de incumplimiento de la obligacion, el acreedor pueda vender la cosa pignorada y con el importe obtenido satisfacer la deuda.

A continuacion hacemos una breve referencia a los principales tipos de garantias: GARANTIA DE LICITACION.GARANTIA DE CUMPLIMIENTO / GARANTIA DE FUNCIONAMIENTO.GARANTIA DE MANTENIMIENTO.DOWN PAYMENT / GARANTIA DE PAGO ANTICIPADO.GARANTIA DE PAGO.GARANTIA DE RETENCION DE FONDOS.

Los contratos de prenda podran ser reinscriptos: 10.1 Por igual termino, por una sola vez, el contrato no cancelado y antes de que opere la caducidad, a solicitud de su legitimo tenedor, acompanando el original del contrato y sus anexos, si los hubiere.

Debes presentar es el articulo o bien a empenar y una identificacion oficial; algunas casas de empeno pueden solicitar la factura (contrato, garantia) del articulo a empenar y los accesorios del mismo, si es que aplica. La casa de empeno o institucion de asistencia evalua el valor (y el desgaste) del articulo.

Entendemos como garantia prendaria aquella accion por la cual una persona obtiene un prestamo, a contrapartida del cual deja como deposito y garantia durante un tiempo determinado una prenda o aval que sea de su actual propiedad.

El dueno de la cosa prendada puede pedir al Registro la cancelacion de la garantia inscripta adjuntando el comprobante de haber depositado el importe de la deuda.