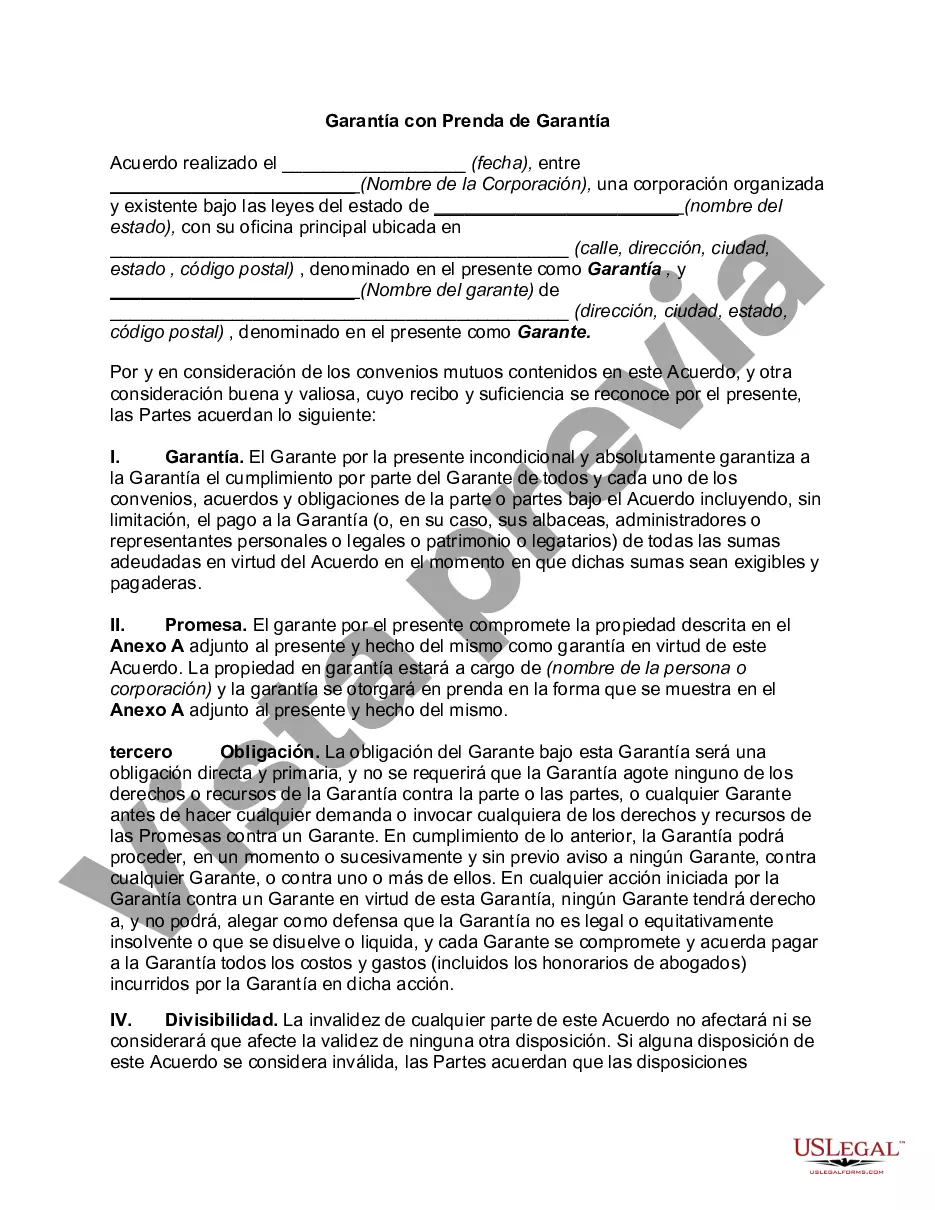

San Antonio Texas Guaranty with Pledged Collateral is a legal contract that provides security for loans in the state of Texas. This agreement is commonly used by lenders to mitigate the risk associated with lending money, ensuring that they have recourse in case of default. The guarantor involved in this agreement pledges collateral as security, thereby reducing the lender's risk. There are different types of San Antonio Texas Guaranty with Pledged Collateral, each serving a specific purpose and tailored to different loan scenarios. These types include: 1. Real Estate Collateral Guaranty: This type of collateral involves the pledging of real estate assets to secure the loan. The guarantor pledges their property as collateral, allowing the lender to foreclose and sell the property if the borrower defaults on their loan obligations. 2. Personal Property Collateral Guaranty: In this case, the guarantor pledges personal property assets to secure the loan. Examples of personal property collateral may include vehicles, equipment, or other valuable items. The lender can seize and sell these assets to recover their funds in the event of default. 3. Financial Collateral Guaranty: Under this type of collateral, the guarantor pledges financial assets, such as stocks, bonds, or savings accounts, to secure the loan. These liquid assets serve as a fallback for the lender, ensuring they have a viable source of repayment in case of default. Regardless of the type of collateral used, San Antonio Texas Guaranty with Pledged Collateral provides a level of assurance to lenders. The guarantor's obligation to repay the loan becomes secondary to the borrower's primary liability. This agreement enhances the lender's ability to recover their funds and reduces the credit risk associated with lending. It is essential for all parties involved, including the borrower, lender, and guarantor, to thoroughly review and understand the terms and conditions outlined in the San Antonio Texas Guaranty with Pledged Collateral. Seeking legal advice from an attorney familiar with Texas state laws and regulations is highly recommended ensuring compliance and protection of all parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Garantía con Prenda de Garantía - Guaranty with Pledged Collateral

Description

How to fill out San Antonio Texas Garantía Con Prenda De Garantía?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a San Antonio Guaranty with Pledged Collateral suiting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the San Antonio Guaranty with Pledged Collateral, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your San Antonio Guaranty with Pledged Collateral:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Antonio Guaranty with Pledged Collateral.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!