Clark Nevada Fideicomiso benéfico con creación supeditada a la calificación para el estado de exención de impuestos - Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Clark Nevada Fideicomiso Benéfico Con Creación Supeditada A La Calificación Para El Estado De Exención De Impuestos?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Clark Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Consequently, if you need the recent version of the Clark Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Clark Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status:

- Glance through the page and verify there is a sample for your region.

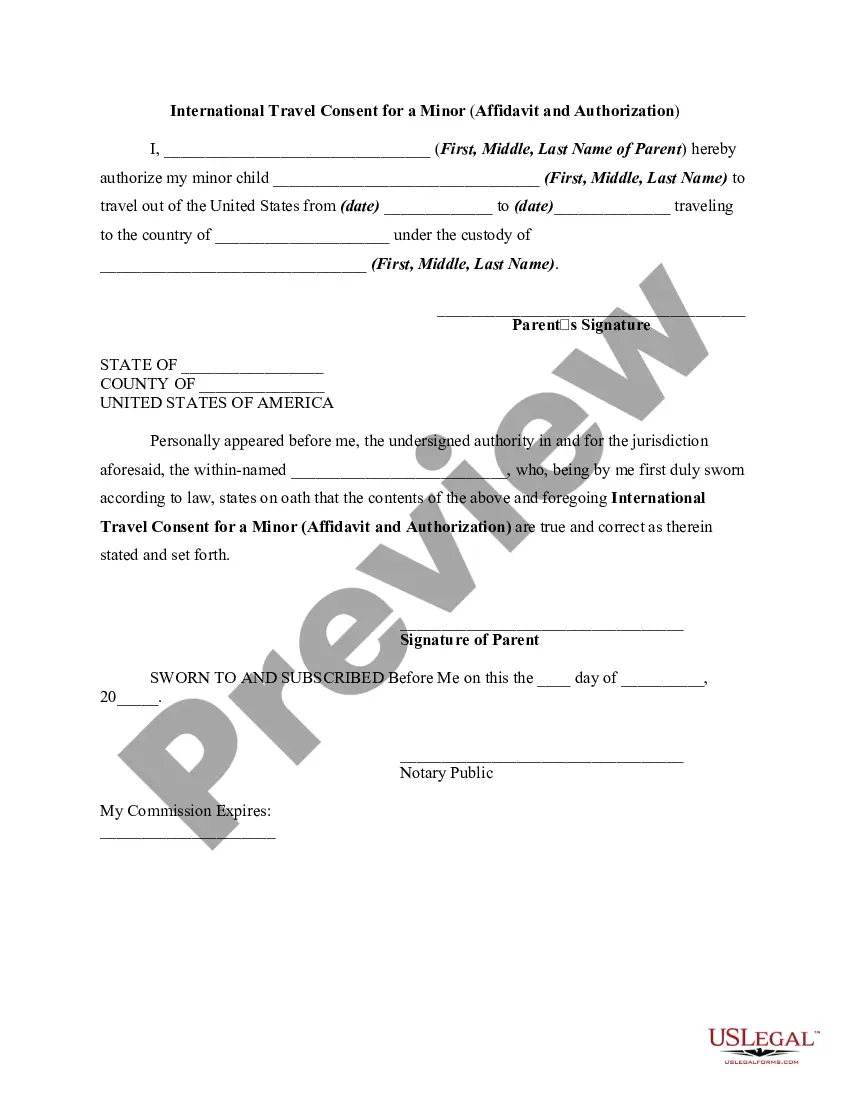

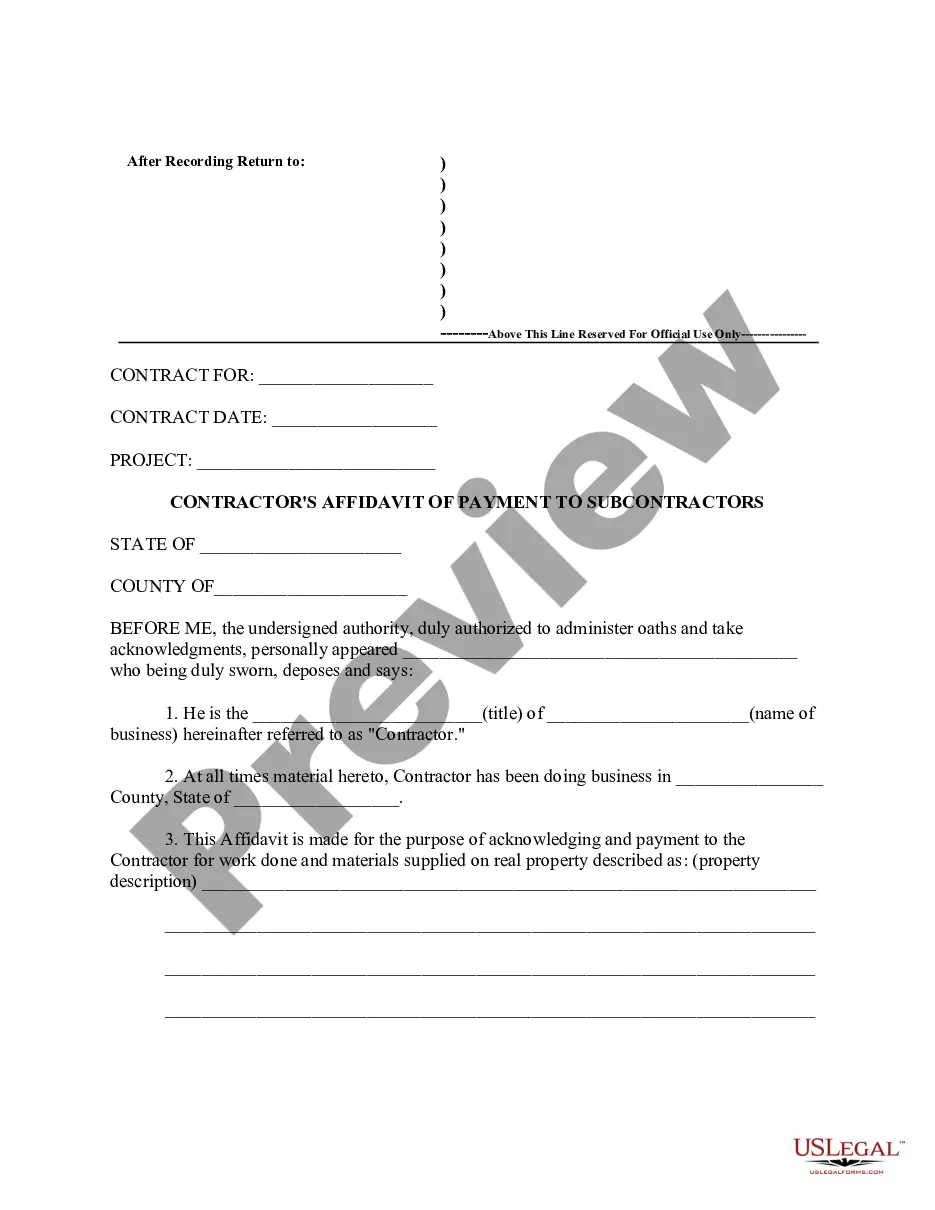

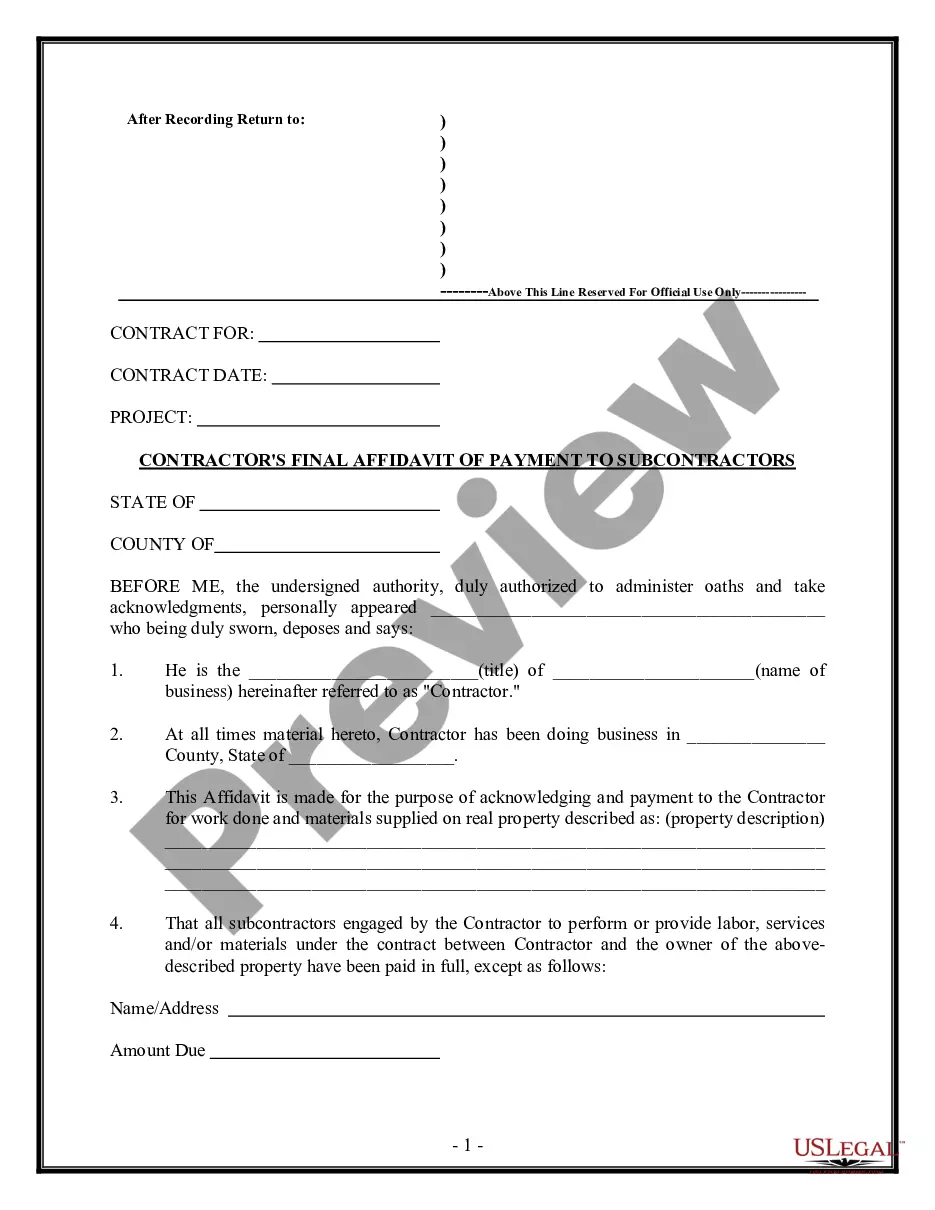

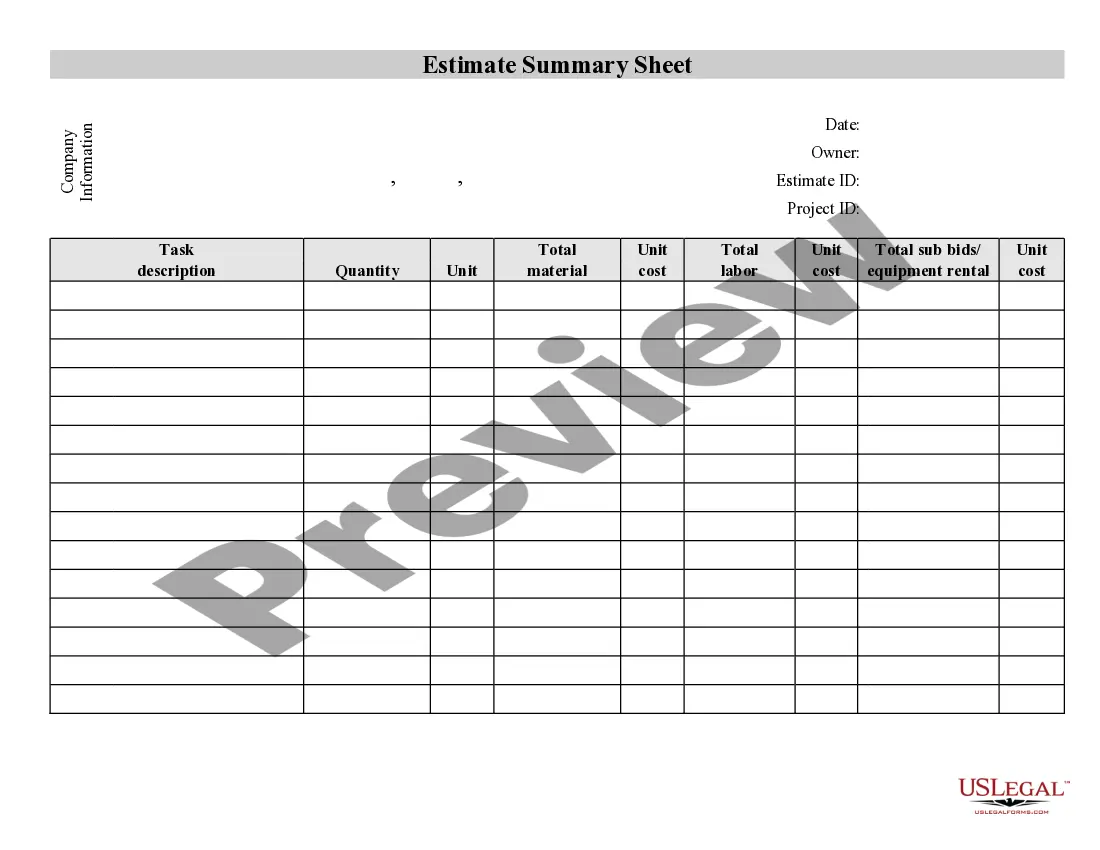

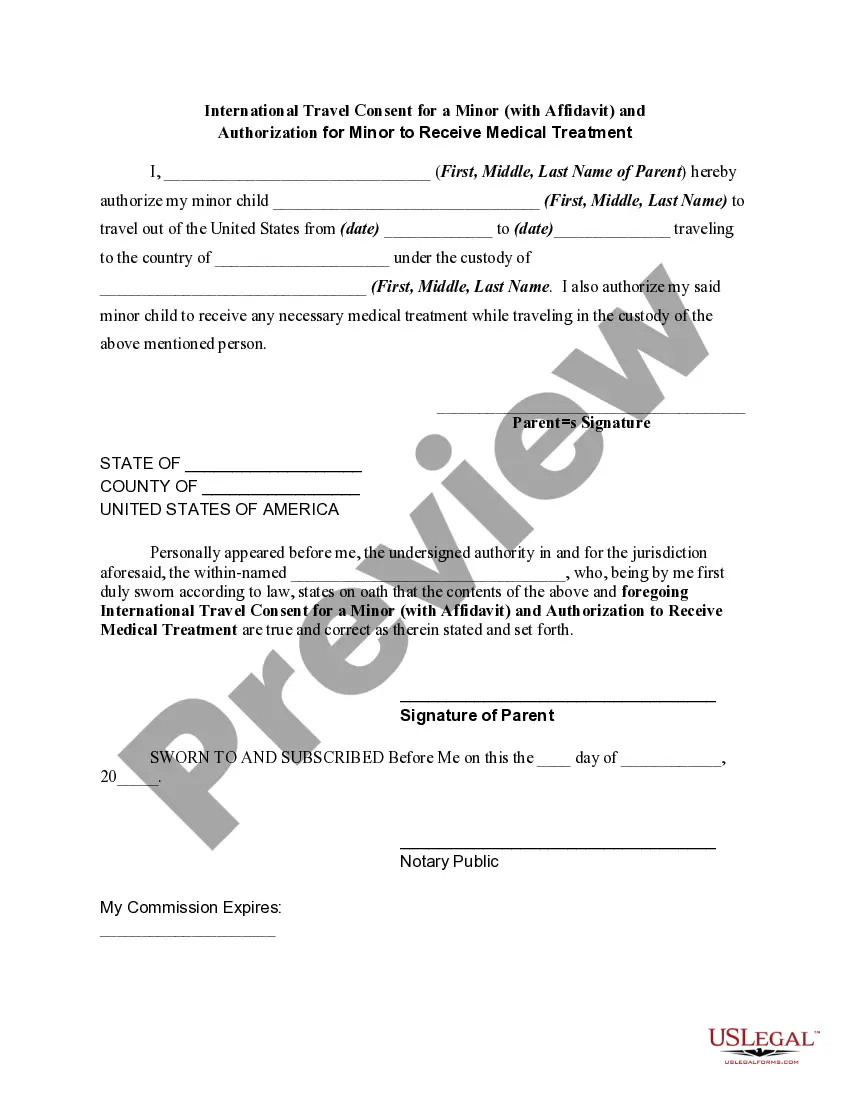

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Clark Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!