Middlesex Massachusetts Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a legal entity established in Middlesex County, Massachusetts, with the purpose of supporting charitable causes and initiatives. The trust operates under the condition of obtaining tax-exempt status from the Internal Revenue Service (IRS), which enables it to receive tax benefits and deductibles. The Middlesex Massachusetts Charitable Trust emphasizes philanthropy and community service by funding various organizations, programs, and projects that aim to improve the lives of individuals and communities within the state of Massachusetts. Primarily focusing on charitable endeavors in Middlesex County, this trust works tirelessly to make a positive impact and provide essential resources to those in need. By adhering to the requirements set forth by the IRS, the trust ensures that it complies with all regulations and is recognized as a tax-exempt organization. This status allows donors to make tax-deductible contributions to the trust, encouraging individuals, corporations, and foundations to participate in the advancement of worthy causes. Different types or classifications of Middlesex Massachusetts Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status might include: 1. Educational Trusts: These trusts support educational initiatives such as scholarships, grants, and programs that promote education and skill development within Middlesex County. 2. Healthcare Trusts: These trusts concentrate on funding healthcare-related projects, hospitals, medical research, and assisting individuals who require medical care or assistance in Middlesex County. 3. Community Development Trusts: These trusts focus on the overall development of the community by supporting affordable housing, community centers, infrastructure projects, and initiatives that enhance the quality of life in Middlesex County. 4. Environmental Trusts: These trusts prioritize the conservation and preservation of the environment by funding projects and organizations that protect natural resources, enhance sustainability, and promote environmental awareness in Middlesex County. 5. Arts and Culture Trusts: These trusts aim to promote artistic and cultural endeavors within Middlesex County by providing funding for museums, theaters, art exhibits, and events that contribute to the local artistic scene. By establishing various types of Middlesex Massachusetts Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status, the overall goal is to address a wide range of charitable needs and positively impact the community, while simultaneously providing tax benefits to donors who contribute to these valuable causes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Fideicomiso benéfico con creación supeditada a la calificación para el estado de exención de impuestos - Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Middlesex Massachusetts Fideicomiso Benéfico Con Creación Supeditada A La Calificación Para El Estado De Exención De Impuestos?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

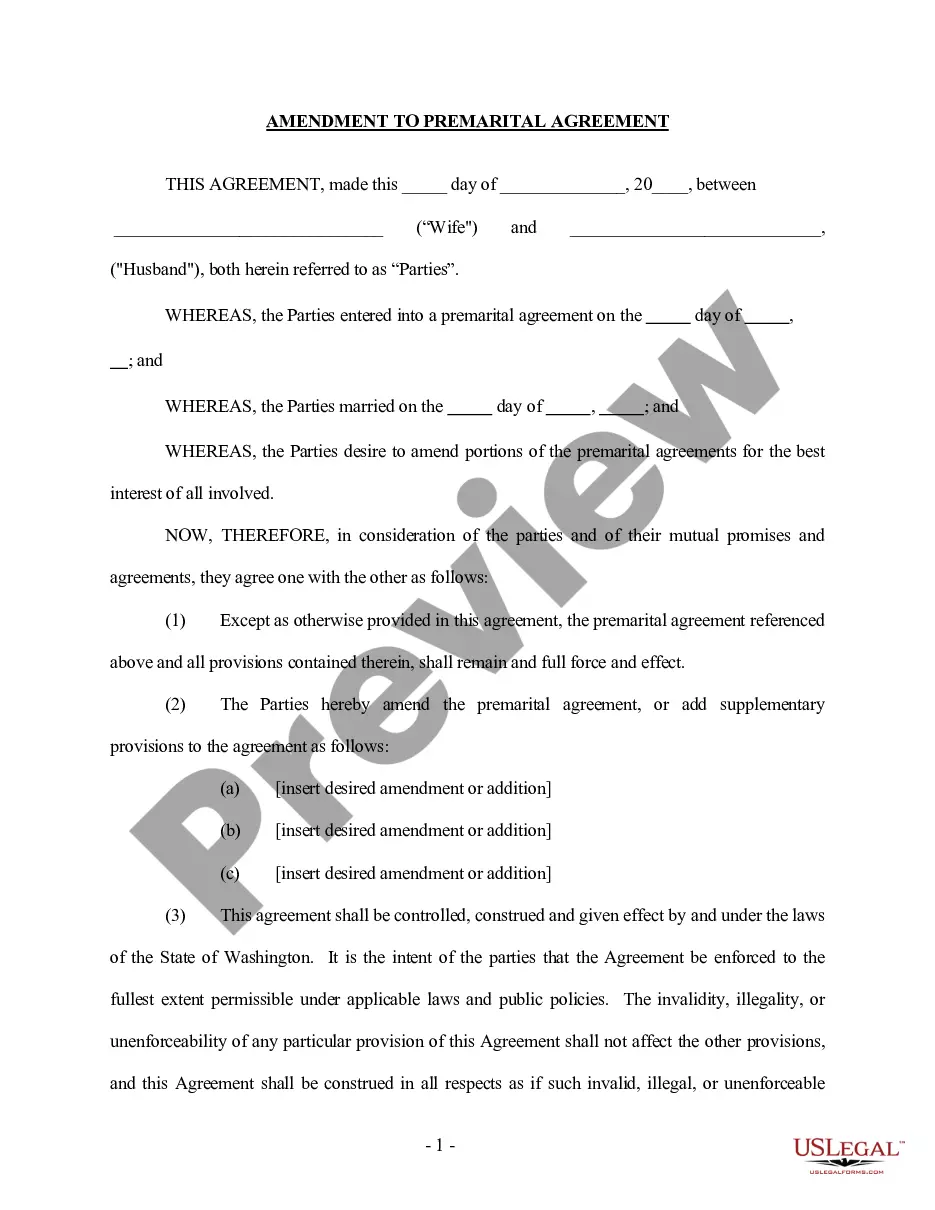

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Middlesex Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Middlesex Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Middlesex Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Middlesex Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Paso 1: Ingresa al portal de la DIAN . Paso 3: Ingresando al sitio web institucional dirijase a la seccion servicios a la ciudadania, y alli dar clic en la opcion certificados de acreditacion de residencia fiscal y situacion tributaria. para radicar su solicitud en el sistema informatico.

Se llama homestead en ingles. La cantidad protegida se llama homestead exemption (exencion de homestead) y varia en funcion de la edad, estado civil, y el ingreso del dueno de la vivienda.

Un certificado de exencion fiscal es un certificado que envia un cliente a una empresa para reclamar la exencion del impuesto sobre las ventas. En este sistema, el certificado de exencion fiscal contiene la siguiente informacion: Indica el periodo de tiempo durante el cual se pueden aplicar las exenciones fiscales.

El termino exento significa que la operacion de que se trate si esta incluida en el ambito de aplicacion del impuesto, pero, por un motivo legal, se le exime de su pago.

¿Donde realizo el tramite? Ingresar datos del Certificado de Posesion Efectiva emitido por el Servicio de Registro Civil: Oficina Registro Civil; N° de Certificado y Fecha respectiva. Incorporar todos los bienes heredados y las obligaciones por pagar del causante.

Sujeto exento es la persona fisica o moral cuya situacion legal normalmente tiene la calidad de causante, pero que no esta obligado a enterar el credito tributario, por encontrarse en condiciones de privilegio o franquicia.

¿Donde realizo el tramite? Ingresar datos del Certificado de Posesion Efectiva emitido por el Servicio de Registro Civil: Oficina Registro Civil; N° de Certificado y Fecha respectiva. Incorporar todos los bienes heredados y las obligaciones por pagar del causante.

¿Cuando no pagar? Recuerda que, si durante el ano anterior trabajaste por un salario que no supero los 400,000 pesos, sobre los que se aplicaron los impuestos correspondientes a cargo del empleador, no tienes obligacion de presentar tu declaracion anual SAT.

¿Que plazo hay para el pago de impuesto a la herencia? El pago del impuesto a la herencia deberia hacerse de inmediato, cuando se asignan bienes por causa de muerte. Sin embargo, existe un plazo maximo de hasta 2 anos para realizar este tramite.

La exencion libre de impuestos, tambien llamada exencion personal, es el valor total de la mercancia que puede traer de regreso a los Estados Unidos sin tener que pagar impuestos. Puede traer de vuelta mas de su exencion, pero tendra que pagar impuestos por ello.