Phoenix Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a legal entity established in Phoenix, Arizona, with the purpose of promoting philanthropic activities and providing charitable support to beneficiaries. This type of trust is created in accordance with specific regulations and requirements set by tax authorities, aiming to gain tax-exempt status. The Phoenix Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status offers various benefits to both donors and recipients. By contributing to this trust, donors can receive tax deductions on their charitable contributions, allowing them to support causes they are passionate about while potentially reducing their tax liability. Recipients, such as eligible non-profit organizations or individuals in need, can receive funds or resources from the trust to support their charitable endeavors or personal needs. Different types of Phoenix Arizona Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status may include: 1. Irrevocable Charitable Remainder Trust: This type of trust allows donors to transfer assets to the trust, receive income for their lifetime or a specified period, and subsequently, the remaining assets go to the designated charitable beneficiaries upon the donor's passing. 2. Charitable Lead Trust: In this trust, beneficiaries receive income or assets from the trust for a specified period, after which the remainder goes to the designated charitable organizations or causes. It allows donors to support charities during their lifetime while ensuring their estate passes to desired beneficiaries later. 3. Charitable Gift Annuity: This type of trust involves donors transferring assets to a charitable organization. In return, donors receive fixed annual payments for their lifetime, with the remaining funds going to the designated charitable cause upon their passing. 4. Pooled Income Fund Trust: This trust combines the contributions of multiple donors into a single investment pool. The income generated from the investments is shared among the donors, and upon their passing, the remaining assets are distributed to the designated charitable beneficiaries. All these trust types share the common goal of supporting charitable causes while offering donors potential tax advantages. It is essential for the trust to meet the requirements for tax-exempt status, which involve complying with specific guidelines and regulations established by the Internal Revenue Service (IRS). Creating a Phoenix Arizona Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status allows donors to leave a lasting impact on the community while potentially obtaining tax benefits. By establishing and contributing to such trusts, individuals and organizations can make a difference in the lives of those in need and support causes near and dear to their hearts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Fideicomiso benéfico con creación supeditada a la calificación para el estado de exención de impuestos - Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Phoenix Arizona Fideicomiso Benéfico Con Creación Supeditada A La Calificación Para El Estado De Exención De Impuestos?

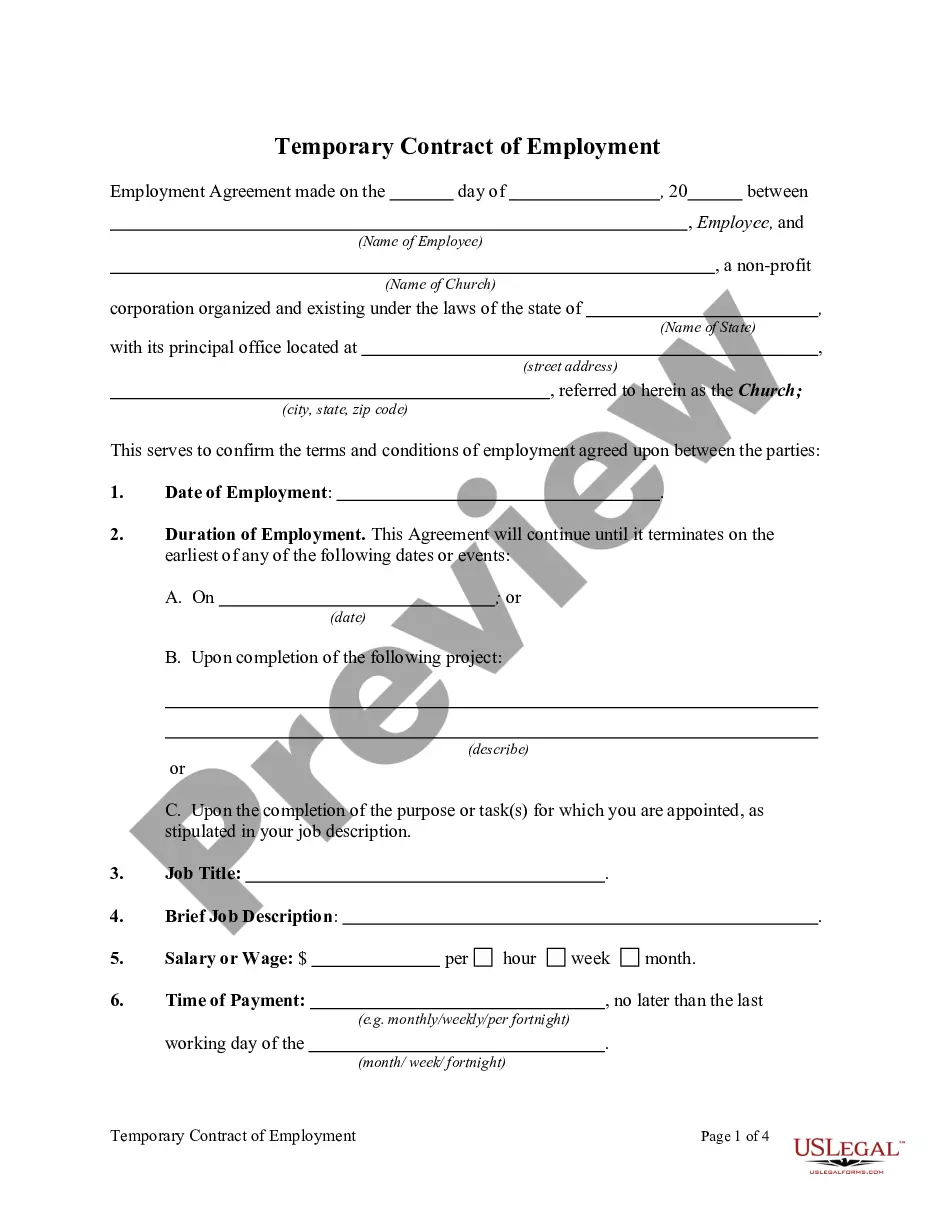

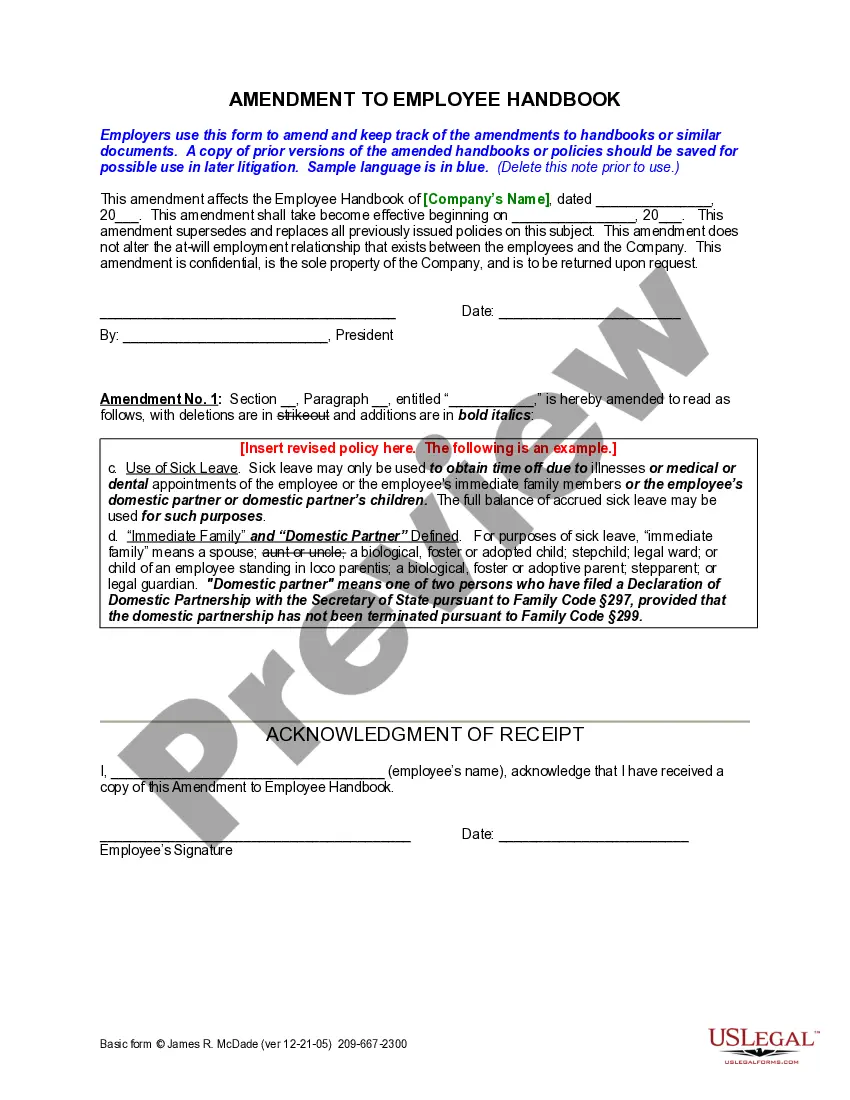

Draftwing paperwork, like Phoenix Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, to manage your legal affairs is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for various scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Phoenix Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Phoenix Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status:

- Ensure that your template is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Phoenix Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Resolucion Miscelanea Fiscal para 2022: Reglas 2.8.3.1., 2.8.3.3., 3.13.8., 3.13.21.... Selecciona el boton iniciar. Ingresa a la aplicacion con tu RFC y contrasena o e.firma. Llena los datos que te solicita la declaracion. Envia la declaracion. Obten el acuse de recibo de la declaracion.

Paso a paso, ¿como declarar impuestos anuales Ingresa directamente a la pagina web del SAT. Accede a tu cuenta con tu RFC y contrasena o e.Llena con cuidado los datos que te solicitan. Firma tu declaracion. Enviala. Revisa que el sistema te haya devuelto tu acuse de recibo.

Free File del IRS le permite preparar y presentar en linea su declaracion de impuestos federales sobre los ingresos mediante la preparacion de impuestos guiada en el sitio web de un socio del IRS o utilizando los Formularios Interactivos Free File. Es seguro, facil y sin costo a usted para una declaracion federal.

La informacion que necesitas para poder llenar la planilla federal es el nombre completo de cada dependiente, exactamente como aparece en la tarjeta de Seguro Social, el numero exacto de Seguro Social y fecha de nacimiento. Ademas el comprobante de retencion o cualquier otra evidencia de ingresos.

Los ciudadanos o residentes extranjeros de los Estados Unidos que no son residentes bona fide de Puerto Rico durante el ano tributario entero, estan obligados a declarar en su planilla de contribuciones federales sobre los ingresos, el ingreso recibido de cualquier fuente.

¿Como puedo hacer mi declaracion anual en el portal del SAT? Ingresa a la aplicacion o portal con tu RFC o contrasena. Llanda los datos que la declaracion anual te solicita. Firma tu declaracion para poder enviarla.

Cuando Debera Radicarse. Si su ano contributivo es el ano natural, radique la planilla a mas tardar el 18 de abril de 2022. La fecha de vencimiento es el 18 de abril en lugar del 15 de abril, debido a la celebracion del Dia de la Emancipacion en el Distrito de Columbia aun si usted no vive en el Distrito de Columbia.

La planilla federal del ano 2021 vence el 18 de abril de 2022, pero tienes hasta tres anos para solicitar el beneficio.

Ya ha comenzado la campana para la Declaracion de la Renta de 2022. El pasado miercoles 6 de abril, el Ministerio de Hacienda inicio la campana, que acaba el proximo 30 de junio. Los espanoles y espanolas deberan hacer la declaracion correspondiente de los ingresos obtenidos durante el 2021.

6 pasos para contribuyentes por primera vez Vigile sus ingresos.Guarde la documentacion apropiada durante todo el ano.Este atento cuando lleguen los documentos de sus ingresos.Conozca que creditos y deducciones puede obtener.Preste atencion a sus fechas limite.Decida como presentar su declaracion de impuestos.

More info

This service, free of charge, provides easy-to-use tools (like the ability to download student activity reports), the capacity to save and use your child's activity schedule, and online tracking of time spent in educational activities. There is currently only one full-time, fully-paid nurse in Pennsylvania schools, but that number is quickly growing, as more children are opting to enter the nursing profession thanks to increased health care choices, including immunizations that were not required until 2009. One-and-a-half dollars is the difference between getting your health insurance from the state and paying the insurance premium for your own insurance. The average cost of a hospital stay in Pennsylvania is 8,858-and that number includes doctors and drugs. The average cost of a dental procedure in Pennsylvania is 10,069 per tooth.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.