San Antonio Texas Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a legal entity established in the city of San Antonio, Texas, that operates for charitable purposes and seeks tax-exempt status from the Internal Revenue Service (IRS). A San Antonio Texas Charitable Trust is created with the primary goal of benefiting the community by providing financial assistance, resources, and support to various causes. These trusts may be set up to address a wide range of charitable purposes, including education, healthcare, poverty alleviation, arts and culture, environmental conservation, and more. One type of San Antonio Texas Charitable Trust is an educational trust, which is established to support educational institutions, scholarships, research, or other educational endeavors. Such trusts aim to advance learning opportunities and contribute to the development of a well-educated society. Another type is a healthcare trust, created to support medical research, healthcare facilities, patient assistance programs, or initiatives targeting specific health issues prevalent in the San Antonio community. These trusts work towards the advancement of medical knowledge, improvement of healthcare access, and betterment of public health. San Antonio Texas Charitable Trusts may also focus on poverty alleviation and social welfare, aiming to support organizations and programs that address the needs of underprivileged individuals and families. They may provide funding for food banks, housing initiatives, job training programs, or initiatives focused on homelessness prevention or reduction. Additionally, cultural or arts-related trusts can be established to preserve and promote artistic endeavors within San Antonio. These trusts may support museums, galleries, theaters, or funding opportunities for local artists, musicians, and performers to enrich the cultural landscape of the city. To qualify for tax-exempt status, a San Antonio Texas Charitable Trust must meet certain requirements set forth by the IRS. Such requirements include operating exclusively for charitable purposes, ensuring that no private interests benefit disproportionately, and adhering to restrictions on political activities and lobbying. By obtaining tax-exempt status, a charitable trust in San Antonio can provide donors with tax incentives, allowing for increased donations and support from individuals, corporations, and foundations. These tax-exempt statuses can vary, such as 501(c)(3) for public charities or 501(c)(4) for social welfare organizations. In summary, a San Antonio Texas Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is an entity dedicated to serving the community through charitable initiatives. These trusts can focus on education, healthcare, poverty alleviation, arts, culture, and more. By qualifying for tax-exempt status, these trusts can maximize their impact and attract support from various sources, ultimately making a difference in the lives of individuals and the overall well-being of the San Antonio community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Fideicomiso benéfico con creación supeditada a la calificación para el estado de exención de impuestos - Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

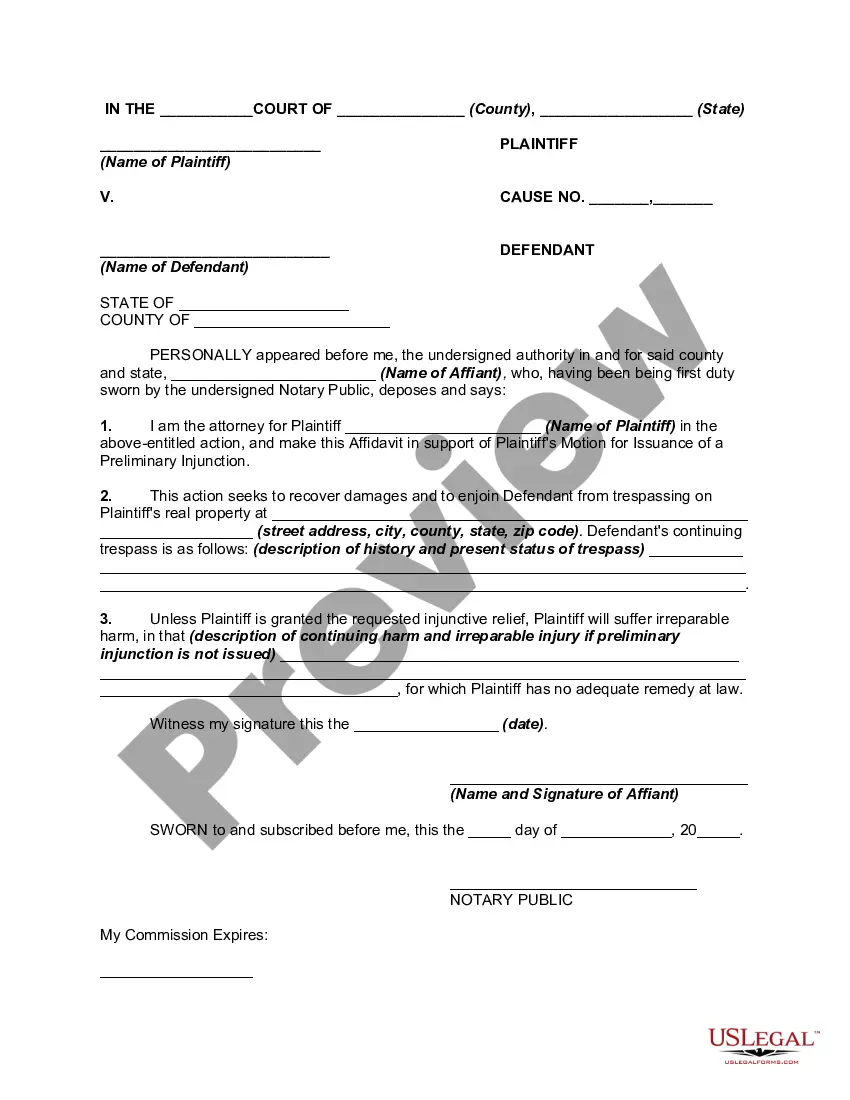

Description

How to fill out San Antonio Texas Fideicomiso Benéfico Con Creación Supeditada A La Calificación Para El Estado De Exención De Impuestos?

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, locating a San Antonio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status meeting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the San Antonio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your San Antonio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Antonio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!