Bexar Texas Annuity as Consideration for Transfer of Securities is a financial arrangement that involves the exchange of securities for an annuity plan offered in Bexar County, Texas. This type of annuity serves as a viable option for individuals who wish to diversify their investment portfolio and secure a steady stream of income for their future. The Bexar Texas Annuity as Consideration for Transfer of Securities provides individuals with the opportunity to defer taxes on gains made from selling their securities. By transferring their securities to an annuity, individuals can take advantage of potentially lower tax rates and enhance their long-term financial stability. There are a few different types of Bexar Texas Annuity as Consideration for Transfer of Securities, each designed to cater to specific financial goals and preferences: 1. Fixed Annuity: This type of annuity offers a fixed interest rate and guarantees a specific income stream for the annuitant. The rate remains unchanged throughout the duration of the annuity, providing stability and predictability to investors. 2. Variable Annuity: With a variable annuity, individuals have the opportunity to invest in a variety of underlying securities such as stocks, bonds, and mutual funds. The return on investment is not fixed but instead fluctuates based on the performance of the chosen investments. This type of annuity allows for potential growth, but it also comes with greater market risk. 3. Indexed Annuity: An indexed annuity combines features from both fixed and variable annuities. The return on investment is tied to a specific market index, such as the S&P 500. This type of annuity offers the potential for growth based on the index's performance, while also providing a minimum guaranteed interest rate to protect against market downturns. An important aspect to consider when choosing a Bexar Texas Annuity as Consideration for Transfer of Securities is the surrender period. This refers to the length of time during which withdrawing funds from the annuity can incur surrender charges. It is crucial to thoroughly review the terms and conditions of the annuity's surrender period to ensure it aligns with your specific financial needs. In conclusion, Bexar Texas Annuity as Consideration for Transfer of Securities is a valuable financial tool for individuals seeking to exchange their securities for a steady income stream and potential tax advantages. It offers various types of annuity plans, including fixed, variable, and indexed annuities, each serving different investment goals and risk tolerance levels. By carefully considering the features and surrender period of these annuity options, individuals can make informed decisions to secure their financial future effectively.

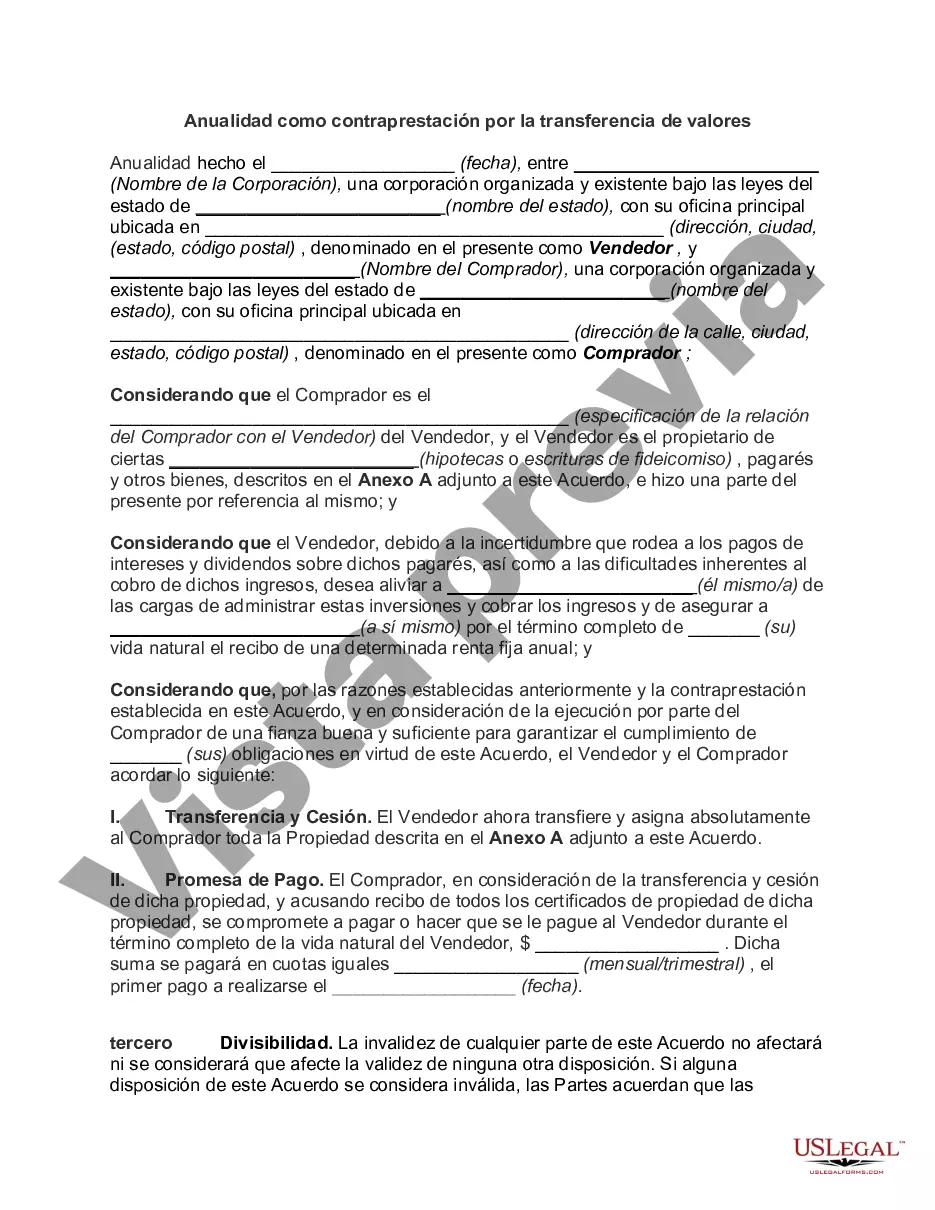

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Bexar Texas Anualidad Como Contraprestación Por La Transferencia De Valores?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Bexar Annuity as Consideration for Transfer of Securities is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Bexar Annuity as Consideration for Transfer of Securities. Follow the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Annuity as Consideration for Transfer of Securities in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!