Houston Texas Annuity as Consideration for Transfer of Securities is a financial arrangement commonly used as a method of asset transfer in the city of Houston, Texas. This arrangement involves the transfer of securities, such as stocks, bonds, or mutual funds, in exchange for an annuity. An annuity is a type of investment product provided by an insurance company that offers a series of regular payments to the annuitant over a specified period of time, typically in retirement. The purpose of using an annuity as consideration for the transfer of securities is to provide the transferor with a reliable source of income while allowing them to preserve and potentially grow their assets. Within the realm of Houston Texas Annuity as Consideration for Transfer of Securities, there are several types of annuities available. These include: 1. Fixed Annuities: These annuities guarantee a fixed interest rate for a specific period, providing a predictable income stream. The rate of return is usually influenced by prevailing market rates at the time of purchase. 2. Variable Annuities: With variable annuities, the annuitant has more control over the investment. These annuities allow the annuitant to choose from a range of investment options, such as stocks, bonds, or mutual funds, to potentially achieve higher returns. However, variable annuities are subject to market risks, and the income received can fluctuate. 3. Indexed Annuities: Indexed annuities offer returns linked to the performance of a specific market index, such as the S&P 500. They provide a potential for higher returns than fixed annuities while protecting the annuitant from market downturns. Indexed annuities typically come with a cap on returns to limit potential gains. 4. Immediate Annuities: Immediate annuities begin paying out income immediately after a lump-sum payment is made. This type of annuity is ideal for individuals seeking immediate income rather than the growth potential of other annuity types. Overall, Houston Texas Annuity as Consideration for Transfer of Securities provides individuals with a structured way to exchange their securities for a reliable income stream in retirement. The specific type of annuity chosen will depend on one's investment needs, risk tolerance, and financial goals. It is essential to work with a financial advisor or insurance professional to determine the most suitable annuity option based on individual circumstances.

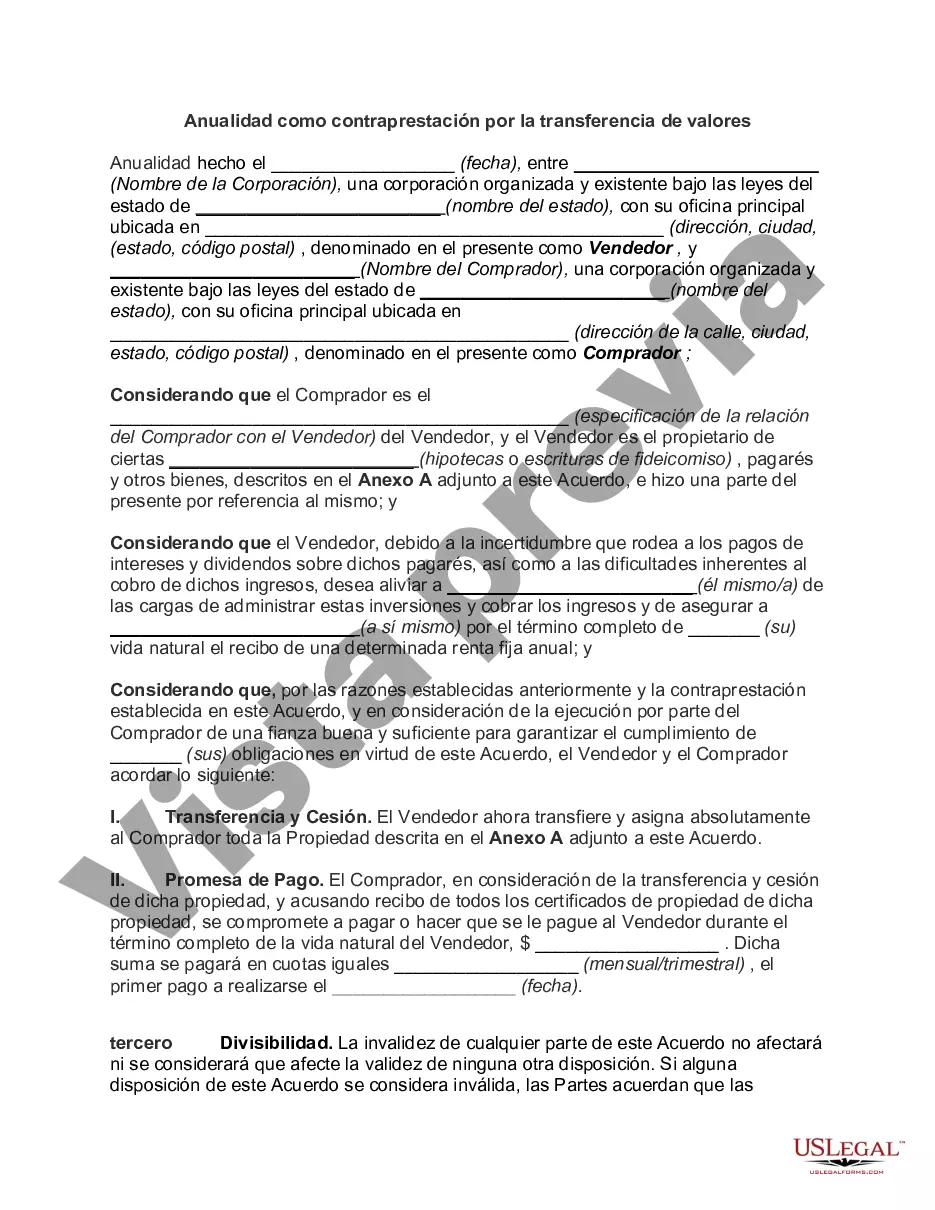

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Houston Texas Anualidad Como Contraprestación Por La Transferencia De Valores?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your county, including the Houston Annuity as Consideration for Transfer of Securities.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Houston Annuity as Consideration for Transfer of Securities will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Houston Annuity as Consideration for Transfer of Securities:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Houston Annuity as Consideration for Transfer of Securities on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!