Montgomery Maryland Annuity as Consideration for Transfer of Securities is a financial arrangement that involves the exchange of securities for an annuity in Montgomery County, Maryland. This type of annuity serves as a method of compensation or payment for securities being transferred. Here are some key details and types of Montgomery Maryland Annuities: 1. Tax-Deferred Annuities: By exchanging transferable securities for a Montgomery Maryland Annuity, individuals or entities can defer taxes on the capital gains they would have incurred if they sold the securities outright. This can be especially beneficial for investors looking to minimize their tax liabilities. 2. Fixed Annuities: These annuities offer a guaranteed income stream to the holder. With a fixed rate of return, this annuity ensures a set amount of money will be received at regular intervals, typically monthly or annually. 3. Variable Annuities: Unlike fixed annuities, this type allows the holder to invest their funds in a range of securities such as stocks, bonds, and mutual funds. The return on investment is not fixed and can vary depending on the performance of the chosen investment options. 4. Immediate Annuities: As the name suggests, immediate annuities provide an immediate income stream, typically starting within a year after the annuity is purchased. This option is suitable for those seeking immediate cash flow from their transferable securities. 5. Deferred Annuities: In contrast to immediate annuities, deferred annuities allow the investor to delay the start of the income stream until a later date, such as retirement. This gives the annuity time to accumulate interest and potentially grow the inherited value. Montgomery Maryland Annuity as Consideration for Transfer of Securities offers a unique opportunity for investors in Montgomery County, Maryland, to convert their securities into a steady income stream while potentially benefiting from tax advantages. It is essential to consult with financial professionals and tax advisors to understand the specific terms, conditions, and tax implications before entering into such arrangements.

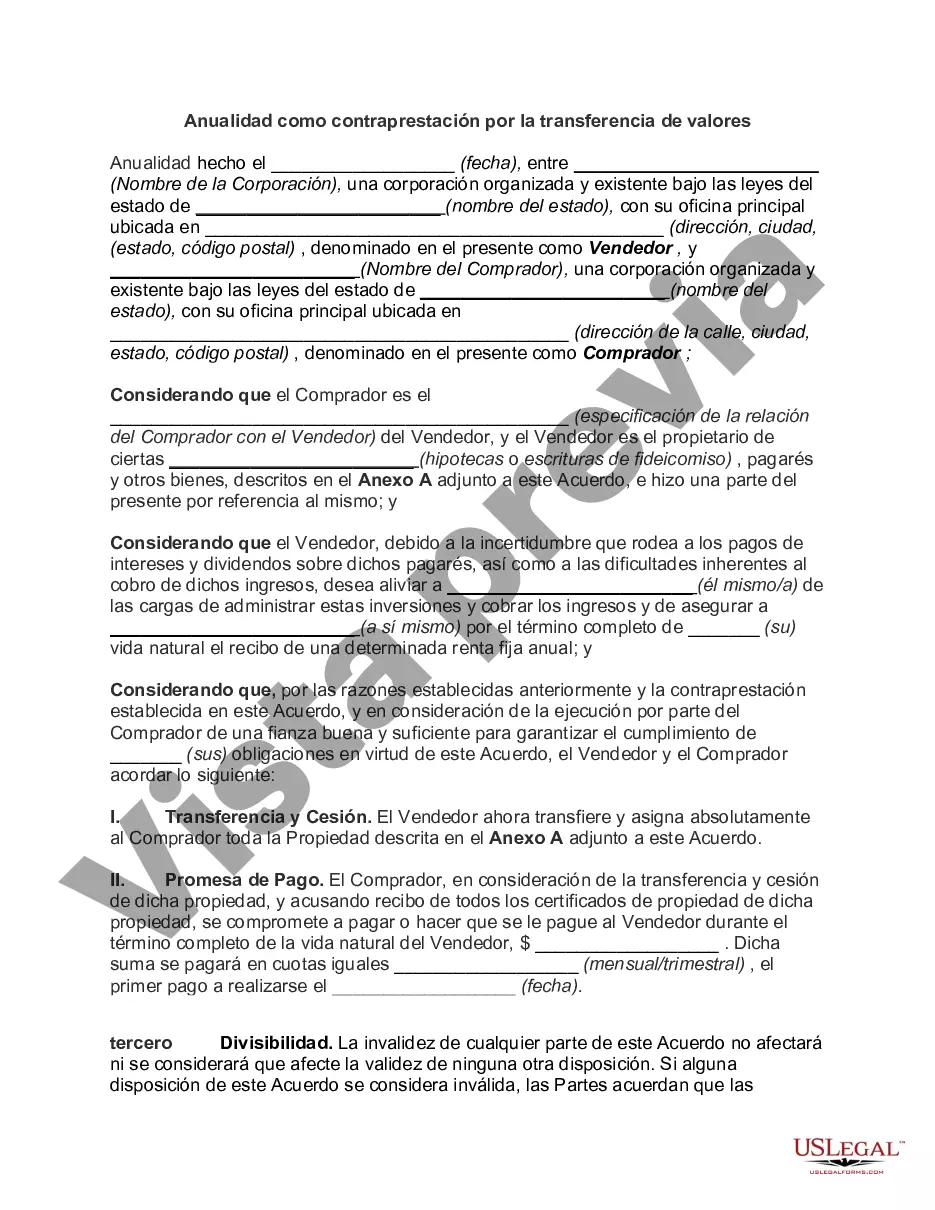

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Montgomery Maryland Anualidad Como Contraprestación Por La Transferencia De Valores?

Creating paperwork, like Montgomery Annuity as Consideration for Transfer of Securities, to take care of your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for various cases and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Montgomery Annuity as Consideration for Transfer of Securities form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Montgomery Annuity as Consideration for Transfer of Securities:

- Make sure that your template is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Montgomery Annuity as Consideration for Transfer of Securities isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start utilizing our website and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!