Oakland Michigan Annuity as Consideration for Transfer of Securities: An annuity can be defined as a financial product designed to provide a steady income stream in retirement. In Oakland, Michigan, individuals have the option to choose an annuity as consideration for the transfer of securities. This means that instead of receiving a one-time payment for the transfer, the person can choose to receive regular annuity payments over a specified period. The Oakland Michigan annuity as consideration for the transfer of securities offers several benefits. Firstly, it provides individuals with a reliable and predictable income, ensuring a financially stable retirement. Secondly, it offers tax advantages, as the income from annuities is typically taxed at a lower rate than ordinary income. There are different types of annuities available in Oakland, Michigan, which can be considered as consideration for the transfer of securities. These include: 1. Fixed Annuities: Fixed annuities guarantee a fixed interest rate for a specific period. This type of annuity provides stability and ensures that the income stream remains constant, regardless of market fluctuations. 2. Variable Annuities: Variable annuities allow individuals to invest their annuity premiums into a range of investment options such as stocks, bonds, and mutual funds. The income generated from variable annuities fluctuates based on the performance of the chosen investments. 3. Indexed Annuities: Indexed annuities offer a combination of guaranteed minimum returns and the potential for higher returns based on the performance of a specific market index, like the S&P 500. This type of annuity provides a balance between security and potential growth. 4. Immediate Annuities: Immediate annuities provide an immediate income stream, typically starting within 30 days of making a lump-sum payment. This type of annuity can be suitable for individuals who require immediate income upon retirement. 5. Deferred Annuities: Deferred annuities are designed to accumulate funds over a specified period before starting the payout phase. During the accumulation phase, the annuity grows tax-deferred, allowing for potential compound growth. When considering the transfer of securities in Oakland, Michigan, individuals should carefully analyze their financial goals and risk tolerance. Consulting with a financial advisor is recommended to determine the most suitable type of annuity as consideration for the transfer of securities.

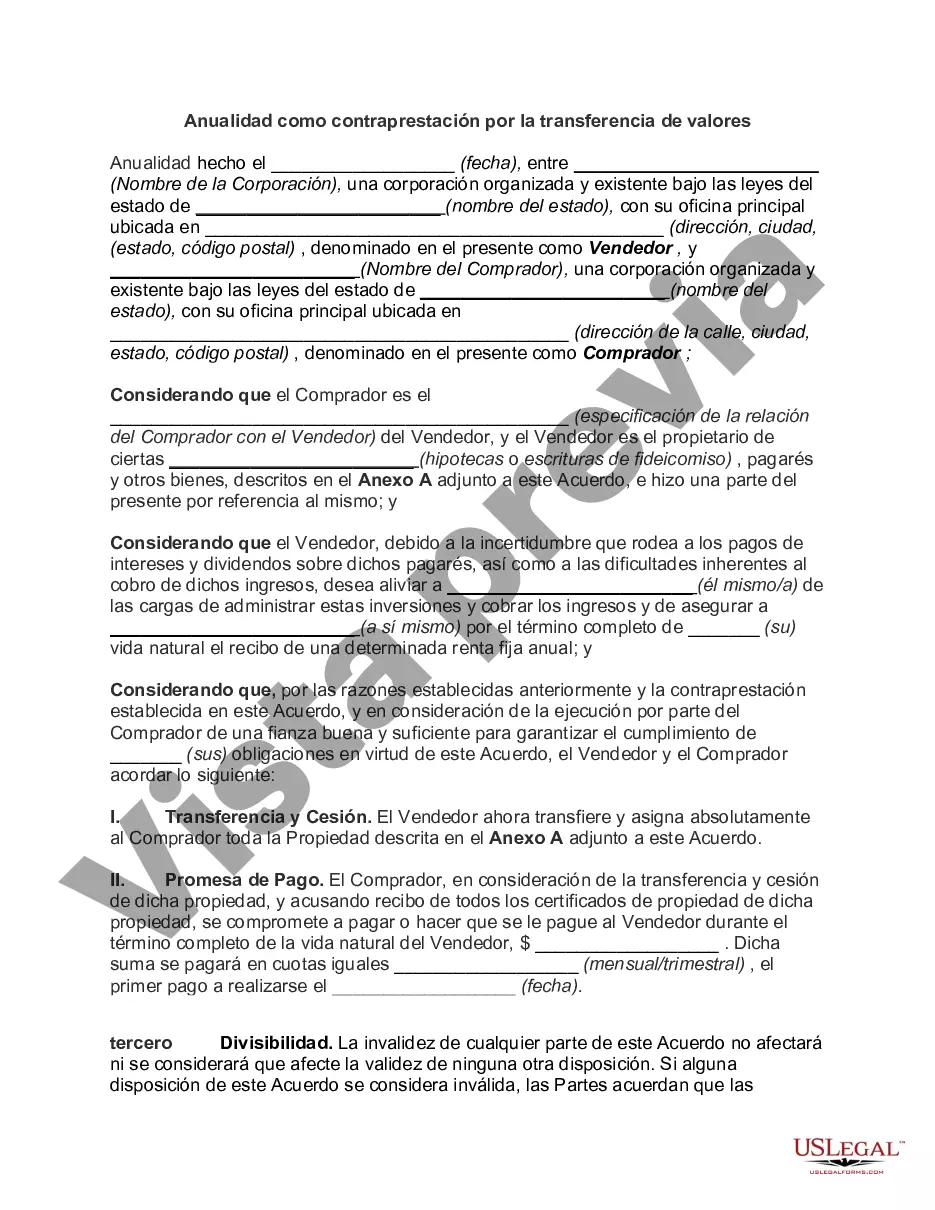

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Oakland Michigan Anualidad Como Contraprestación Por La Transferencia De Valores?

Are you looking to quickly create a legally-binding Oakland Annuity as Consideration for Transfer of Securities or probably any other document to manage your own or business matters? You can go with two options: hire a professional to write a legal document for you or create it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Oakland Annuity as Consideration for Transfer of Securities and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, double-check if the Oakland Annuity as Consideration for Transfer of Securities is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Oakland Annuity as Consideration for Transfer of Securities template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!