Orange, California Annuity as Consideration for Transfer of Securities: An annuity is a financial product offered by insurance companies, designed to provide a steady stream of income to an individual over a specific period of time, often during retirement. In the case of Orange, California, there are several types of annuities available as consideration for the transfer of securities. 1. Fixed Annuities: Fixed annuities offer a guaranteed interest rate for a specific duration. They provide a stable income without the worry of market fluctuations. With Orange, California fixed annuities as consideration for the transfer of securities, individuals can enjoy a reliable income source during retirement. 2. Variable Annuities: Variable annuities allow for investment in underlying securities, such as stocks and bonds. These annuities offer the potential for higher returns but also come with the risk of market volatility. For those willing to take on some investment risk, Orange, California offers variable annuities as consideration for transferring securities. 3. Indexed Annuities: Indexed annuities combine features of both fixed and variable annuities. They offer a minimum guaranteed interest rate along with the potential to earn additional returns based on the performance of a specific index, such as the S&P 500. Orange, California indexed annuities serve as an attractive option for individuals seeking a balance between stability and growth. 4. Immediate Annuities: Immediate annuities provide an instant income stream in exchange for a lump-sum payment. With Orange, California immediate annuities as consideration for transferring securities, investors can secure a reliable income source that starts immediately, helping to meet immediate financial needs. 5. Deferred Annuities: Deferred annuities allow individuals to accumulate funds over a specified period before annuitization begins. This can be an effective strategy for those looking to grow their retirement savings over time. Orange, California deferred annuities as consideration for transferring securities provide individuals with the ability to save for the future while enjoying potential tax advantages. When considering the transfer of securities in Orange, California, individuals have a range of annuity options available to them. Whether one prefers the stability of fixed annuities, desires growth potential through variable or indexed annuities, or needs immediate income with immediate annuities, Orange, California accommodates all these requirements. The choice of annuity as consideration for transferring securities ultimately depends on an individual's financial goals, risk tolerance, and retirement needs.

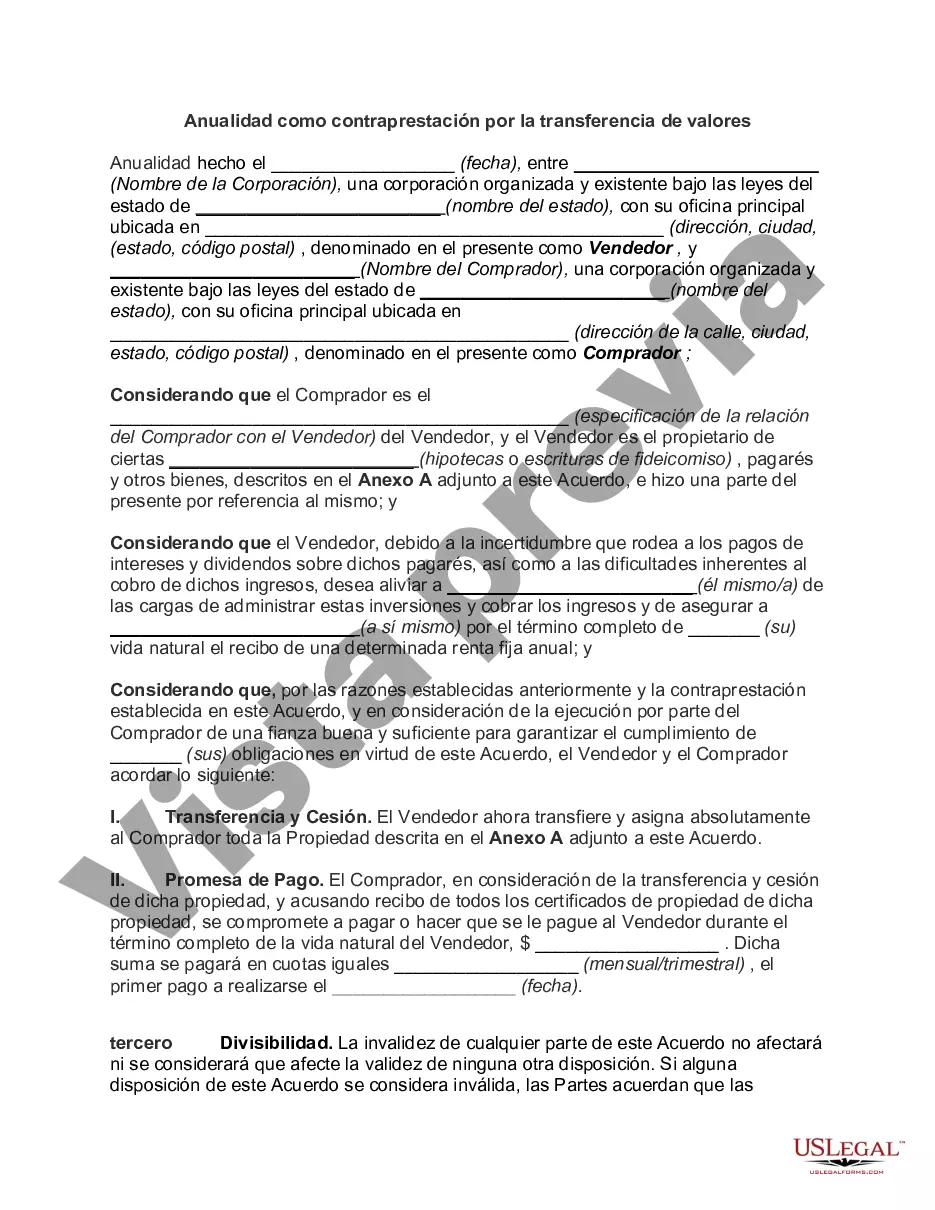

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Orange California Anualidad Como Contraprestación Por La Transferencia De Valores?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Orange Annuity as Consideration for Transfer of Securities, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks related to paperwork execution straightforward.

Here's how you can find and download Orange Annuity as Consideration for Transfer of Securities.

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Orange Annuity as Consideration for Transfer of Securities.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Orange Annuity as Consideration for Transfer of Securities, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you have to cope with an exceptionally difficult case, we recommend getting a lawyer to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and get your state-specific documents with ease!