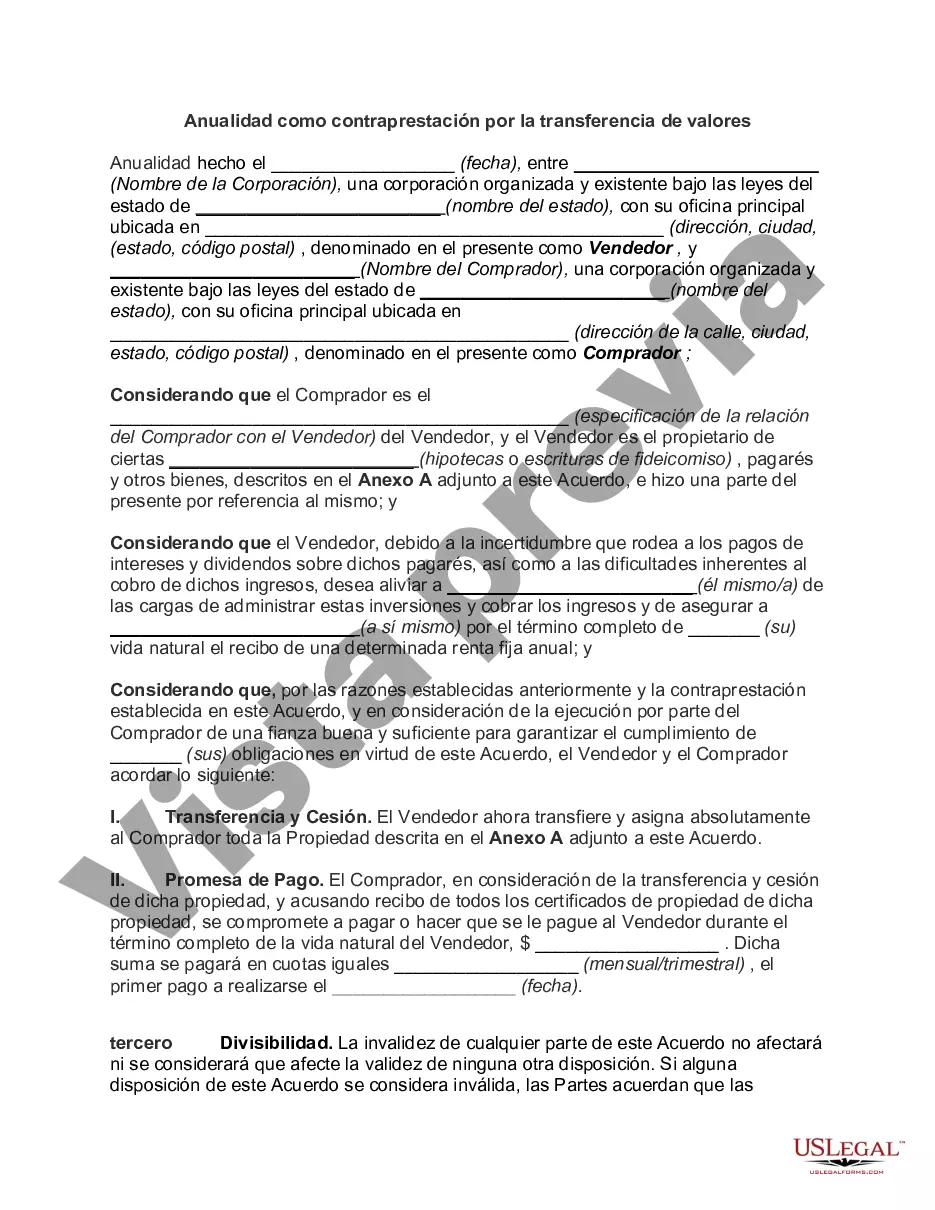

A San Diego California annuity as consideration for the transfer of securities is a financial arrangement where an individual or entity transfers their securities, such as stocks, bonds, or mutual funds, to an annuity provider based in San Diego, California, in exchange for an annuity contract. San Diego, California, offers various types of annuities as consideration for the transfer of securities, including: 1. Fixed Annuities: This type of annuity provides a guaranteed interest rate for a specific period, ensuring a stable and predictable income stream for the annuitant. Fixed annuities are popular among individuals seeking a secure retirement income source. 2. Variable Annuities: Unlike fixed annuities, variable annuities offer investment options tied to the performance of underlying securities, allowing the annuitant to participate in potential market gains. However, the annuity's value can fluctuate based on the performance of the selected investments. 3. Immediate Annuities: Immediate annuities start providing regular income payments shortly after the transfer of securities. Usually, these annuities are suitable for individuals who require immediate retirement income. 4. Deferred Annuities: Deferred annuities, as the name suggests, delay income payments to a later date, typically during retirement. This annuity type allows the annuity holder to accumulate wealth on a tax-deferred basis until they decide to start receiving payments. San Diego, California, serves as a prominent hub for annuity providers, offering a range of annuity products tailored to meet the financial goals and preferences of individuals looking to transfer their securities. It is crucial for potential annuity seekers to engage with trusted financial advisors or annuity experts based in San Diego to navigate the complexities of this financial decision and find the best annuity option suited for their needs. Keywords: San Diego California, annuity, transfer of securities, fixed annuities, variable annuities, immediate annuities, deferred annuities, financial arrangement, retirement income, annuity providers, financial advisors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out San Diego California Anualidad Como Contraprestación Por La Transferencia De Valores?

Creating paperwork, like San Diego Annuity as Consideration for Transfer of Securities, to take care of your legal matters is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for various scenarios and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the San Diego Annuity as Consideration for Transfer of Securities template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting San Diego Annuity as Consideration for Transfer of Securities:

- Make sure that your template is specific to your state/county since the rules for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the San Diego Annuity as Consideration for Transfer of Securities isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start utilizing our service and download the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!