San Jose, California Annuity as Consideration for Transfer of Securities: An annuity in San Jose, California can serve as a valuable consideration for the transfer of securities between parties. An annuity is a financial product that provides a fixed stream of income over a specific period, ensuring a steady flow of payments to the annuitant. These annuities can be classified into different types to suit different investment goals and risk tolerance levels: 1. Fixed Annuities: Fixed annuities guarantee a fixed interest rate for a specific duration, typically ranging from one to ten years. They offer stability and security, making them a popular choice for conservative investors who seek a reliable source of income and want to minimize risk. 2. Variable Annuities: Variable annuities enable investors to allocate their funds to a range of investment options, such as mutual funds. The growth and income generated from these investments fluctuate based on market performance, offering potential higher returns but also greater risk. Variable annuities often appeal to those seeking the opportunity for long-term capital appreciation. 3. Indexed Annuities: Indexed annuities link the annuity's performance to a specific market index, such as the S&P 500. This type of annuity offers the potential for higher returns than fixed annuities while providing a degree of downside protection. Indexed annuities are suited for individuals looking for a balance between growth potential and protection against market downturns. 4. Immediate Annuities: Immediate annuities provide an instant income stream after a lump-sum payment. This type of annuity is attractive for retirees who want to start receiving payments immediately and don't require an accumulation phase. 5. Deferred Annuities: Deferred annuities involve making payments into the annuity over a specified period before starting the income distribution phase. This type of annuity appeals to individuals who intend to accumulate savings over time and defer the income stream until retirement or a future date. When considering the transfer of securities in San Jose, California, an annuity can offer advantages such as tax-deferred growth, the potential for higher returns, and a consistent income stream. It is crucial to carefully assess individual financial goals, risk tolerance, and investment time horizon to determine the most suitable annuity type to use as consideration for the transfer of securities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out San Jose California Anualidad Como Contraprestación Por La Transferencia De Valores?

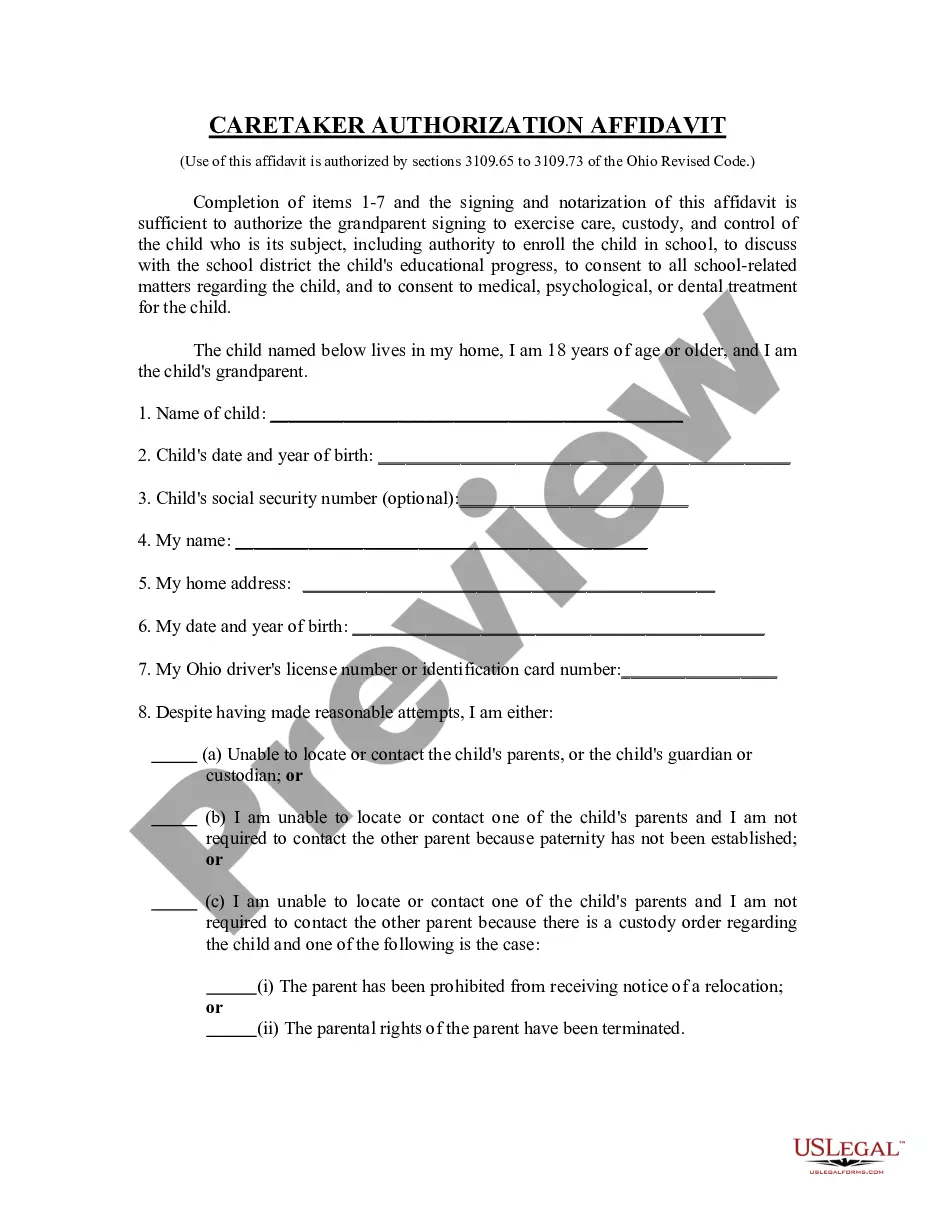

If you need to get a reliable legal paperwork provider to obtain the San Jose Annuity as Consideration for Transfer of Securities, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to get and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse San Jose Annuity as Consideration for Transfer of Securities, either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the San Jose Annuity as Consideration for Transfer of Securities template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less costly and more reasonably priced. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the San Jose Annuity as Consideration for Transfer of Securities - all from the convenience of your home.

Sign up for US Legal Forms now!