Tarrant Texas Annuity as Consideration for Transfer of Securities: Exploring Types and Benefits In Tarrant, Texas, one popular financial option that individuals consider when transferring securities is the Tarrant Texas Annuity as Consideration. An annuity is a contractual agreement between an individual and an insurance company in which the individual pays a premium or a series of payments in exchange for a future income stream. When it comes to transferring securities, individuals have several types of Tarrant Texas annuities available to choose from. These annuities can vary in terms of features, benefits, and payout options. Here, we will delve into some different types of Tarrant Texas annuity as consideration for transfer of securities. 1. Fixed Annuities: Fixed annuities provide a guaranteed interest rate and a fixed income over a specified period. With this type of annuity, individuals can transfer their securities and receive regular payments, ensuring a secure and predictable source of income in the future. 2. Variable Annuities: Variable annuities, on the other hand, offer individuals the opportunity to invest their transferred securities in a range of sub-accounts. These sub-accounts are similar to mutual funds, allowing individuals to choose from various investment options. The income generated from these investments is not fixed, as it depends on the performance of the chosen investment vehicles. 3. Indexed Annuities: Indexed annuities combine features of both fixed and variable annuities. The returns in indexed annuities are linked to a market index, typically the S&P 500. This means that individuals can potentially benefit from market gains while being protected from market losses. Indexed annuities can be an attractive option for those looking for potential growth without assuming too much risk. The Tarrant Texas annuity as consideration for transfer of securities offers several benefits to individuals. Firstly, it provides a reliable and consistent income stream, ensuring financial stability in retirement. Moreover, annuities can offer tax advantages, allowing individuals to defer taxes on their transferred securities until they start receiving payments, potentially lowering their overall tax liability. Another advantage of Tarrant Texas annuity as consideration for transfer of securities is that it provides protection against market volatility. With fixed annuities, individuals are shielded from market downturns, guaranteeing a steady income regardless of market fluctuations. For those who opt for variable annuities or indexed annuities, there is potential for growth, albeit with certain risks associated with market performance. In conclusion, the Tarrant Texas annuity as consideration for transfer of securities offers individuals a range of options to secure their financial future. Whether they choose fixed, variable, or indexed annuities, individuals can enjoy a reliable income stream, potential tax advantages, and protection against market volatility. To make an informed decision, it is advisable for individuals to consult with financial professionals who can assess their unique circumstances and help them determine the most suitable annuity type for their needs.

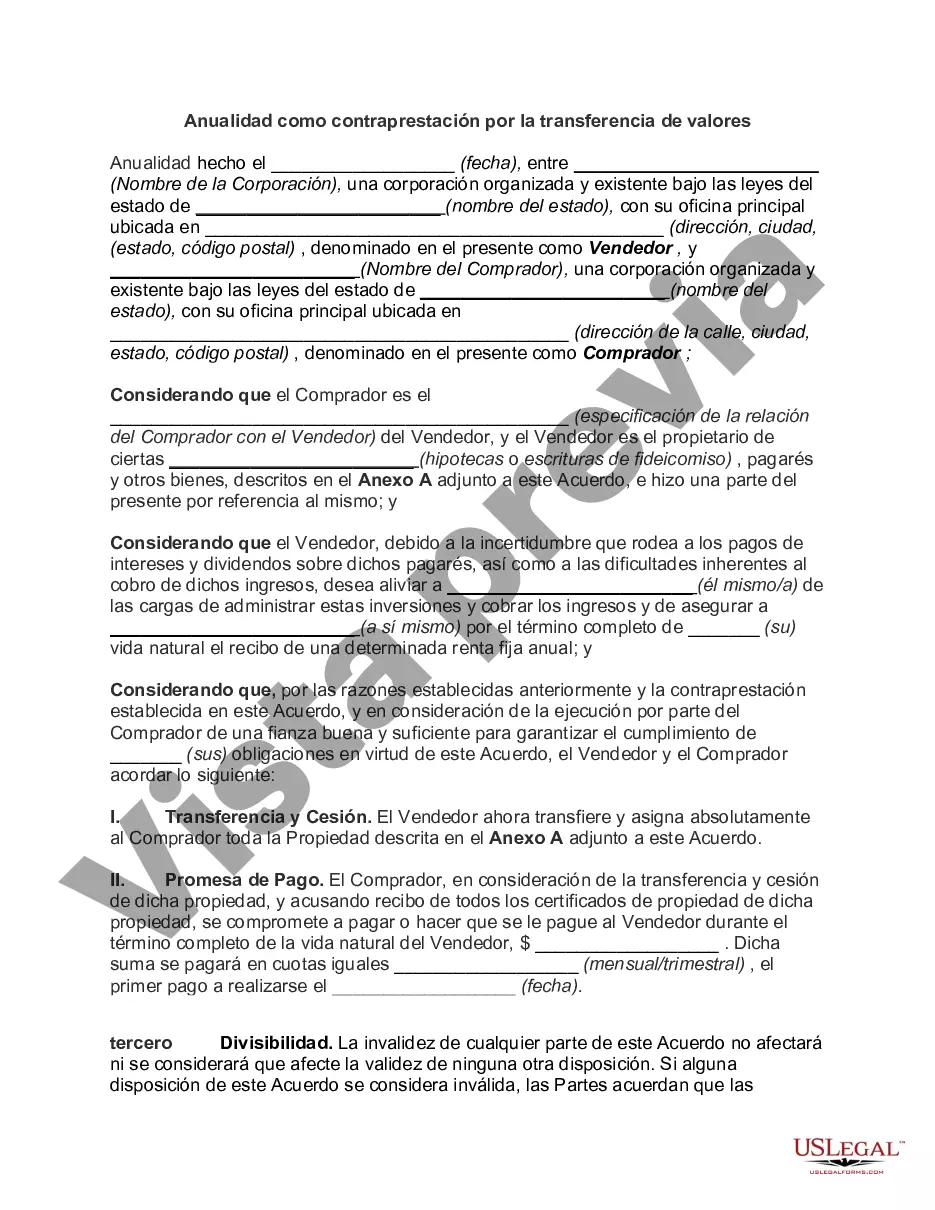

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Tarrant Texas Anualidad Como Contraprestación Por La Transferencia De Valores?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Tarrant Annuity as Consideration for Transfer of Securities, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Tarrant Annuity as Consideration for Transfer of Securities from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Tarrant Annuity as Consideration for Transfer of Securities:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!