Travis Texas Annuity as Consideration for Transfer of Securities is a type of financial arrangement that involves the exchange of securities for an annuity contract in the state of Texas. This transaction serves as a means for individuals or entities to transfer their securities holdings in exchange for a regular income stream in the form of annuity payments. Travis Texas Annuity offers various options to suit the unique needs and preferences of investors. These annuity types are designed to provide individuals with flexibility and financial stability. Here are a few common types: 1. Fixed Annuity: This type of Travis Texas Annuity guarantees a fixed rate of return over a specific period. Investors receive a predictable income stream, making it an attractive option for those seeking stability. 2. Variable Annuity: With a variable annuity, the return on investment depends on the performance of an underlying investment portfolio. This allows investors to participate in potential market gains, but they also face the risk of market fluctuations. 3. Indexed Annuity: Indexed annuities provide the opportunity to earn returns linked to a specific market index, such as the S&P 500. Investors can enjoy potential gains while also having some downside protection. 4. Immediate Annuity: Immediate annuities offer regular payments that start immediately after the annuity contract purchase. This type of annuity is suitable for individuals who desire an immediate income stream without any delay. 5. Deferred Annuity: Unlike immediate annuities, deferred annuities provide a waiting period before the income payments begin. This allows investors to accumulate funds over time and benefit from potential tax advantages. Travis Texas Annuity as Consideration for Transfer of Securities enables individuals to diversify their financial holdings and exchange securities for a reliable income stream. It offers an opportunity to transition from asset ownership to regular income, ensuring financial security throughout retirement or specific periods of life. It is crucial for individuals considering this type of transaction to consult with financial advisors or professionals familiar with Travis Texas Annuities and relevant regulations to make informed decisions based on their specific financial circumstances and goals.

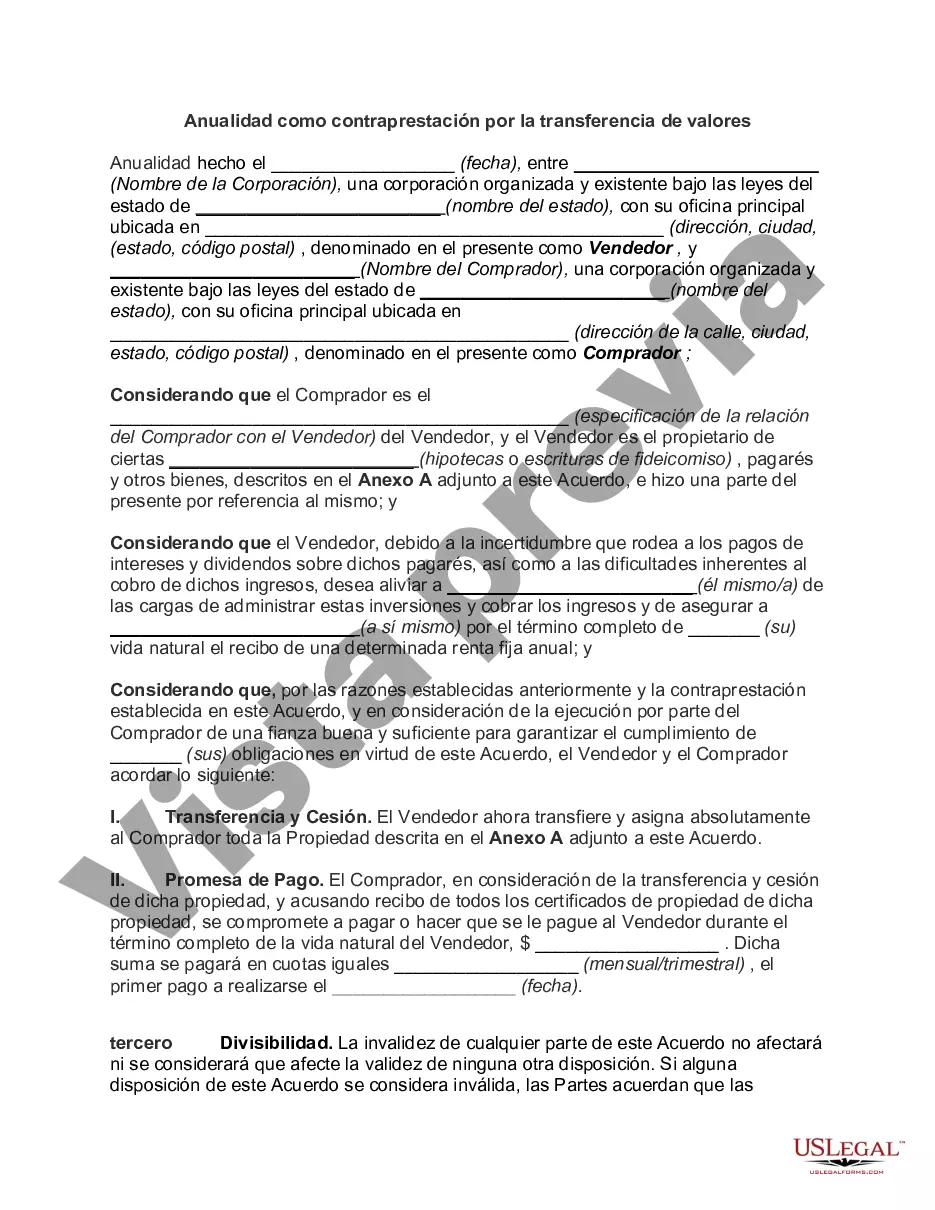

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Travis Texas Anualidad Como Contraprestación Por La Transferencia De Valores?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Travis Annuity as Consideration for Transfer of Securities, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the recent version of the Travis Annuity as Consideration for Transfer of Securities, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Annuity as Consideration for Transfer of Securities:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Travis Annuity as Consideration for Transfer of Securities and download it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!