Wayne Michigan Annuity as Consideration for Transfer of Securities In Wayne, Michigan, an annuity serves as a valuable form of consideration for the transfer of securities. An annuity is a financial product that offers individuals a steady stream of income over a specific period or for the rest of their lives. It is commonly considered as a safe and reliable investment option. When used as consideration for transferring securities, it provides investors with an opportunity to diversify their investment portfolio. There are different types of annuities available in Wayne, Michigan, each offering unique features and benefits. Here are a few examples: 1. Fixed Annuities: These annuities guarantee a fixed interest rate for a defined period, providing a reliable and predictable income stream. With fixed annuities, investors do not face market risks, making them ideal for those who prioritize stability and consistent returns. 2. Variable Annuities: Variable annuities enable investors to allocate funds into different investment options like stocks, bonds, and mutual funds. The value of the annuity fluctuates based on the performance of these underlying investments. While it offers potential for higher returns, variable annuities also involve market risks. 3. Immediate Annuities: As the name suggests, immediate annuities start generating income right after the investment is made. They are suitable for individuals looking for immediate retirement income or those who have received a lump sum payment and want to ensure a regular cash flow. 4. Deferred Annuities: Deferred annuities allow individuals to accumulate funds over a specified period before receiving regular payments. They are often used as retirement savings vehicles, providing tax-deferred growth on the invested sums. Deferred annuities can be either fixed or variable, depending on the investor's preference. The utilization of annuities as consideration for the transfer of securities in Wayne, Michigan, provides investors with several advantages. First, it allows for diversification of investment holdings, reducing their exposure to market volatility. Second, annuities offer a reliable income stream, serving as an essential component of retirement planning. Lastly, the tax advantages associated with annuities make them an attractive option for investors seeking long-term, stable financial growth. In conclusion, Wayne, Michigan, offers various types of annuities as consideration for the transfer of securities, catering to different investment goals and risk tolerances. Whether it's fixed, variable, immediate, or deferred annuities, individuals can choose the type that aligns with their financial objectives while ensuring a secure and reliable income stream.

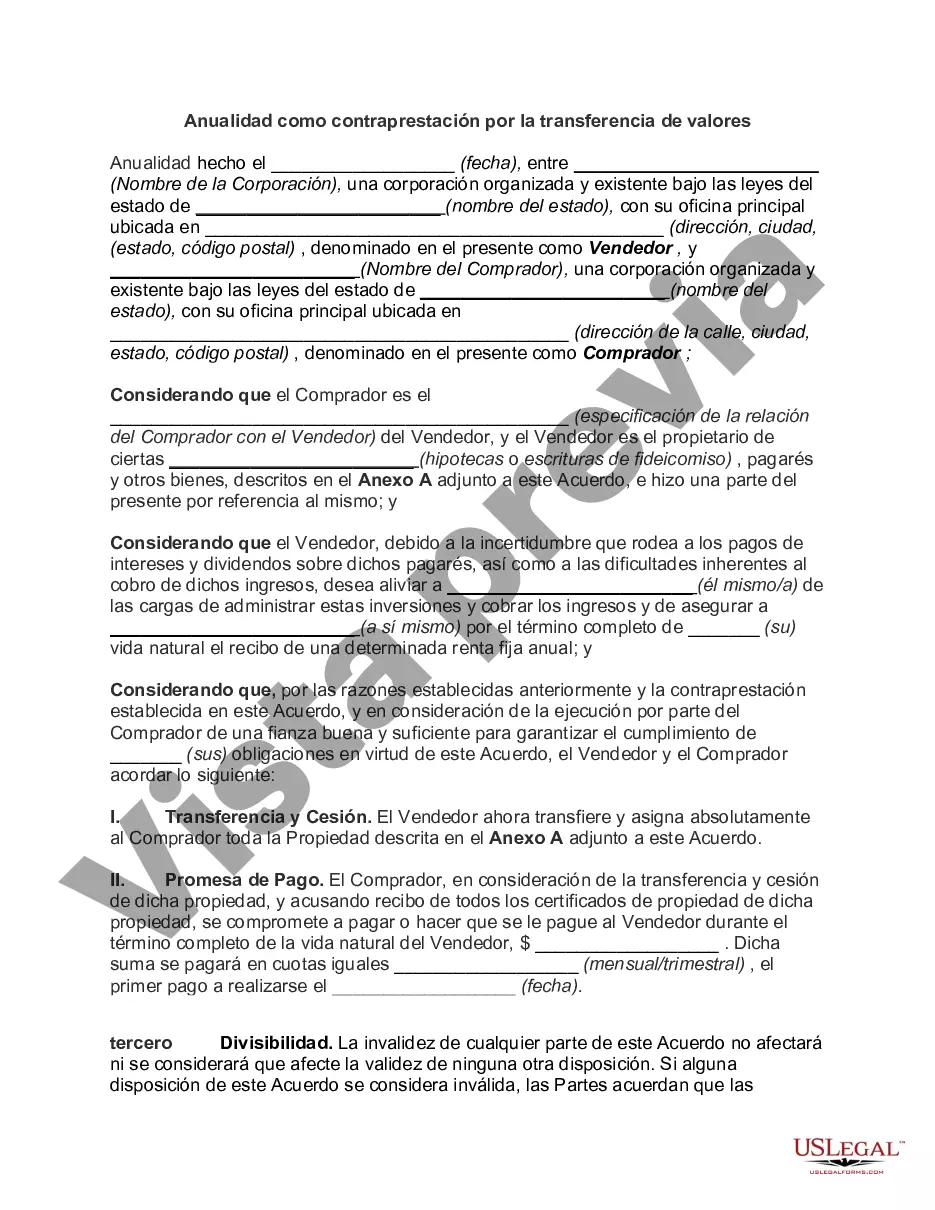

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Anualidad como contraprestación por la transferencia de valores - Annuity as Consideration for Transfer of Securities

Description

How to fill out Wayne Michigan Anualidad Como Contraprestación Por La Transferencia De Valores?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Wayne Annuity as Consideration for Transfer of Securities, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Wayne Annuity as Consideration for Transfer of Securities from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Wayne Annuity as Consideration for Transfer of Securities:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!