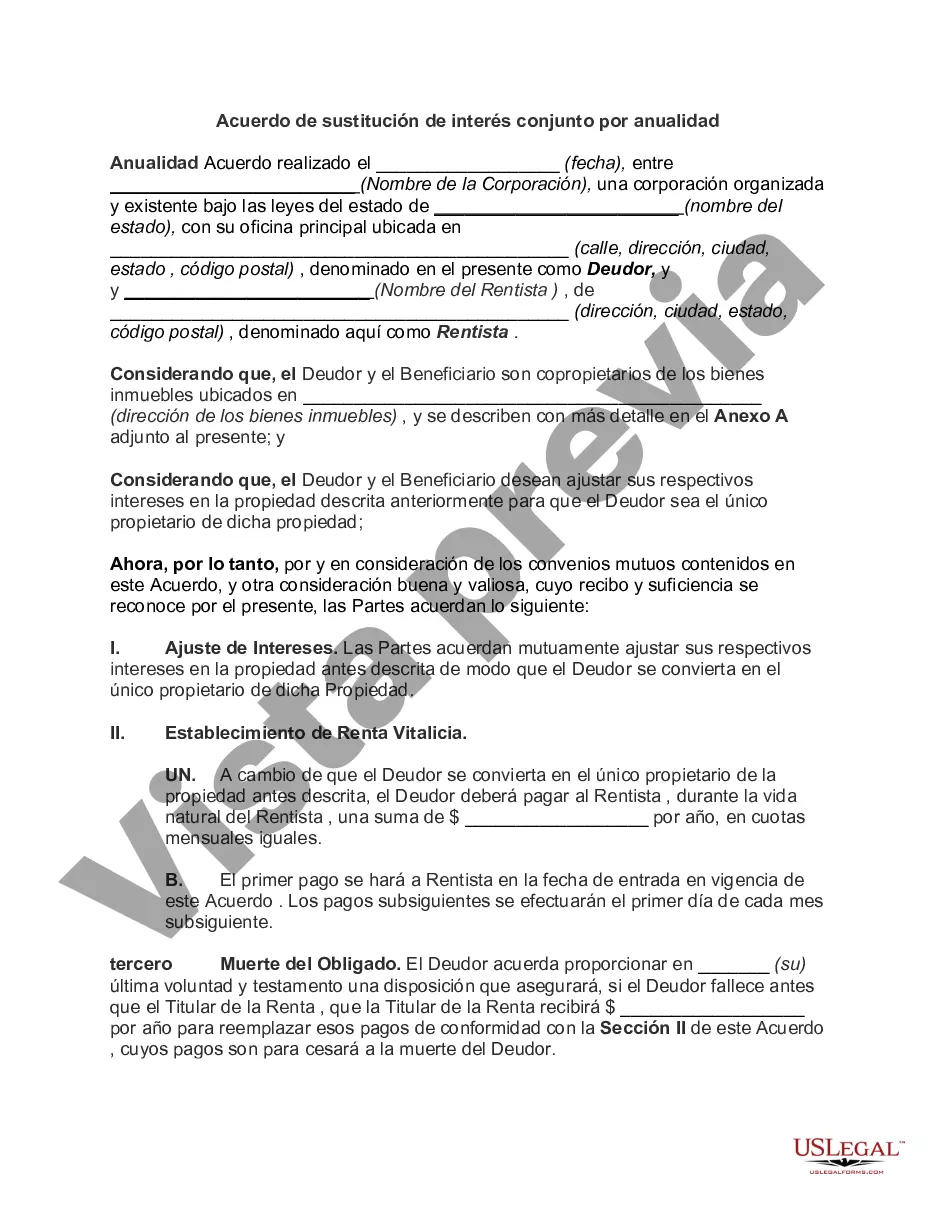

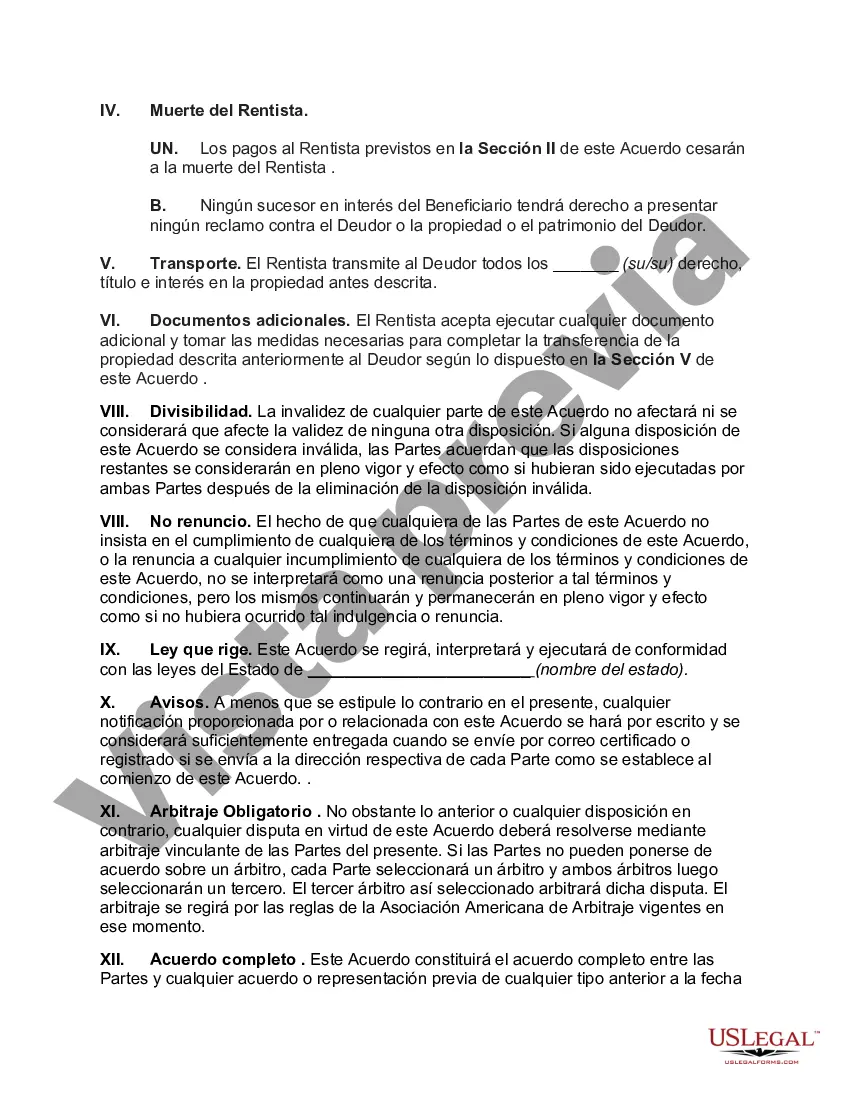

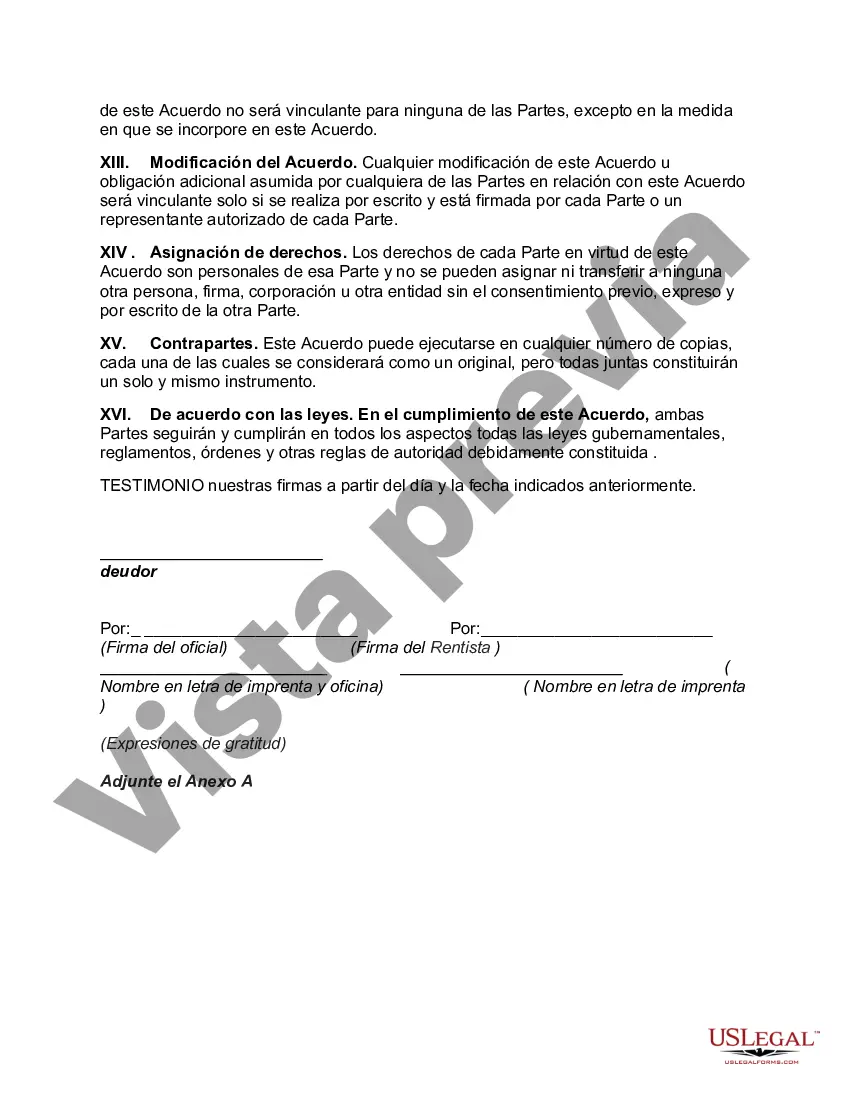

Title: Clark Nevada Agreement Replacing Joint Interest with Annuity: A Comprehensive Overview Keywords: Clark Nevada Agreement, Replacing Joint Interest, Annuity, Types Introduction: The Clark Nevada Agreement Replacing Joint Interest with Annuity is a legal document that outlines the terms and conditions under which joint interest ownership in an asset or property is replaced by an annuity. This agreement provides a structured framework for individuals or entities to transfer their joint interest to a secure annuity investment for long-term financial stability. In this article, we will explore the details of the Clark Nevada Agreement, its purpose, benefits, and potential variations. Understanding Clark Nevada Agreement Replacing Joint Interest with Annuity: The Clark Nevada Agreement Replacing Joint Interest with Annuity involves a mutual agreement between parties to relinquish their joint interest in a property or asset and convert it into an annuity. The agreement is typically drafted by legal professionals and encompasses all necessary provisions to ensure a smooth transition. Benefits of the Agreement: 1. Ensures financial stability: By converting joint interest into a fixed income annuity stream, the agreement provides a reliable source of income and financial security for the involved parties. 2. Risk diversification: Holding joint interest can be volatile due to market fluctuations, but annuities offer a more stable investment option by providing guaranteed income over a specified period. 3. Simplifies ownership: With joint interest replaced by annuity, there is a clear distinction of ownership. This eliminates potential conflicts and complications that can arise from shared ownership. 4. Tax advantages: Depending on the jurisdiction, annuity investments may offer tax advantages, such as deferred tax payments or preferential tax treatment, which can enhance overall financial planning. Types of Clark Nevada Agreement Replacing Joint Interest with Annuity: The Clark Nevada Agreement may vary depending on specific requirements and the nature of the assets involved. Some common variations include: 1. Real Estate Clark Nevada Agreement: In real estate, this agreement allows the conversion of joint interest in a property into an annuity, ensuring a consistent income stream. 2. Business Clark Nevada Agreement: This variation is used when joint interest ownership in a business entity is transferred into an annuity, providing stable income post-sale or during retirement. 3. Asset Clark Nevada Agreement: When joint interest involves other assets such as vehicles, equipment, or intellectual property, this agreement allows converting such ownership into an annuity. Conclusion: The Clark Nevada Agreement Replacing Joint Interest with Annuity serves as a valuable tool for individuals or entities seeking to streamline joint interest ownership and secure reliable long-term income through annuity investments. It offers numerous benefits, including financial stability, risk diversification, simplified ownership, and potential tax advantages. Tailored variations of this agreement, such as the real estate, business, or asset-specific types, ensure flexibility and accommodate diverse needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo de sustitución de interés conjunto por anualidad - Agreement Replacing Joint Interest with Annuity

Description

How to fill out Clark Nevada Acuerdo De Sustitución De Interés Conjunto Por Anualidad?

Are you looking to quickly create a legally-binding Clark Agreement Replacing Joint Interest with Annuity or probably any other document to take control of your own or business matters? You can select one of the two options: contact a professional to write a valid document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Clark Agreement Replacing Joint Interest with Annuity and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Clark Agreement Replacing Joint Interest with Annuity is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Clark Agreement Replacing Joint Interest with Annuity template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!