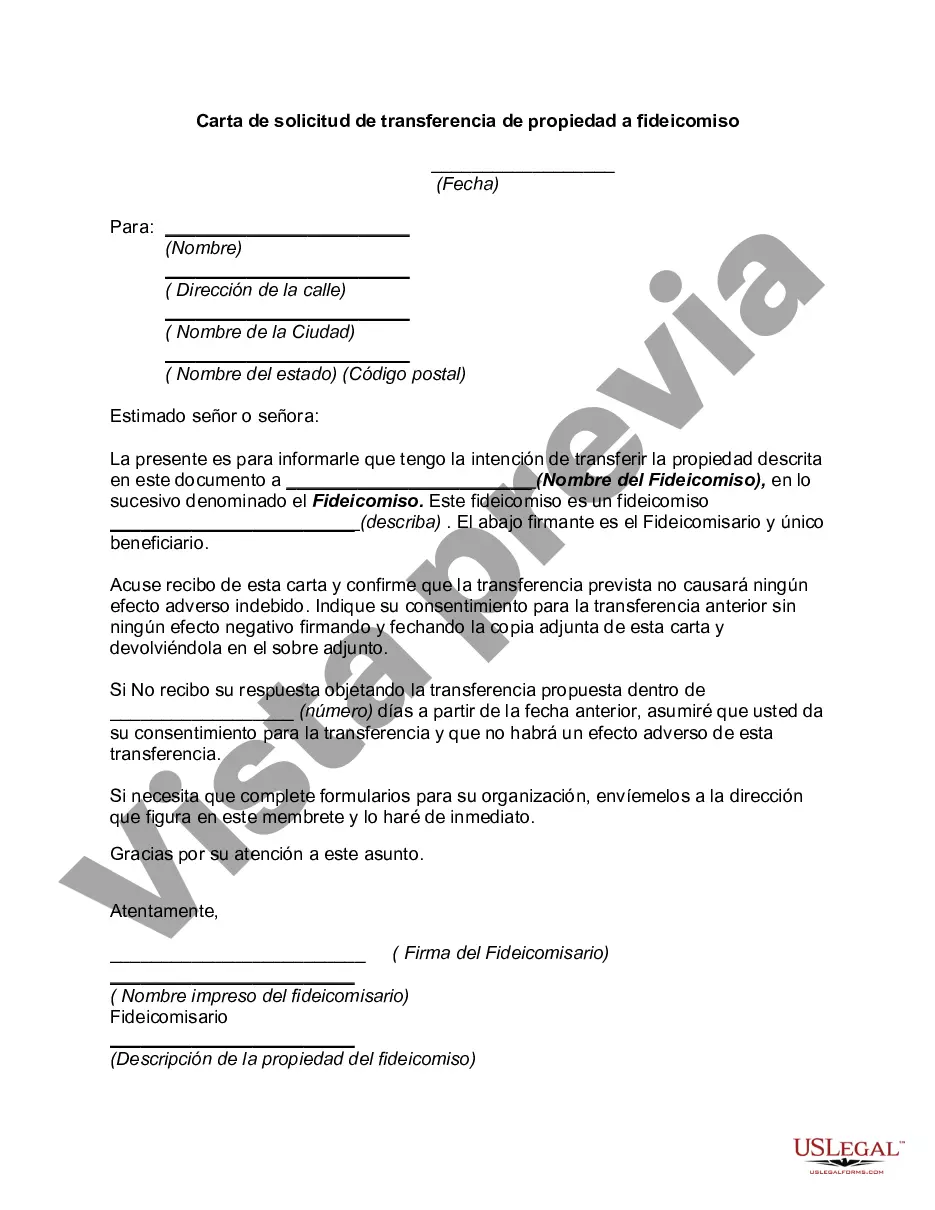

Title: Chicago Illinois Letter Requesting Transfer of Property to Trust: A Comprehensive Guide Introduction: If you are a resident of Chicago, Illinois, and planning to transfer your property to a trust, it is essential to understand the process involved and the significance of a formal letter requesting the transfer. This guide provides a detailed description of what a Chicago Illinois Letter Requesting Transfer of Property to Trust entails and its various types. 1. Importance of a Chicago Illinois Letter Requesting Transfer of Property to Trust: — A formal letter ensures transparency and serves as a legally binding document. — It clearly communicates your intent to transfer property to a trust, avoiding any ambiguity. 2. Key components of the Chicago Illinois Letter Requesting Transfer of Property to Trust: — Identification of the property: Describing the property, including its legal description, address, and parcel number. — Trust details: Clearly stating the trust's name, trustee’s information, and the purpose or objectives of the trust. — Transfer provisions: Outlining the terms and conditions of the property transfer and any specific instructions or restrictions. — Effective date: Specifying the date on which the transfer of property to the trust becomes effective. — Signatures: Including the signatures of the property owner, trustees, and witnesses for authentication. 3. Types of Chicago Illinois Letter Requesting Transfer of Property to Trust: a) Revocable Living Trust Transfer Letter: This type of letter is used when the property owner wishes to transfer assets to a revocable living trust during their lifetime while retaining control and flexibility over the trust. b) Irrevocable Trust Transfer Letter: This letter is utilized when transferring assets to an irrevocable trust, resulting in the property owner relinquishing control and ownership rights permanently. 4. Additional Considerations: — Consultation with an attorney: It is advisable to seek legal advice from a trusted attorney experienced in estate planning and property transfers to ensure compliance with Chicago, Illinois, laws and regulations. — Notarization: Some property transfer letters may require notarization for validity and authentication purposes. — Complying with tax regulations: Transferring property to a trust may have tax implications, so it is crucial to consult a tax professional to understand any tax obligations associated with the transfer. Conclusion: In summary, a Chicago Illinois Letter Requesting Transfer of Property to Trust is a crucial document that formalizes the transfer of property to a trust, ensuring clarity and legal legitimacy. Whether you opt for a revocable living trust or an irrevocable trust, understanding the components and adhering to legal requirements are essential steps to preserve your property's integrity. Always consult with professionals to navigate the complexities of property transfers and estate planning effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Carta de solicitud de transferencia de propiedad a fideicomiso - Letter Requesting Transfer of Property to Trust

Description

How to fill out Chicago Illinois Carta De Solicitud De Transferencia De Propiedad A Fideicomiso?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Chicago Letter Requesting Transfer of Property to Trust is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Chicago Letter Requesting Transfer of Property to Trust. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Letter Requesting Transfer of Property to Trust in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!