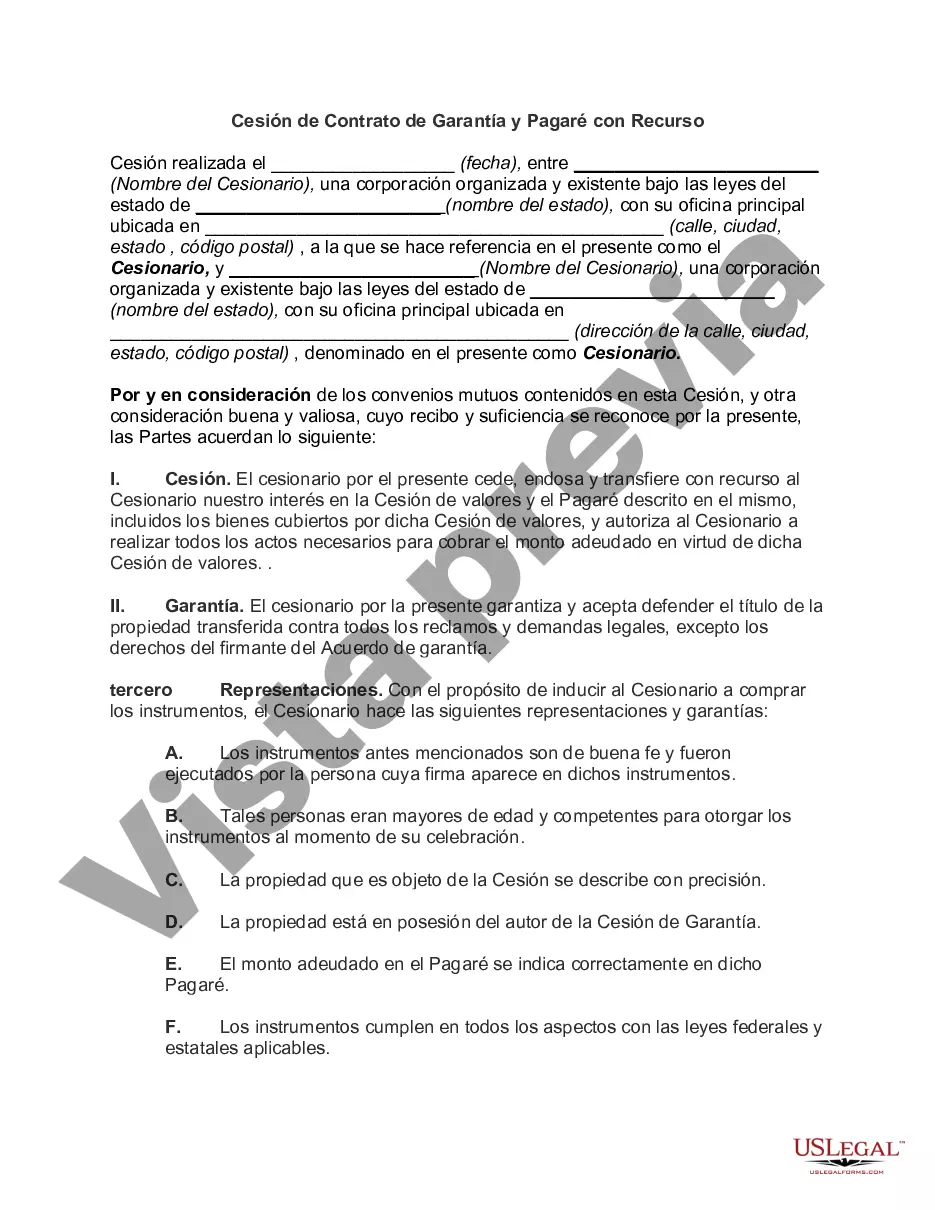

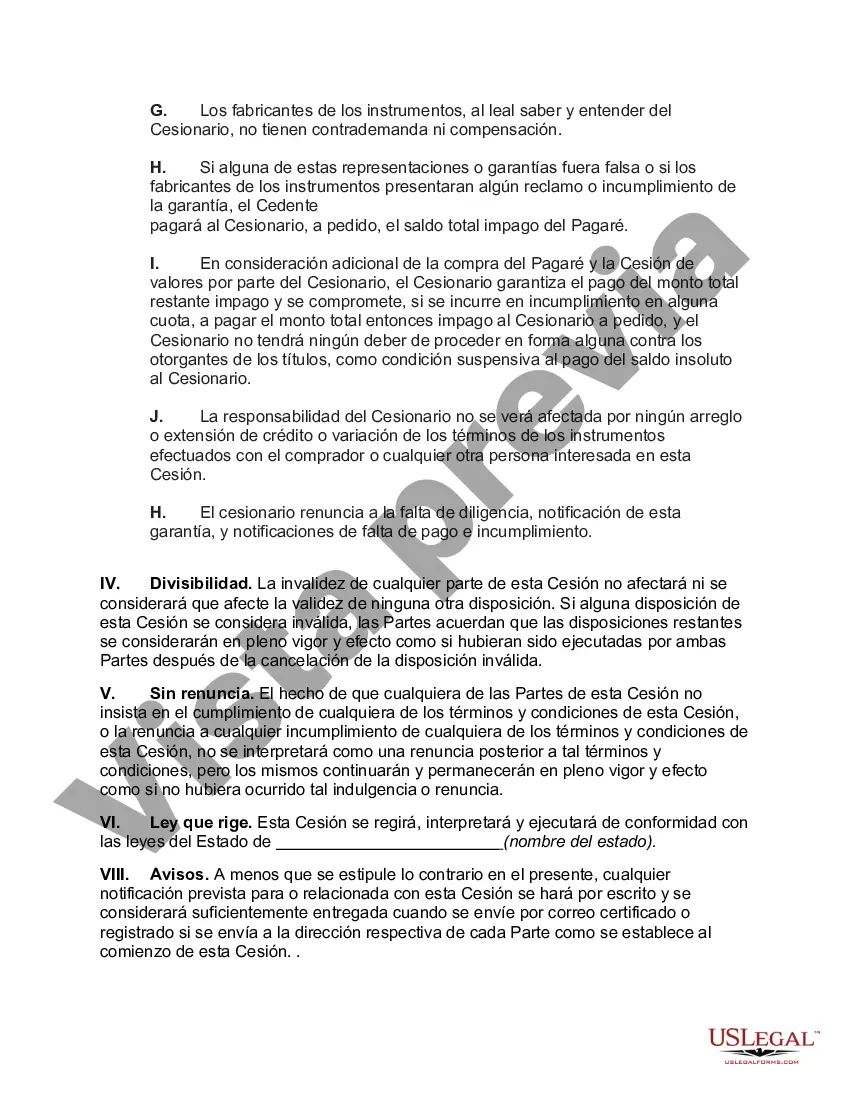

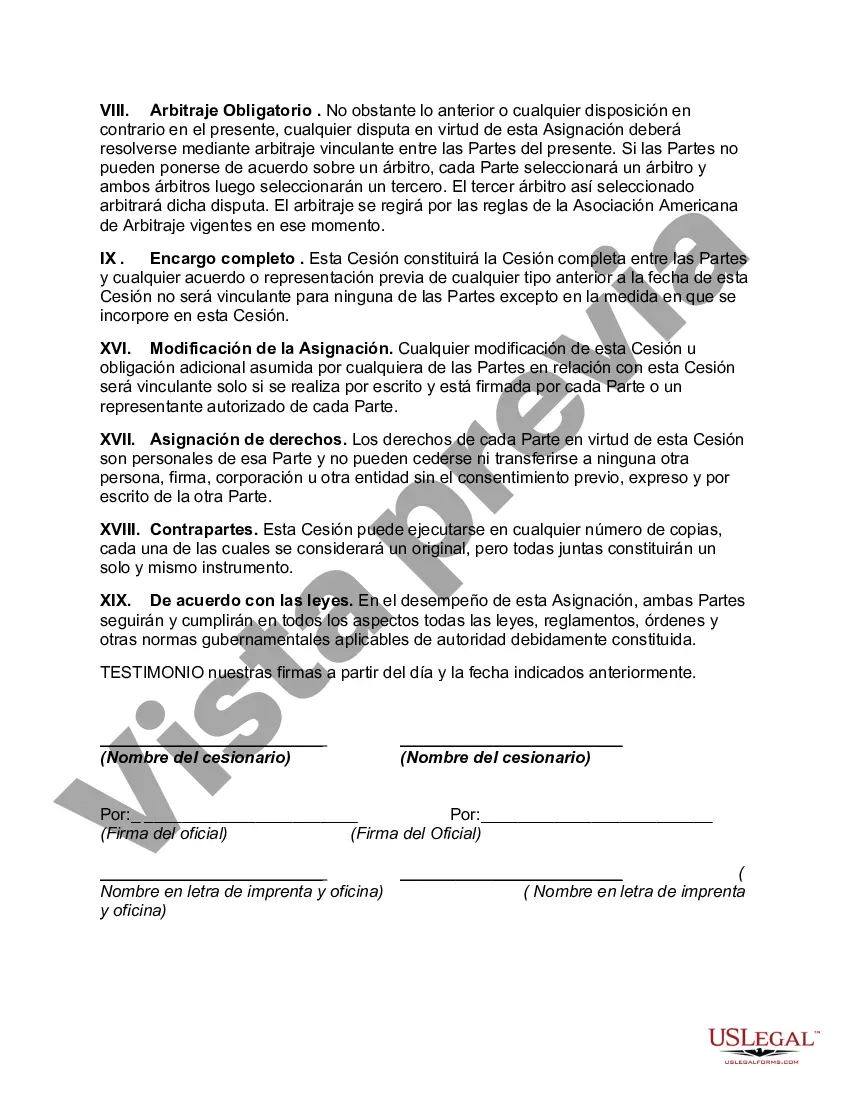

San Diego, California is a vibrant and picturesque city located on the southern coast of the state. It is known for its breathtaking beaches, pleasant climate, and rich cultural diversity. With its thriving economy, San Diego offers numerous opportunities in various sectors, including real estate and finance. In these sectors, one crucial legal document frequently utilized is the Assignment of Security Agreement and Note with Recourse. A San Diego Assignment of Security Agreement and Note with Recourse is a legal contract that transfers the rights and obligations of a security agreement and a promissory note from one party (the assignor) to another party (the assignee). This assignment serves as a mechanism to secure the repayment of a debt through the assignment of collateral or assets. In essence, it allows the assignee to step into the assignor's position and become the new creditor or lender. The Assignment of Security Agreement and Note with Recourse provides protection to the assignee by specifying that in case of default or non-payment by the debtor, the assignee can pursue legal action against both the assignor and the debtor for full recourse. This means that if the debtor fails to meet their payment obligations, the assignee can seek compensation not only from the assigned collateral or assets but can also hold the assignor personally liable for the full debt amount. In San Diego, there are several types of Assignment of Security Agreement and Note with Recourse that can be tailored to specific needs or circumstances. These variations may include: 1. Real Estate Assignment: This type of assignment applies when the security agreement and promissory note are related to a real estate transaction. It secures the debt against the property, allowing the assignee to foreclose on the property and recover the outstanding balance if necessary. 2. Business Assignment: This form of assignment is commonly used when the security agreement and promissory note are associated with a business transaction, such as a loan for acquiring business assets or financing operational expenses. The assignee can pursue the collateral or assets specified in the agreement, as well as hold the assignor personally liable for any unpaid debts. 3. Equipment Assignment: In situations where the security agreement and promissory note involve financing equipment, this assignment is employed. It permits the assignee to repossess and sell the equipment to recoup any outstanding debt if the debtor defaults. 4. Personal Property Assignment: This type of assignment encompasses any security agreement and promissory note tied to personal property, excluding real estate and equipment. The assignee can seize and sell the personal property to recover the debts owed in the event of a default. It is essential for all parties involved in a San Diego Assignment of Security Agreement and Note with Recourse to seek the advice of an experienced attorney to ensure that the terms and conditions of the agreement meet their specific requirements and comply with applicable state laws. By doing so, all parties can protect their rights, interests, and financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Cesión de Contrato de Garantía y Pagaré con Recurso - Assignment of Security Agreement and Note with Recourse

Description

How to fill out San Diego California Cesión De Contrato De Garantía Y Pagaré Con Recurso?

Are you looking to quickly draft a legally-binding San Diego Assignment of Security Agreement and Note with Recourse or maybe any other document to handle your personal or corporate matters? You can select one of the two options: hire a professional to write a valid paper for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific document templates, including San Diego Assignment of Security Agreement and Note with Recourse and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the San Diego Assignment of Security Agreement and Note with Recourse is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by utilizing the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the San Diego Assignment of Security Agreement and Note with Recourse template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the templates we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!