A Santa Clara California Triple-Net Office Lease of Commercial Building is a type of leasing agreement that is commonly used in the commercial real estate industry. It refers to a lease in which the tenant is responsible for paying the base rent as well as additional costs associated with the property such as property taxes, insurance, and maintenance expenses. In Santa Clara, which is located in the heart of Silicon Valley, Triple-Net Office Leases are highly sought after due to the area's thriving tech industry and proximity to major tech companies. These leases are typically signed for a long-term period, usually ranging from 5 to 20 years. There are different types of Triple-Net Office Leases available in Santa Clara, each with its own unique characteristics. Some of these variations include: 1. Absolute Triple-Net Lease: In this type of lease, the tenant is responsible for all costs associated with the property, including structural repairs, improvements, and even major renovations. This lease provides the most responsibility to the tenant. 2. Modified Gross Triple-Net Lease: This lease incorporates a combination of net lease and gross lease elements. Under this arrangement, the tenant is responsible for paying a base rent along with a portion of additional costs, such as property taxes and insurance. However, the responsibility for repairs and maintenance may be shared between the landlord and the tenant. 3. IN (Double Net) Lease: In a Double Net Lease, the tenant is responsible for paying property taxes and insurance, in addition to the base rent. However, the landlord typically retains the responsibility for maintenance and repairs. 4. N (Net) Lease: Under a Net Lease, the tenant is responsible for paying the base rent as well as a portion or all of the property taxes associated with the commercial building. The landlord generally retains the responsibility for insurance and maintenance expenses. Santa Clara California Triple-Net Office Leases provide businesses with the opportunity to operate in a prime location within Silicon Valley while having clear and delineated financial responsibilities. These leases offer benefits to both landlords, who can offload certain expenses, and tenants, who are able to forecast and manage their expenses more effectively. With Santa Clara's thriving tech ecosystem, a Triple-Net Office Lease in this area can be an excellent opportunity for businesses looking to establish a presence or expand within the heart of Silicon Valley.

Santa Clara California Triple-Net Office Lease of Commercial Building

Description

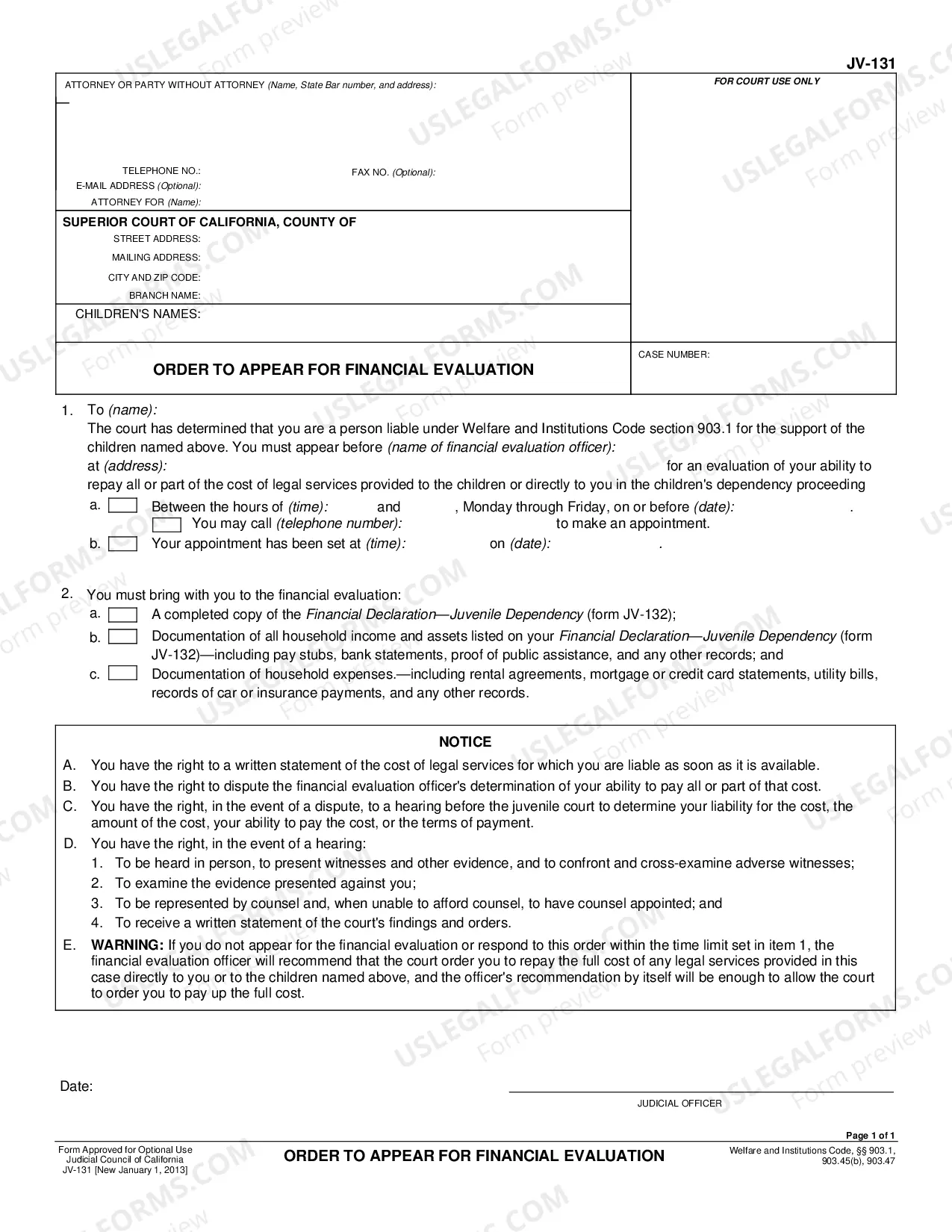

How to fill out Santa Clara California Triple-Net Office Lease Of Commercial Building?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Santa Clara Triple-Net Office Lease of Commercial Building, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Santa Clara Triple-Net Office Lease of Commercial Building from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Santa Clara Triple-Net Office Lease of Commercial Building:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!