Title: Understanding the Chicago Illinois Agreement for Auditing Services between Accounting Firm and Municipality Introduction: The Chicago Illinois Agreement for Auditing Services between an Accounting Firm and the Municipality entails a comprehensive partnership aimed at ensuring the financial integrity and accountability of the municipal entity. The agreement outlines the scope, responsibilities, and terms under which the accounting firm will conduct independent audits of the municipality's financial statements. Keywords: Chicago Illinois, Agreement for Auditing Services, Accounting Firm, Municipality, Independent Audits, Financial Integrity, Accountability. Types of Chicago Illinois Agreements for Auditing Services between Accounting Firm and Municipality: 1. Annual Auditing Agreement: This agreement is typically executed on an annual basis and outlines the responsibilities and procedures involved in conducting a thorough audit of the municipality's financial records. It ensures compliance with relevant laws and regulations and provides an accurate depiction of the financial health of the municipality. 2. Performance Audit Agreement: This type of agreement focuses on assessing the effectiveness and efficiency of specific programs, projects, or processes within the municipality. It delves into various aspects, such as cost-effectiveness, risk management, and compliance, to recommend improvements and enhance overall performance. 3. Compliance Auditing Agreement: This agreement concentrates on assessing the municipality's adherence to applicable laws, regulations, and internal policies. It ensures that the municipality is meeting legal requirements, such as tax filing and spending limits, while identifying any potential areas of non-compliance that require corrective action. 4. Fraud and Forensic Audit Agreement: In cases where fraudulent activities or irregularities are suspected, this agreement provides for a specialized audit. The accounting firm works closely with the municipality to investigate any potential misconduct, gather evidence, and uncover any fraudulent actions. This type of audit aims to mitigate financial risks and protect the municipality from potential fraud. Detailed Description: The Chicago Illinois Agreement for Auditing Services between an Accounting Firm and Municipality is a legally binding contract that defines the roles, responsibilities, and expectations of both parties involved. This agreement assists in maintaining the financial integrity and accountability of the municipality, enabling transparent reporting and compliance with statutory requirements. The agreement typically covers the following key elements: 1. Objectives: Clearly states the purpose and objectives of the audit, ensuring a common understanding between the municipality and the accounting firm. This section includes items like financial statement review, fraud detection, compliance assessment, and program evaluation, as per the specific type of audit agreement chosen. 2. Scope of Work: Outlines the extent of the audit by specifying the financial years or reporting periods to be audited, the areas to be examined, and the audit methodologies to be employed. This section defines the boundaries within which the accounting firm will operate and the areas that will be covered by the audit process. 3. Deliverables: Specifies the reports or documentation that the accounting firm will provide to the municipality upon the conclusion of the audit. This may include financial statements, management letters, compliance reports, and suggestions for improvement. The deliverables ensure transparency, provide recommendations for strengthening financial systems, and aid in decision-making. 4. Timeline: Indicates the schedule for the audit engagements, including key milestones, deadlines, and submission dates for interim and final reports. This section establishes a clear timeline, allowing both parties to allocate necessary resources and plan accordingly. 5. Fees and Compensation: Details the financial arrangements and compensation for the accounting firm's services. It covers aspects such as hourly rates, payment terms, billing methods, and any additional costs incurred during the audit process. Conclusion: The Chicago Illinois Agreement for Auditing Services between an Accounting Firm and Municipality is a crucial partnership that ensures financial accountability in the municipality, protects against fraud, and identifies areas for improvement. By establishing clear guidelines and expectations, the agreement facilitates a transparent and effective audit process while upholding the highest standards of financial integrity and compliance.

Chicago Illinois Agreement for Auditing Services between Accounting Firm and Municipality

Description

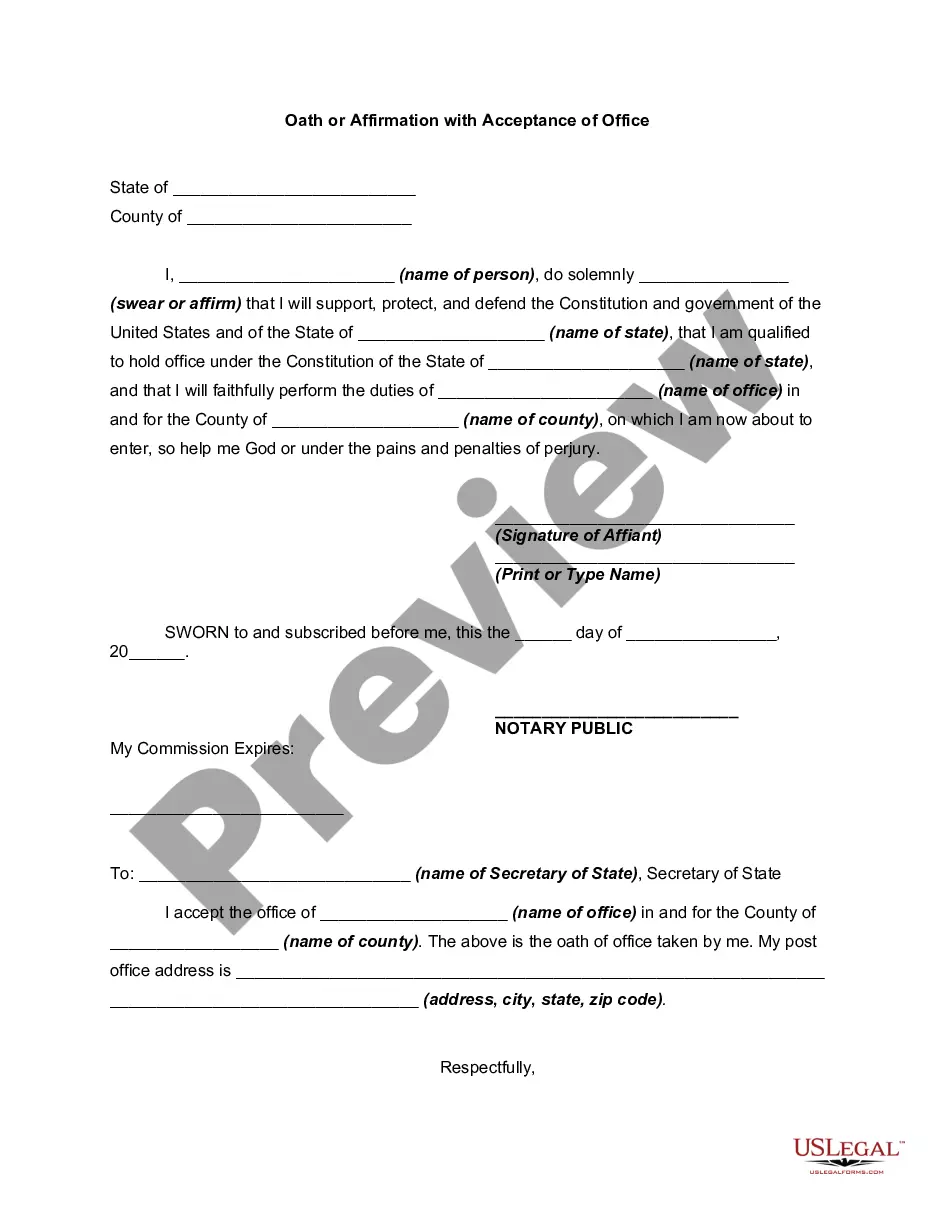

How to fill out Chicago Illinois Agreement For Auditing Services Between Accounting Firm And Municipality?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Chicago Agreement for Auditing Services between Accounting Firm and Municipality, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Chicago Agreement for Auditing Services between Accounting Firm and Municipality, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Chicago Agreement for Auditing Services between Accounting Firm and Municipality:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Chicago Agreement for Auditing Services between Accounting Firm and Municipality and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!