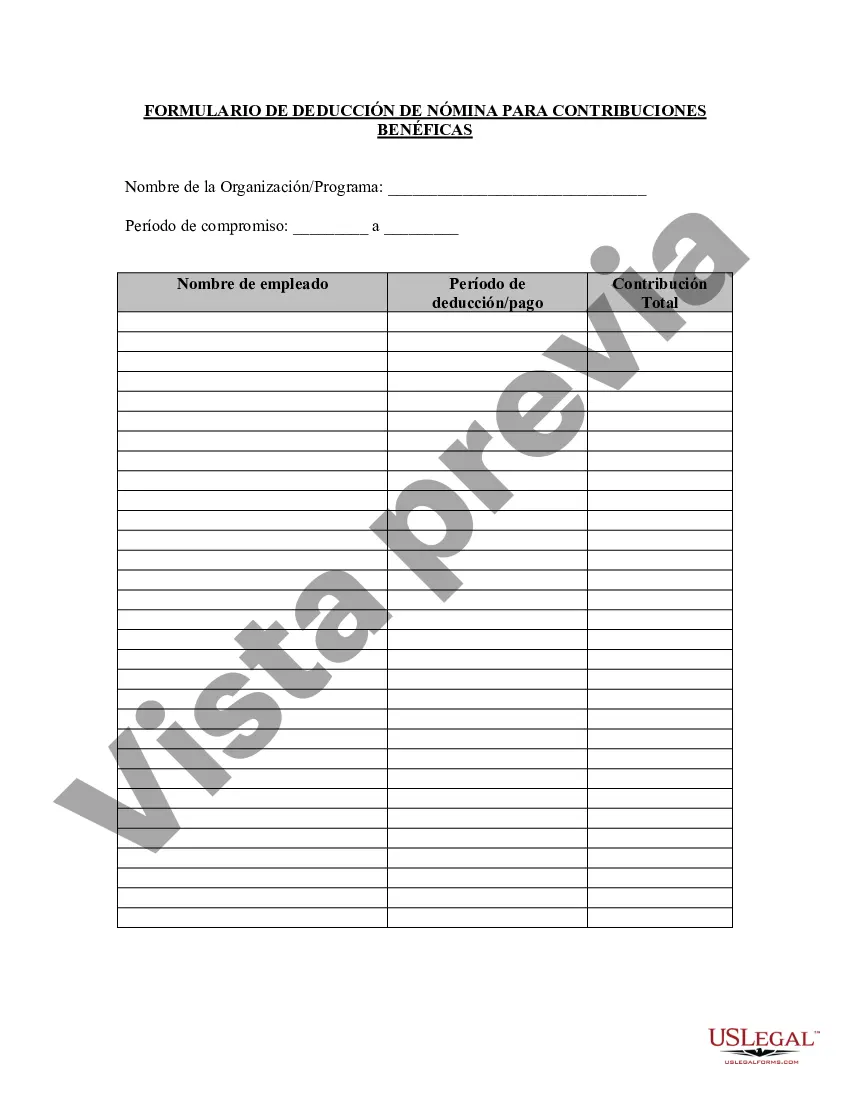

The Alameda California Charitable Contribution Payroll Deduction Form is a crucial tool used by employees who wish to contribute a portion of their earnings towards charitable organizations in Alameda, California. This form allows employees to make regular deductions directly from their payroll on a pre-tax basis, making it a convenient and tax-efficient method to give back to the community. This dedicated form enables employees to specify the amount they wish to contribute per paycheck or on a one-time basis. By completing this form, employees can support a diverse range of charitable causes within Alameda California. Contributions can vary in size depending on an individual's financial capacity and charitable preferences. Key information included in the Alameda California Charitable Contribution Payroll Deduction Form includes: 1. Employee Details: This section requires the employee to provide their full name, employee identification number, position, department, and contact information. 2. Payroll Contribution Information: In this segment, the form outlines the different types of charitable contribution options available. It is important to name the specific types of Alameda California Charitable Contribution Payroll Deduction Forms, if applicable. These may include options to donate a fixed dollar amount per paycheck, a specific percentage of income, or a one-time lump sum donation. 3. Charitable Organization Details: Employees are required to specify the name, address, and tax identification number of the charitable organization(s) they wish to support through their payroll deductions. This ensures that funds are directed to the intended charities. 4. Contribution Start Date and Duration: The form requests the desired start date for contributions and whether it will be a one-time donation or recurring contributions over a specific period. 5. Signature and Authorization: The employee must sign and date the form, thereby granting permission for the employer to make payroll deductions from their earnings and allocate these funds to the designated charities. By offering the Alameda California Charitable Contribution Payroll Deduction Form, the city of Alameda aims to encourage philanthropy among its employees. This form offers an efficient and straightforward way for employees to support charitable organizations that align with their values and actively contribute to the betterment of the community. In summary, the Alameda California Charitable Contribution Payroll Deduction Form is a vital instrument for employees who wish to donate a portion of their earnings to charitable organizations in Alameda, California. It ensures seamless payroll deductions, tax benefits, and empowers individuals to make a positive impact within their local community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Alameda California Formulario De Deducción De Nómina De Contribución Benéfica?

If you need to find a reliable legal form supplier to find the Alameda Charitable Contribution Payroll Deduction Form, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support make it easy to find and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Alameda Charitable Contribution Payroll Deduction Form, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Alameda Charitable Contribution Payroll Deduction Form template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or complete the Alameda Charitable Contribution Payroll Deduction Form - all from the comfort of your sofa.

Sign up for US Legal Forms now!