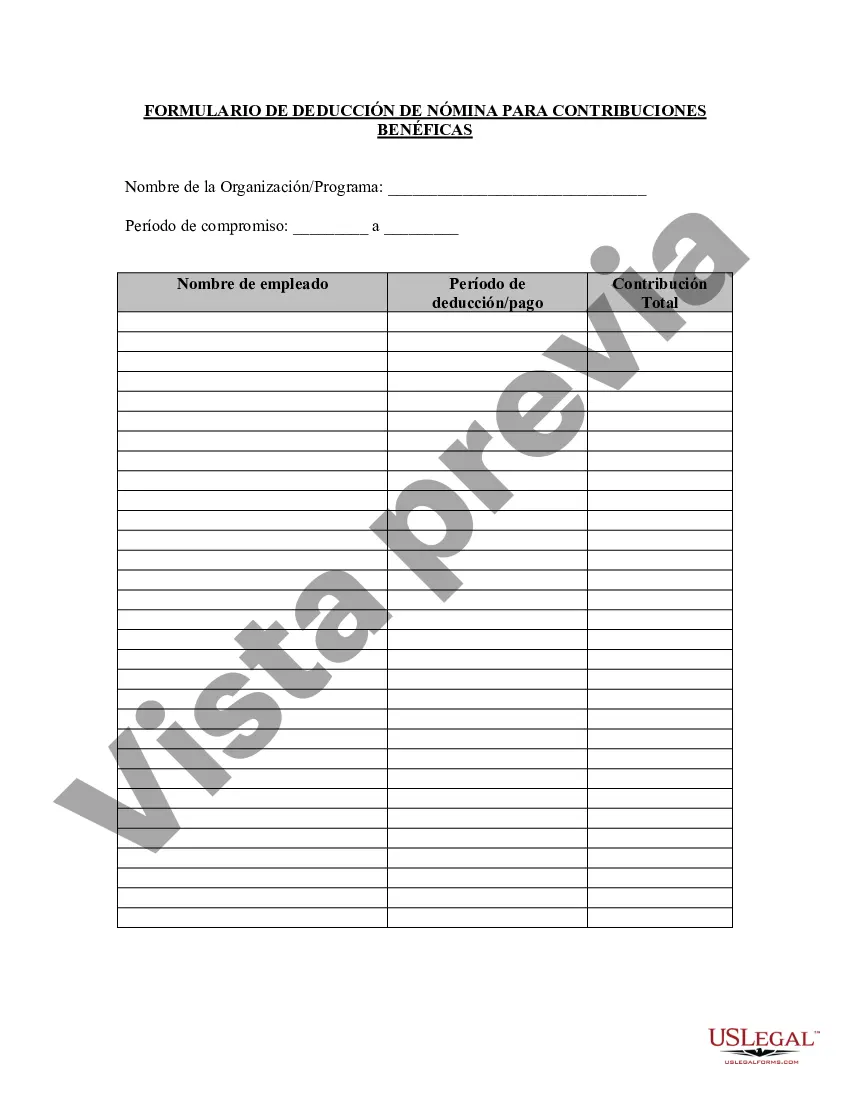

The Allegheny Pennsylvania Charitable Contribution Payroll Deduction Form is a document designed for residents of Allegheny County, Pennsylvania, who wish to make charitable donations through automatic payroll deductions. By filling out this form, employees can contribute a portion of their salary to the charitable organization(s) of their choice on a regular basis. The form includes various fields where employees can provide their personal details, such as name, employee identification number, contact information, and the name of their employer. Additionally, it requires the selection of the charitable organization(s) to which the employee wants to donate, alongside the desired deduction amount or percentage for each organization. In order to ensure accuracy and efficiency, it is crucial for employees to carefully review the form and complete all required sections. The form must be signed and dated to validate the employee's authorization for the deductions from their payroll. The Allegheny Pennsylvania Charitable Contribution Payroll Deduction Form aims to simplify the process of supporting charitable causes by allowing individuals to contribute regularly without the need for manual donations or reminders. By filling out this form, employees can effortlessly extend their philanthropic efforts and make a positive impact within their community. Types of Allegheny Pennsylvania Charitable Contribution Payroll Deduction Forms: 1. Standard Deduction Form: This is the most common form used by employees to specify their desired contribution amount or percentage for each chosen charitable organization. 2. Multiple Charities Form: This form allows employees to select and allocate different deduction amounts or percentages to multiple charitable organizations simultaneously, supporting various causes of their preference. 3. Annual Pledge Form: This form is intended for employees who wish to make a one-time annual pledge instead of monthly deductions. It enables them to specify the total donation amount, dividing it equally or according to their desired allocation among the selected charitable organizations. In conclusion, the Allegheny Pennsylvania Charitable Contribution Payroll Deduction Form streamlines the process of supporting charitable organizations by providing a simple, automatic, and regular donation mechanism.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Allegheny Pennsylvania Formulario De Deducción De Nómina De Contribución Benéfica?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your region, including the Allegheny Charitable Contribution Payroll Deduction Form.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Allegheny Charitable Contribution Payroll Deduction Form will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Allegheny Charitable Contribution Payroll Deduction Form:

- Make sure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Allegheny Charitable Contribution Payroll Deduction Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!