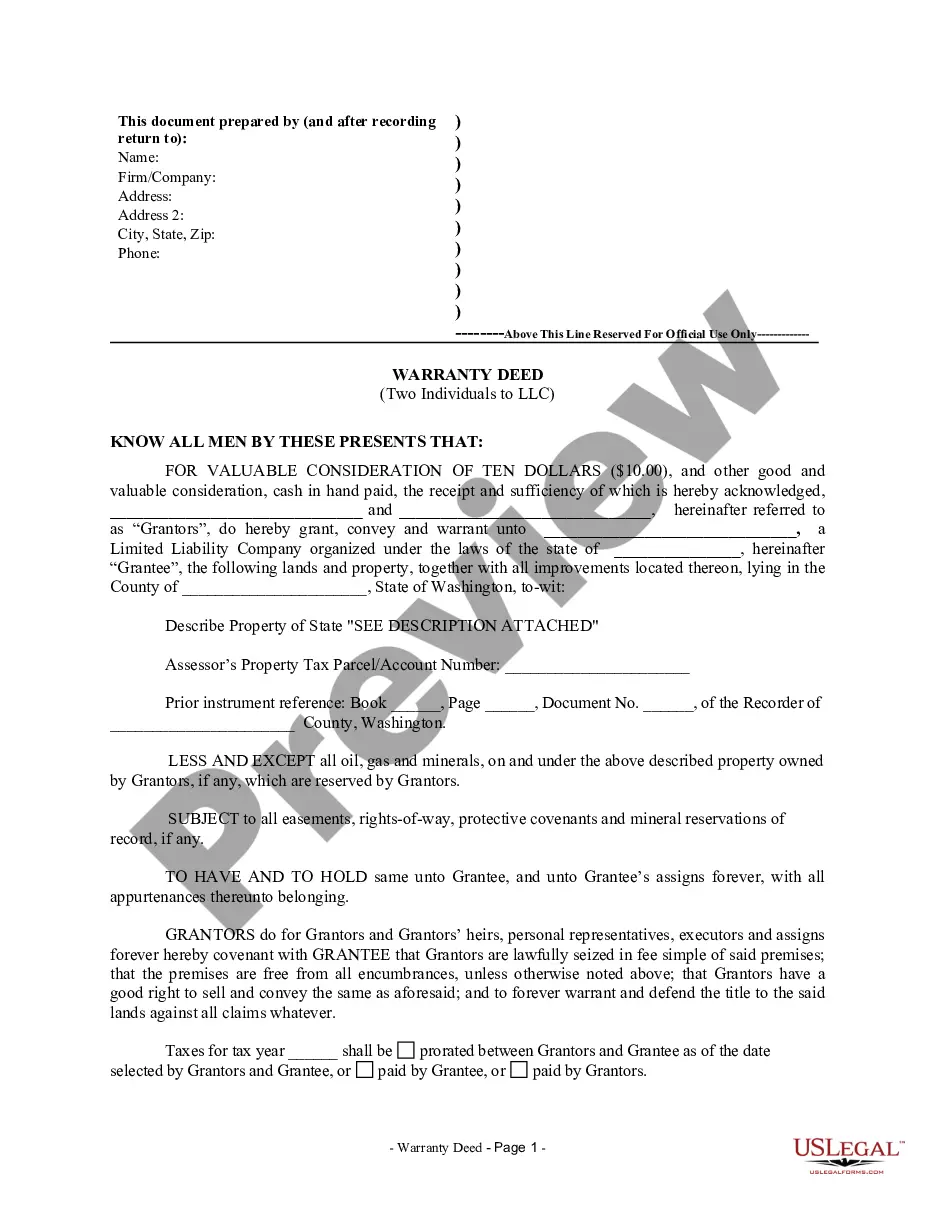

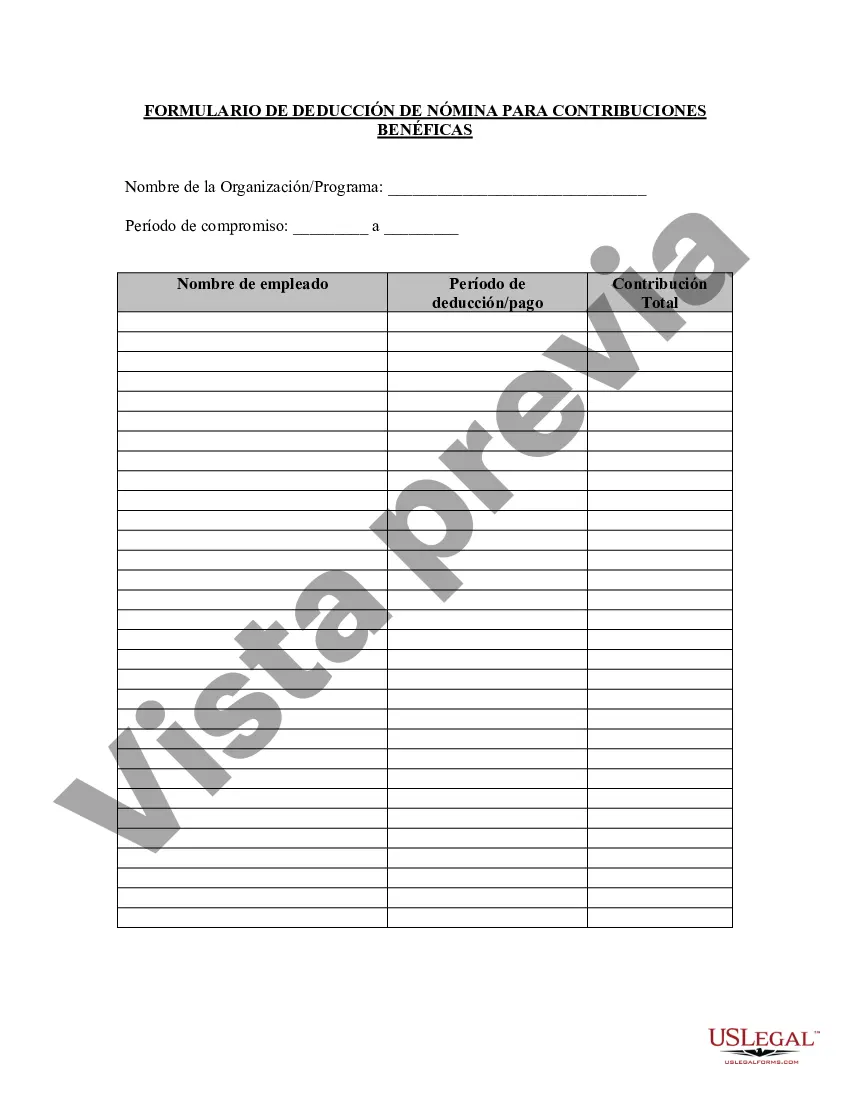

The Chicago Illinois Charitable Contribution Payroll Deduction Form is a document used by employees in Chicago, Illinois, to voluntarily contribute a portion of their salary to eligible charitable organizations. By completing this form, employees can authorize their employer to deduct a specified amount from their wages on each paycheck and direct it towards a chosen charity. Keywords: Chicago, Illinois, charitable contribution, payroll deduction, form, employees, salary, eligible charitable organizations, authorize, deduct, wages, paycheck, chosen charity. There are various types of Chicago Illinois Charitable Contribution Payroll Deduction Forms, depending on the specific purpose or organization they support. Some notable forms include: 1. Charitable Contribution Payroll Deduction Form for Local Non-Profits: This specific form allows employees to support local non-profit organizations that operate within the Chicago, Illinois area. Employees can list the preferred organizations and specify donation amounts for each. 2. Employee Emergency Assistance Fund Deduction Form: This form enables employees to contribute to an emergency assistance fund designed to provide financial aid to fellow employees experiencing unforeseen hardships or emergencies. This deduction form allows colleagues to support each other in times of need. 3. Chicago Public Schools Foundation Payroll Deduction Form: This form targets employees who wish to support educational initiatives within the Chicago Public School system. By selecting this form, employees can allocate a portion of their wages to contribute towards the improvement and enrichment of educational programs and resources for schools in Chicago. 4. Disaster Relief Payroll Deduction Form: This form is utilized during emergency situations such as natural disasters or community crises. It allows employees to contribute funds towards relief efforts for affected individuals and communities, both within and outside of Chicago, Illinois. 5. City of Chicago Employee Charitable Campaign (CCC) Payroll Deduction Form: Designed specifically for City of Chicago employees, this form focuses on supporting a wide range of charitable organizations and causes. Employees can choose from hundreds of eligible organizations and allocate their donations accordingly. By offering these different types of Chicago Illinois Charitable Contribution Payroll Deduction forms, employers promote employee engagement, encourage philanthropy, and provide opportunities for individuals to support causes that resonate with them personally.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Chicago Illinois Formulario De Deducción De Nómina De Contribución Benéfica?

If you need to find a trustworthy legal paperwork supplier to find the Chicago Charitable Contribution Payroll Deduction Form, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support make it easy to get and complete various documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Chicago Charitable Contribution Payroll Deduction Form, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Chicago Charitable Contribution Payroll Deduction Form template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Chicago Charitable Contribution Payroll Deduction Form - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Estados Unidos - Impuestos sobre la renta de los trabajadores FechaTipo medio: Individuo SMTipo maximo201823,8%46,0%201923,9%46,0%202021,3%46,0%202122,6%46,0%18 more rows

ISR o ISPT (Impuesto sobre el producto del trabajo): ¿como hacer su calculo? Limite InferiorLimite Superior% sobre excedente$10,298.36$20,770.2921.36%$20,770.30$32,736.8323.52%$32,736.84$62,500.0030.00%$62,500.01$83,333.3332.00%7 more rows

El porcentaje de Seguro Social (OASDI, por sus siglas en ingles) es 6.20% que se aplica a los ingresos hasta la cantidad maxima sujeta a impuestos (vea la tabla a continuacion).

Las deducciones de una nomina son la parte que resta a los devengos salariales. Incluye los pagos a la Seguridad Social y el Impuesto Sobre la Renta de Personas Fisicas (IRPF) que recibe la Agencia Tributaria por adelantado. Esto es asi porque la empresa para la que trabajas ejerce como agente recaudador.

El empleador paga 1.45% de los salarios y el empleador retiene otro 1.45% del empleado. Los salarios para fines de seguridad social incluyen 401 (k) contribuciones y compensacion diferida.

El promedio se ubica entre 5 a 8,75%, dependiendo de la ciudad o el tipo de producto o servicio adquirido.

Firma, podras conocer los conceptos que han sido identificados con alguno de los siguientes tipos de deducciones personales: Honorarios medicos, dentales y gastos hospitalarios. Gastos funerarios. Donativos. Aportaciones complementarias. Primas por seguros de gastos medicos. Transportacion escolar.

Las deducciones de nomina son los descuentos o valores que se le restan o deducen al trabajador de su total devengado, es decir, del monto total del salario que recibe en un mes o quincena. Conceptos o valores que se deducen de la nomina. Aportes a salud.

Las deducciones pueden ser de varios tipos: retenciones del IRPF, cuotas (sindicales y a la Seguridad Social), pagos en especie, anticipos y otras.

La tasa vigente de impuestos de seguro social es del 6.2% para el empleador y del 6.2% para el empleado, o un total del 12.4%.