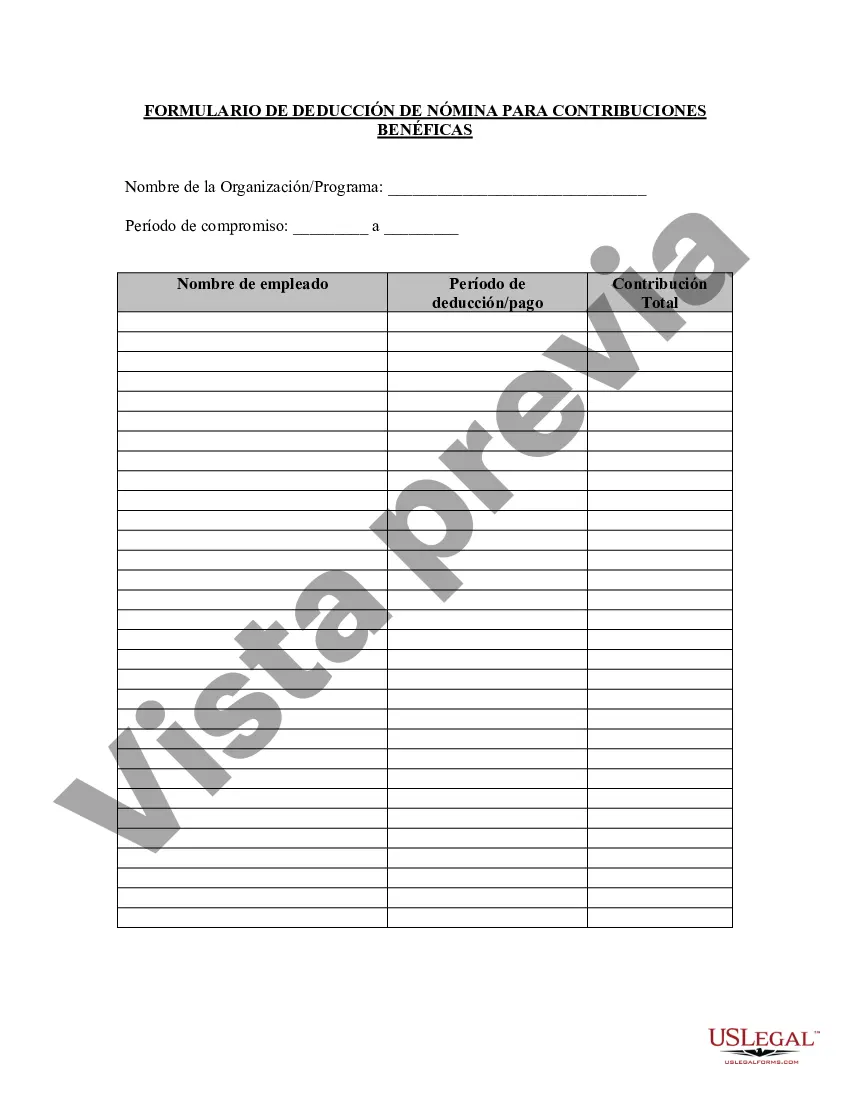

The Contra Costa California Charitable Contribution Payroll Deduction Form is a document used by employees in Contra Costa County, California, to make voluntary donations to charitable organizations directly from their paychecks. This form allows employees to contribute a portion of their salary to eligible nonprofits, enabling them to support causes they are passionate about and make a positive impact in their community. The Contra Costa California Charitable Contribution Payroll Deduction Form is typically provided by employers as part of their payroll process. It provides a convenient and efficient way for individuals to make regular contributions to nonprofits without the need for direct transactions or checks. By deducting the specified amount from each paycheck, employees can effortlessly support local charities and non-governmental organizations that rely on public donations. This form generally consists of several sections where employees need to provide their personal details, such as name, employee ID, and contact information. It also includes sections where employees can indicate the amount they wish to contribute and select the charitable organization(s) they intend to support. Some forms might offer a list of pre-approved nonprofits, while others may allow employees to write in the names of nonprofits not listed. The Contra Costa California Charitable Contribution Payroll Deduction Form is designed to comply with state regulations governing charitable contributions and payroll deductions. It ensures that employee contributions are properly managed and distributed to the chosen charitable organizations. Employers typically handle the deduction process and transfer the contributed funds to the designated nonprofits on behalf of their employees. Different variations of the Contra Costa California Charitable Contribution Payroll Deduction Form may exist, depending on the specific requirements of the employer or the county. These variations may include electronic or paper forms, differing formatting, or additional sections for employees to include specific instructions or notes. By utilizing the Contra Costa California Charitable Contribution Payroll Deduction Form, employees in Contra Costa County are able to support charitable causes effortlessly, promote social welfare, and foster community development through regular and convenient contributions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Contra Costa California Formulario De Deducción De Nómina De Contribución Benéfica?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Contra Costa Charitable Contribution Payroll Deduction Form, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities associated with document completion straightforward.

Here's how to find and download Contra Costa Charitable Contribution Payroll Deduction Form.

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the similar forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Contra Costa Charitable Contribution Payroll Deduction Form.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Contra Costa Charitable Contribution Payroll Deduction Form, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you have to deal with an extremely complicated case, we recommend using the services of a lawyer to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!