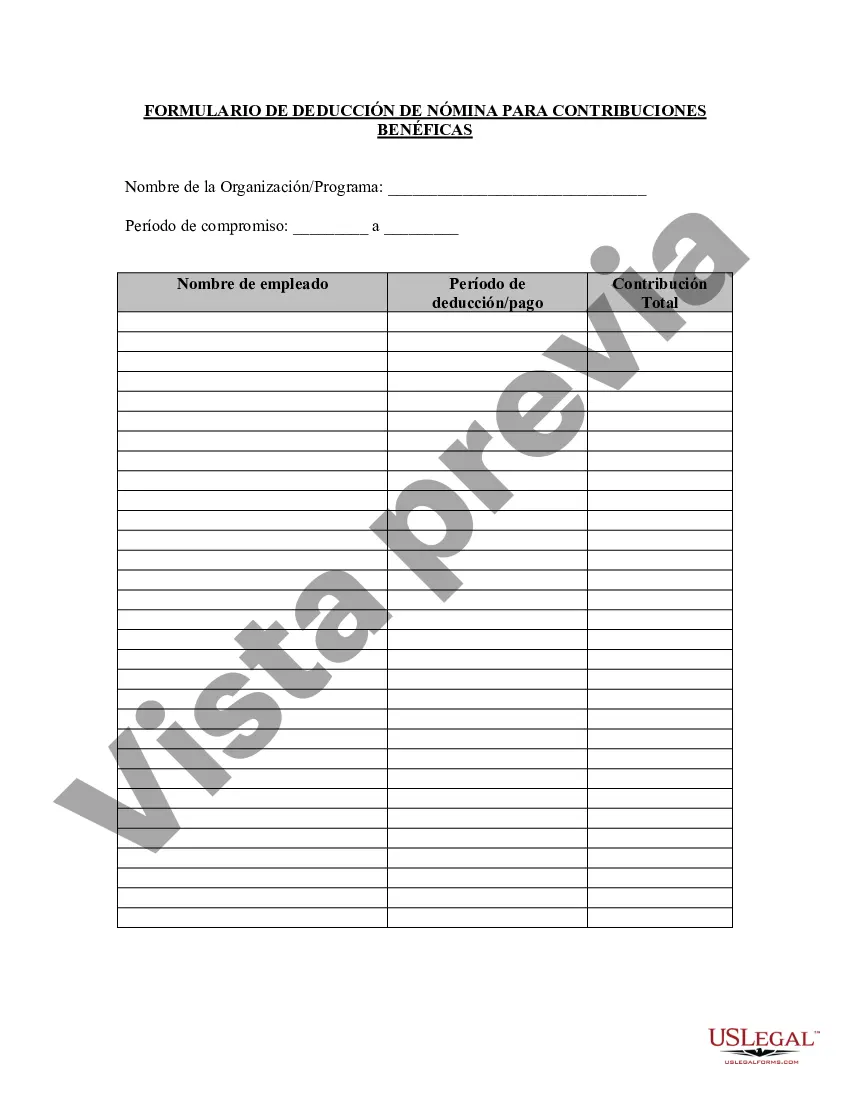

Kings New York Charitable Contribution Payroll Deduction Form is a document provided by Kings New York, a renowned charitable organization in New York, for their employees to voluntarily contribute a portion of their paycheck towards charitable causes. This form acts as a formal agreement between the employee and the organization, outlining the terms and conditions of the charitable donation. The Kings New York Charitable Contribution Payroll Deduction Form allows employees to make regular, ongoing contributions conveniently through automatic deductions from their salary. This payroll deduction method is designed to encourage and facilitate employee participation in charitable giving, promoting a culture of philanthropy within the organization. By filling out the Kings New York Charitable Contribution Payroll Deduction Form, employees can select the specific charitable cause or organization they wish to support. Whether it's aiding underprivileged children, supporting healthcare initiatives, contributing to disaster relief efforts, or any other worthy cause, employees have the flexibility to choose the charitable organization closest to their hearts. The Kings New York Charitable Contribution Payroll Deduction Form includes important fields such as employee details (name, employee ID, contact information), the chosen charitable organization, the contribution amount or percentage, and the frequency of deduction (monthly, bi-weekly, etc.). Additionally, the form may request the employee's consent for periodic updates on the impact of their contributions or details about changes to the payroll deduction process. It's worth noting that there may be different versions or types of Kings New York Charitable Contribution Payroll Deduction Forms, depending on factors such as the length of commitment employees wish to make. For example, there could be forms for one-time deductions or forms for ongoing deductions until an employee decides to stop. In summary, Kings New York Charitable Contribution Payroll Deduction Form is a valuable tool that enables Kings New York employees to contribute to charitable causes effortlessly. This form provides a structured framework for charitable giving, allowing employees to make a lasting impact on the chosen charitable organization while promoting a sense of social responsibility within the workplace.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Kings New York Formulario De Deducción De Nómina De Contribución Benéfica?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Kings Charitable Contribution Payroll Deduction Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to document completion simple.

Here's how you can find and download Kings Charitable Contribution Payroll Deduction Form.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar forms or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Kings Charitable Contribution Payroll Deduction Form.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Kings Charitable Contribution Payroll Deduction Form, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you need to cope with an exceptionally challenging situation, we advise using the services of an attorney to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and get your state-compliant documents with ease!