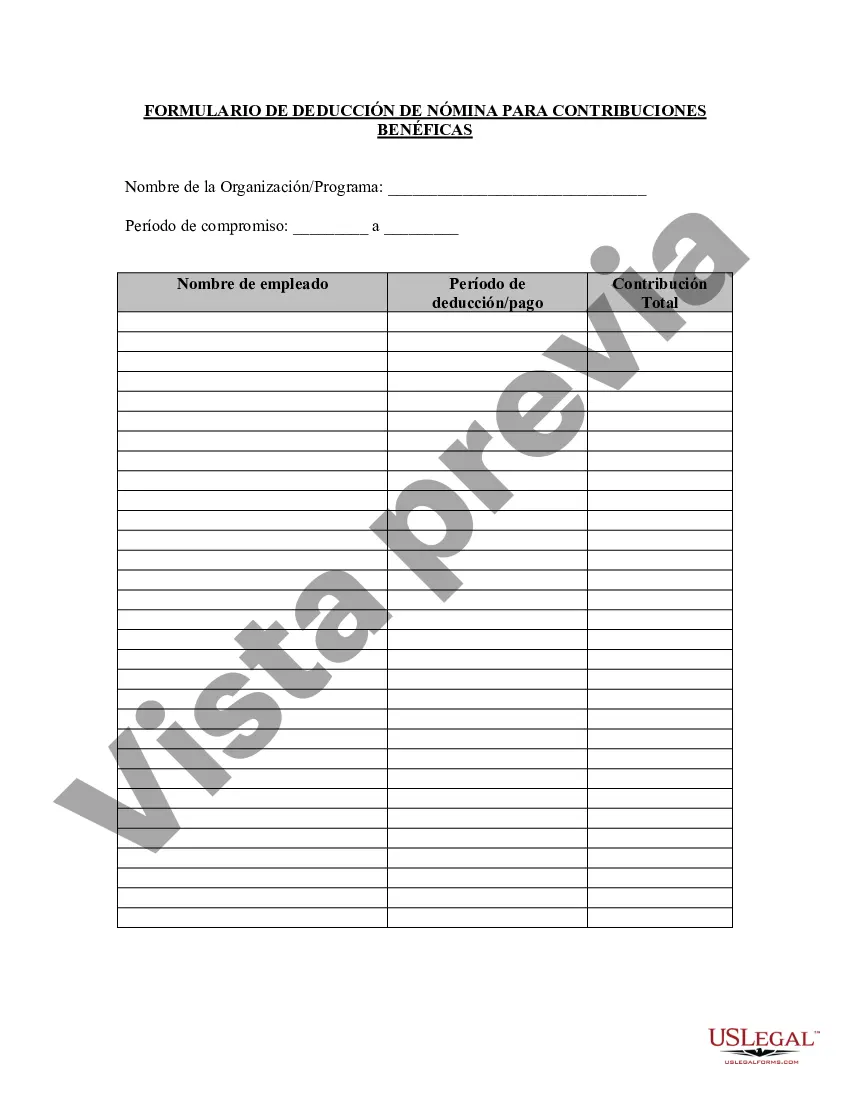

Miami-Dade Florida Charitable Contribution Payroll Deduction Form is a document specifically designed to facilitate employee donations to charitable organizations through automatic payroll deductions. This form allows employees in Miami-Dade County, Florida, to contribute a portion of their salary to the charitable cause of their choice on a regular basis. The Miami-Dade Florida Charitable Contribution Payroll Deduction Form is an effective way for employees to support nonprofit organizations and causes that are important to them. By selecting this option, employees can easily contribute to charitable initiatives without having to make individual donations each time. This form typically includes several sections, such as personal information where employees can provide their full name, employee identification number, department, and contact details. It also requires the employee to name the charitable organization they wish to support, along with the contribution amount or percentage of their salary they would like deducted. Moreover, this form may have sections to specify the duration for which the deduction should last, whether it's a one-time deduction or ongoing until further notice. Additionally, it might include an authorization area where the employee provides explicit consent for the employer to deduct the specified amount from their paycheck. Different types or variations of the Miami-Dade Florida Charitable Contribution Payroll Deduction Form may exist depending on the administering organization or specific campaign. For instance, there might be specific forms for annual charity drives, disaster relief efforts, or even employee-selected donation initiatives. Keywords: Miami-Dade Florida, Charitable Contribution, Payroll Deduction Form, employee donations, nonprofit organizations, automatic deductions, employee-selected donation initiatives, employee identification number, ongoing deduction, payroll deduction authorization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

State:

Multi-State

County:

Miami-Dade

Control #:

US-134EM

Format:

Word

Instant download

Description

Este formulario se puede utilizar para realizar un seguimiento de las deducciones caritativas realizadas por los empleados a través del departamento de nómina de la empresa.

Miami-Dade Florida Charitable Contribution Payroll Deduction Form is a document specifically designed to facilitate employee donations to charitable organizations through automatic payroll deductions. This form allows employees in Miami-Dade County, Florida, to contribute a portion of their salary to the charitable cause of their choice on a regular basis. The Miami-Dade Florida Charitable Contribution Payroll Deduction Form is an effective way for employees to support nonprofit organizations and causes that are important to them. By selecting this option, employees can easily contribute to charitable initiatives without having to make individual donations each time. This form typically includes several sections, such as personal information where employees can provide their full name, employee identification number, department, and contact details. It also requires the employee to name the charitable organization they wish to support, along with the contribution amount or percentage of their salary they would like deducted. Moreover, this form may have sections to specify the duration for which the deduction should last, whether it's a one-time deduction or ongoing until further notice. Additionally, it might include an authorization area where the employee provides explicit consent for the employer to deduct the specified amount from their paycheck. Different types or variations of the Miami-Dade Florida Charitable Contribution Payroll Deduction Form may exist depending on the administering organization or specific campaign. For instance, there might be specific forms for annual charity drives, disaster relief efforts, or even employee-selected donation initiatives. Keywords: Miami-Dade Florida, Charitable Contribution, Payroll Deduction Form, employee donations, nonprofit organizations, automatic deductions, employee-selected donation initiatives, employee identification number, ongoing deduction, payroll deduction authorization.