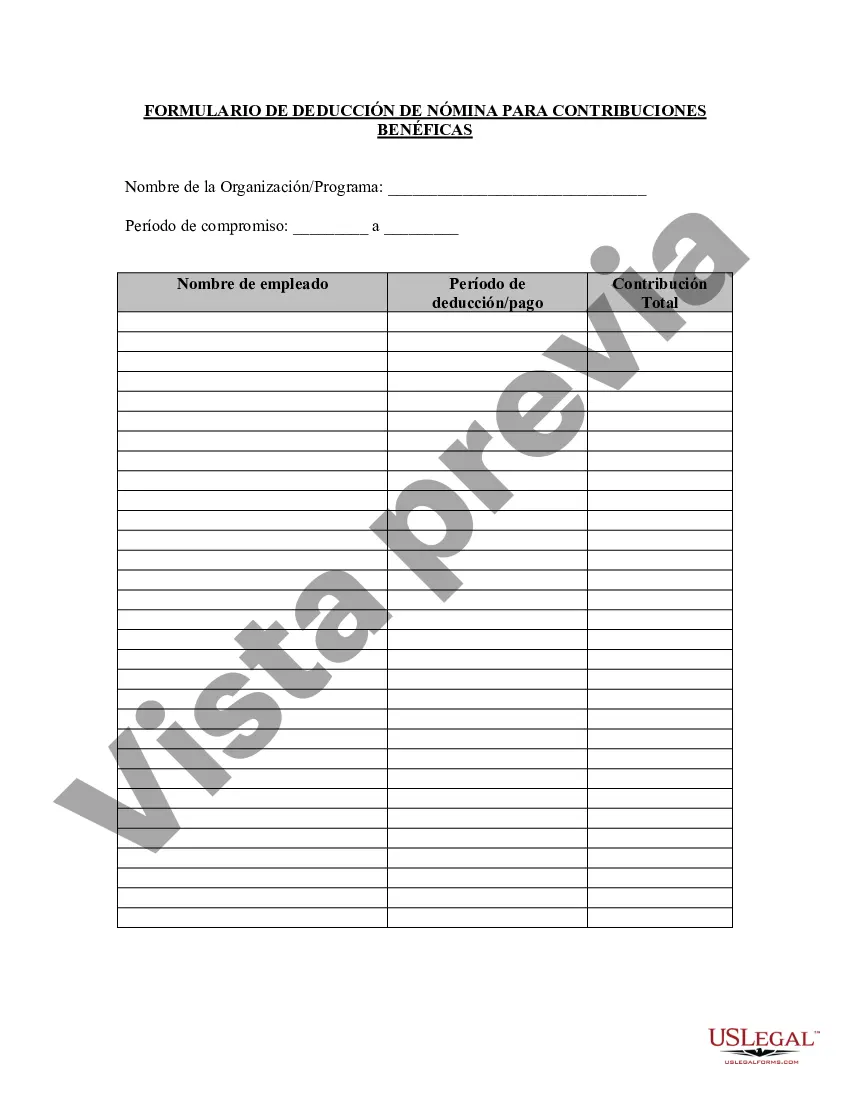

Nassau New York Charitable Contribution Payroll Deduction Form is a document that allows employees to make voluntary donations to charitable organizations through regular payroll deductions. This form is used by employers in Nassau County, New York, to facilitate the process of deducting a specified amount from an employee's paycheck towards their chosen charitable cause. The Nassau New York Charitable Contribution Payroll Deduction Form is an important tool for individuals looking to support various nonprofit organizations. It provides a convenient and hassle-free way for employees to contribute to charitable causes they believe in, directly from their salary. By opting for payroll deductions, employees can ensure a consistent and steady flow of financial support to their preferred charities throughout the year. The form typically includes several key fields for employees to fill out. These may include personal information such as name, address, employee identification or social security number, and contact details. Additionally, the form includes sections to specify the chosen charitable organization(s) and the amount to be deducted from each paycheck. The frequency of deductions (monthly, bi-monthly, or annually) may also be indicated on the form. Some common types of Nassau New York Charitable Contribution Payroll Deduction Forms may include: 1. Individual Charitable Contribution Payroll Deduction Form: This type of form is used by employees who wish to donate to a single charitable organization. 2. Multiple Charitable Organization Contribution Payroll Deduction Form: This form allows employees to allocate their contributions among multiple charities. It may provide sections or options to divide the donation amount by percentages or specific dollar amounts for each organization. 3. Annual Charitable Contribution Payroll Deduction Form: This form is specifically designed for employees who prefer to make a one-time annual deduction rather than recurring deductions from each paycheck. It is important to note that the specific format and requirements of the Nassau New York Charitable Contribution Payroll Deduction Form may vary slightly depending on the employer's policies and procedures. Employees should consult their human resources department or payroll administrator for the official form and guidelines. In conclusion, the Nassau New York Charitable Contribution Payroll Deduction Form offers a simple and efficient way for employees in Nassau County, New York, to contribute to charitable organizations of their choice through regular payroll deductions. It promotes philanthropy and enables individuals to make a meaningful impact on the causes they care about.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Nassau New York Formulario De Deducción De Nómina De Contribución Benéfica?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Nassau Charitable Contribution Payroll Deduction Form, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Nassau Charitable Contribution Payroll Deduction Form, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Nassau Charitable Contribution Payroll Deduction Form:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Nassau Charitable Contribution Payroll Deduction Form and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!