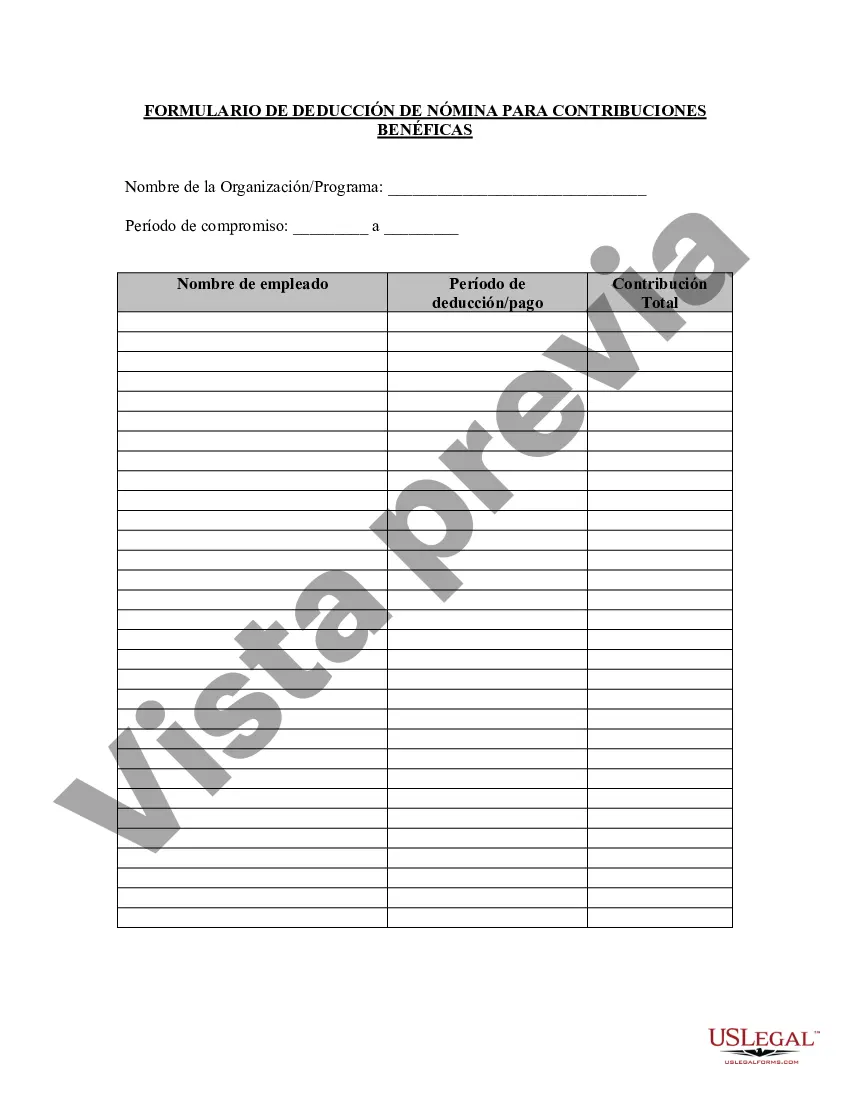

The Oakland Michigan Charitable Contribution Payroll Deduction Form is a document that allows employees to contribute a portion of their salaries to charitable organizations of their choice. This form facilitates a convenient and organized way for employees in Oakland, Michigan, to make regular donations to a cause they support directly from their payroll. By completing this form, employees can choose the amount they wish to donate per pay period and specify the charitable organization to which they want their contributions directed. The form typically requires employees to provide their personal information such as name, address, and employee identification number, as well as their preferred donation amount and frequency. This charitable deduction option through payroll provides employees with an easy way to contribute to various charitable causes, allowing them to make a positive impact in their community or beyond. By automating the deduction process, employees don't have to worry about remembering to make donations or setting aside funds separately. The Oakland Michigan Charitable Contribution Payroll Deduction Form promotes a culture of giving and corporate social responsibility within organizations. It enables employees to support causes they feel strongly about, fostering a sense of personal satisfaction and engagement in their workplace. Different types of Oakland Michigan Charitable Contribution Payroll Deduction Forms may exist, depending on the specific organizations or initiatives supported by the employer. Some variations might include: 1. General Charitable Contribution Form: This allows employees to make contributions to any registered 501(c)(3) charitable organization of their choice. Employees can specify the organization's name, address, and tax identification number. 2. Local Community Support Form: Specifically designed for contributing to local organizations or initiatives that benefit the community within Oakland, Michigan. Employees can choose from a list of approved local nonprofits or propose new ones for consideration. 3. Disaster Relief Contribution Form: Created during times of natural disasters or emergencies, this form enables employees to support relief efforts by donating to recognized disaster relief agencies or organizations providing aid to affected individuals and communities. 4. Education Donation Form: Geared towards supporting educational institutions, scholarships, or educational programs within Oakland, Michigan. Employees can allocate their contributions to schools, colleges, universities, or educational non-profits. It is essential for employers to communicate the availability of these forms and educate employees about the process and potential impact of their contributions. This empowers employees to make informed decisions while supporting charitable causes that align with their values and ideals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Oakland Michigan Formulario De Deducción De Nómina De Contribución Benéfica?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Oakland Charitable Contribution Payroll Deduction Form is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Oakland Charitable Contribution Payroll Deduction Form. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Charitable Contribution Payroll Deduction Form in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!