The Lima Arizona Charitable Contribution Payroll Deduction Form is a document used to facilitate employee donations to various charitable organizations or causes. This form is specifically designed for individuals working in Lima, Arizona, who wish to make regular contributions to their chosen charities through automatic payroll deductions. By filling out this form, employees can specify the amount they want to donate from each paycheck, helping them contribute to their favorite causes conveniently and consistently. This form requires the employee to provide their personal information, such as name, employee identification number, and contact details. Additionally, employees need to input their desired donation amount, frequency of deduction (such as monthly or bi-weekly), and the specific charitable organization or because they wish to support. The Lima Arizona Charitable Contribution Payroll Deduction Form ensures a transparent and structured process for employees to allocate a portion of their earnings to charitable causes effortlessly. This not only allows individuals to actively participate in philanthropy but also promotes a culture of giving within the Lima community. Types of Lima Arizona Charitable Contribution Payroll Deduction Forms: 1. General Charitable Contribution Form: This form is used when employees want to make a donation to a wide range of eligible charities. It provides space for employees to list multiple organizations or causes they wish to support, along with their respective donation amounts. 2. Specific Charity Contribution Form: Sometimes, companies may partner with a specific charity or run an employee-driven campaign in support of a particular cause. In such cases, a dedicated form is created to streamline contributions towards the specified charity. This form typically includes pre-filled details regarding the chosen charity and its mission. 3. Campaign-Specific Charitable Contribution Form: Employers often organize special fundraising campaigns or drives for a limited period, such as during holidays or emergencies. For these events, a unique form is designed to capture the employee's donation preferences for the specific campaign. These forms may include additional fields to capture employee participation in related events or volunteering opportunities. By offering these various types of Lima Arizona Charitable Contribution Payroll Deduction Forms, employers allow their workforce to support a diverse set of charities or contribute towards specific causes, creating a positive impact both locally and globally.

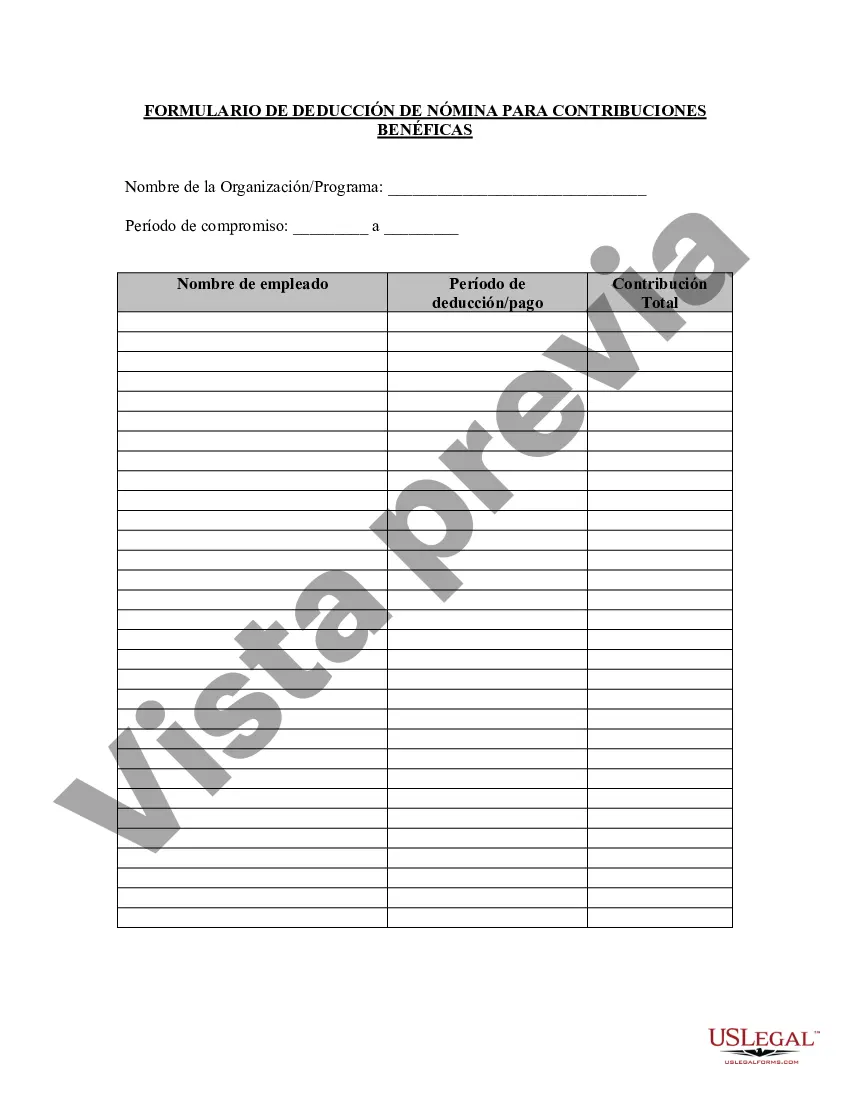

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Pima Arizona Formulario De Deducción De Nómina De Contribución Benéfica?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Pima Charitable Contribution Payroll Deduction Form is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Pima Charitable Contribution Payroll Deduction Form. Follow the instructions below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Pima Charitable Contribution Payroll Deduction Form in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!