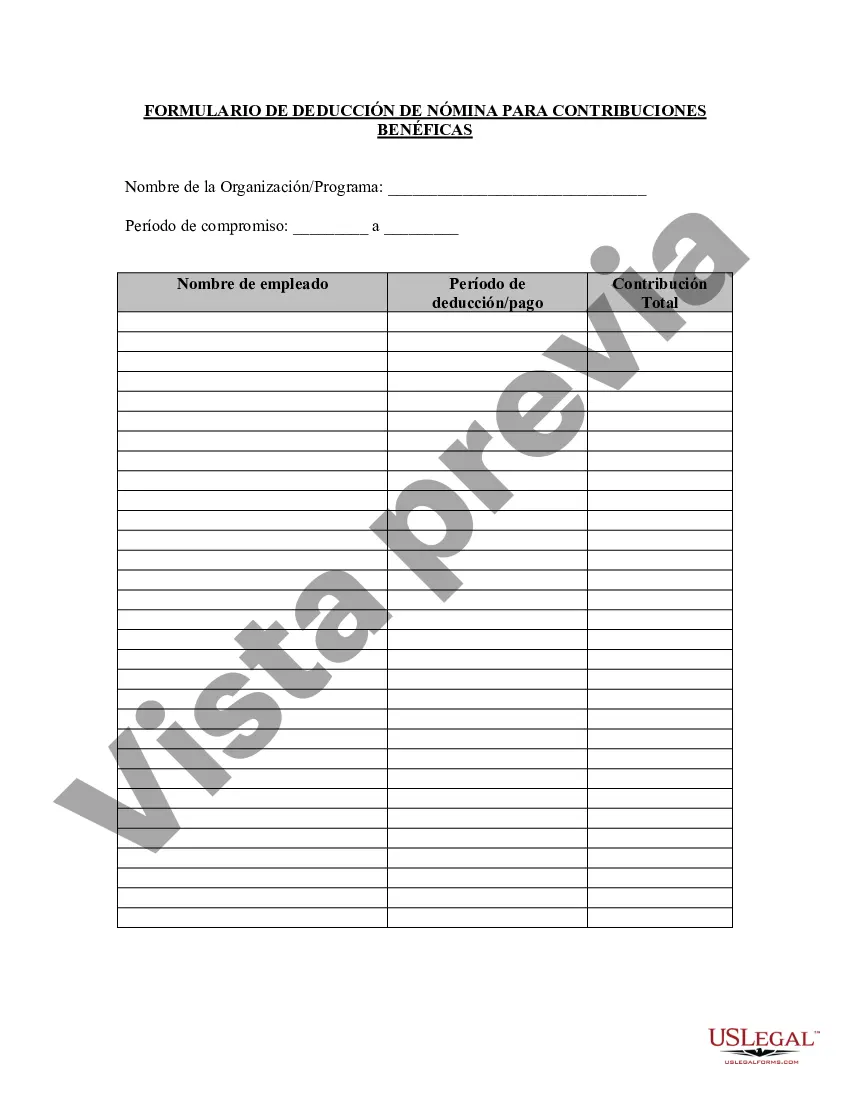

The Salt Lake Utah Charitable Contribution Payroll Deduction Form is a document designed for employees in the Salt Lake City, Utah area to make charitable donations directly from their paychecks. This convenient form allows individuals to support their preferred causes and give back to the community in an easy and systematic manner. To initiate a charitable contribution through payroll deduction, individuals can obtain the Salt Lake Utah Charitable Contribution Payroll Deduction Form from their employer's human resources department or the payroll office. This document typically includes several sections that provide important information and instructions for the process. The form generally starts with personal details such as the employee's name, address, and contact information. To ensure accurate payroll deduction, employees may need to provide their employee identification number or social security number. It is essential to fill out these sections completely for efficient processing. The Salt Lake Utah Charitable Contribution Payroll Deduction Form also includes a section where employees can specify the charity or charities they wish to support. Rather than donating to a single organization, some forms allow individuals to contribute to multiple charities simultaneously. This flexibility enables employees to distribute their donations among various causes based on their personal preferences and philanthropic goals. Furthermore, the form may contain a segment dedicated to specifying the donation amount or percentage of their paycheck that employees want to contribute regularly. Whether it's a fixed sum or a percentage, individuals can choose the most suitable option based on their financial situation and desired level of support. It is important to note that there could be several variations of the Salt Lake Utah Charitable Contribution Payroll Deduction Form, as different employers may have customized versions to meet their specific requirements. These variations can include additional sections for employees to provide special instructions, change their contribution amounts, or select from pre-approved charitable organizations based on the company's corporate social responsibility initiatives. Employers often provide detailed instructions alongside the form, guiding employees through the process of completing and submitting the form. The Salt Lake Utah Charitable Contribution Payroll Deduction Form is typically designed to be straightforward and user-friendly, ensuring that employees can easily navigate the document and make their desired charitable contributions without any hassle. By utilizing the Salt Lake Utah Charitable Contribution Payroll Deduction Form, individuals have the opportunity to make a meaningful impact on their community. This form promotes a culture of philanthropy by making it convenient and accessible for employees to contribute to various charitable causes, ultimately helping organizations in need and fostering a sense of unity and collective social responsibility.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Salt Lake Utah Formulario De Deducción De Nómina De Contribución Benéfica?

Draftwing paperwork, like Salt Lake Charitable Contribution Payroll Deduction Form, to manage your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for a variety of cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Salt Lake Charitable Contribution Payroll Deduction Form form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Salt Lake Charitable Contribution Payroll Deduction Form:

- Ensure that your form is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Salt Lake Charitable Contribution Payroll Deduction Form isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!