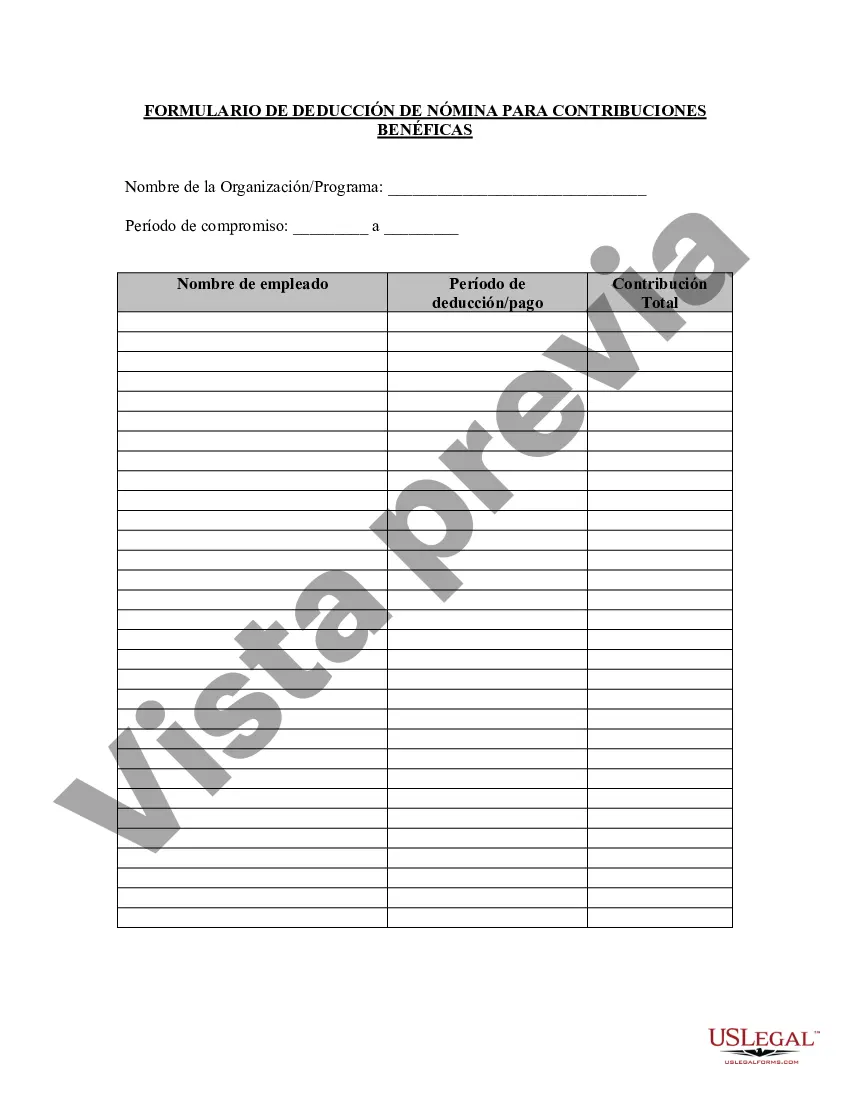

The San Jose California Charitable Contribution Payroll Deduction Form is an official document utilized by employees to contribute a portion of their earnings to charitable organizations. This voluntary payroll deduction program allows individuals to support causes they care about while simplifying the donation process. Keyword: San Jose California Charitable Contribution Payroll Deduction Form This form serves as an efficient means for San Jose residents to enhance philanthropic efforts and actively give back to their local community. By completing this form, employees authorize their employer to deduct a specified amount from each paycheck, ensuring regular contributions to the chosen charity or charities. San Jose California offers various types of Charitable Contribution Payroll Deduction Forms to cater to the diverse interests and preferences of their residents. Some different types of payroll deduction forms include: 1. General Charitable Contribution Payroll Deduction Form: This is the standard form used to designate a portion of the employee's salary for charitable giving. It grants employees the flexibility to allocate their contributions to a broad range of registered charitable organizations operating within San Jose. 2. Employee Emergency Assistance Fund Deduction Form: This form focuses on providing financial assistance to fellow employees during times of crisis or unexpected hardship. Employees can contribute a portion of their salary to establish an emergency fund aimed at supporting colleagues facing unforeseen circumstances such as natural disasters, medical emergencies, or personal tragedies. 3. Education Support Fund Deduction Form: This form caters specifically to the educational needs of San Jose's students. With this charitable contribution, employees can donate a portion of their earnings to educational institutions, scholarship programs, or initiatives aimed at enhancing educational opportunities and supporting students' academic endeavors. 4. Environmental Conservation Fund Deduction Form: This specialized form addresses the importance of environmental sustainability and supports initiatives dedicated to preserving San Jose's natural resources. Employees can select this option to contribute towards organizations working on environmental conservation, biodiversity protection, and sustainable development. 5. Animal Welfare Fund Deduction Form: For those passionate about improving animal welfare and protection, this form allows employees to contribute to animal shelters, rescue centers, and organizations dedicated to the well-being and humane treatment of animals within the San Jose community. In conclusion, the San Jose California Charitable Contribution Payroll Deduction Form empowers employees to make a positive impact in their community by conveniently allocating a portion of their income towards charitable causes. By offering various types of deduction forms, San Jose ensures that residents have the opportunity to support charities aligned with their specific interests and values.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out San Jose California Formulario De Deducción De Nómina De Contribución Benéfica?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft San Jose Charitable Contribution Payroll Deduction Form without professional help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid San Jose Charitable Contribution Payroll Deduction Form on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the San Jose Charitable Contribution Payroll Deduction Form:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!