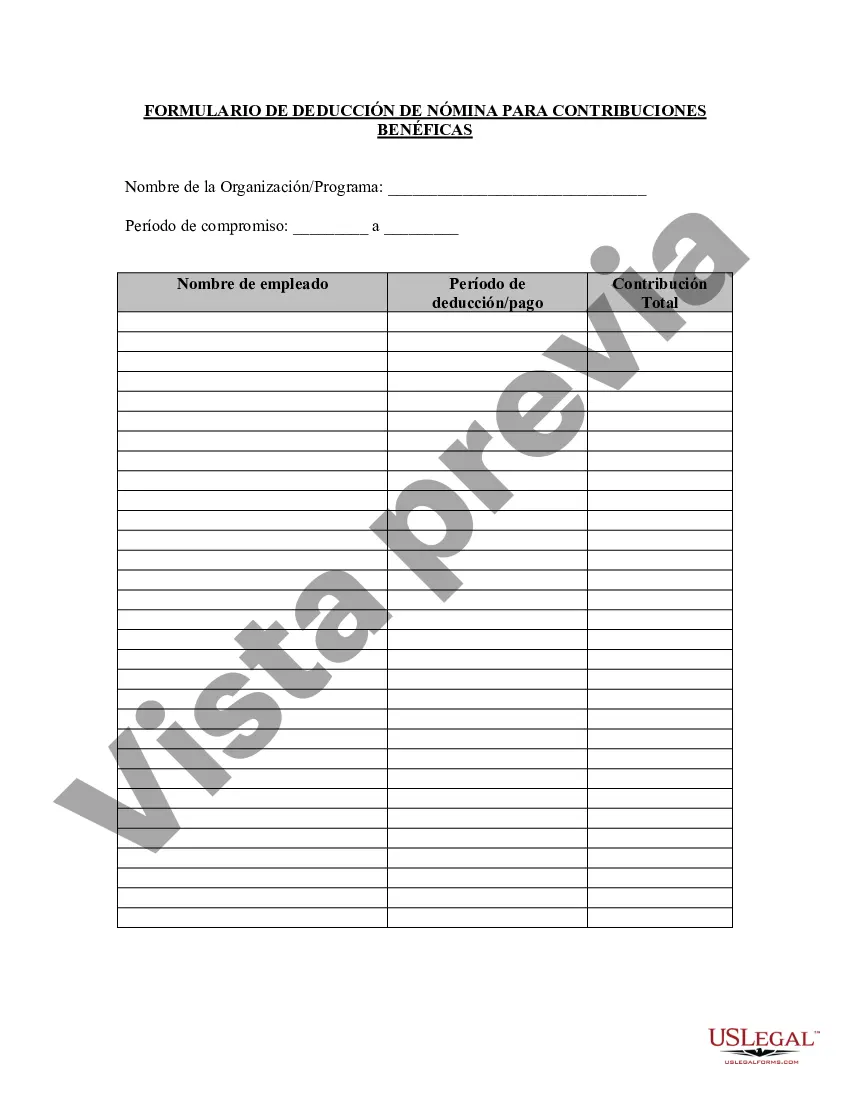

Wayne Michigan Charitable Contribution Payroll Deduction Form is a document that facilitates the process of voluntary payroll deductions made by employees to support charitable organizations in Wayne, Michigan. This form allows employees to contribute a specific amount or a percentage of their salary towards charitable causes directly from their paychecks. The Wayne Michigan Charitable Contribution Payroll Deduction Form serves as a convenient tool for employees to show their philanthropic support to the community. By filling out this form, individuals can establish recurring donations which are deducted automatically from their wages, making it an efficient and hassle-free way to contribute towards the betterment of the community. The form typically requires the employee's personal information, including their name, address, contact details, and employee identification number. Additionally, it may also ask for the name and address of the charitable organization(s) the employee wishes to support, along with the specific donation amount or percentage to be deducted. There might be different types or variations of the Wayne Michigan Charitable Contribution Payroll Deduction Form: 1. Basic Charitable Contribution Form: This standard version allows employees to make a one-time or ongoing deduction from their paychecks to support a single charitable organization of their choice. 2. Multiple Charities Contribution Form: This variation of the form allows employees to split their contributions among multiple charitable organizations. It may require additional fields or sections where employees can specify the donation amount or percentage allocated to each chosen charity. 3. Seasonal or Event-based Contribution Form: This specific type of form is designed for employees who wish to make temporary payroll deductions during specific times of the year or for special events. For example, it may be used during holiday seasons or to support disaster relief efforts. Overall, the Wayne Michigan Charitable Contribution Payroll Deduction Form represents a valuable means for individuals to play an active role in supporting their community by making regular, automatic contributions to charities of their preference. It helps streamline the donation process, ensuring that employees' contributions are accurately recorded and directed to the organizations they wish to support.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Wayne Michigan Formulario De Deducción De Nómina De Contribución Benéfica?

Creating documents, like Wayne Charitable Contribution Payroll Deduction Form, to take care of your legal affairs is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents crafted for a variety of cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Wayne Charitable Contribution Payroll Deduction Form template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Wayne Charitable Contribution Payroll Deduction Form:

- Make sure that your template is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Wayne Charitable Contribution Payroll Deduction Form isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and download the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Estados Unidos - Impuestos sobre la renta de los trabajadores FechaTipo medio: Individuo SMTipo maximo201923,9%46,0%201823,8%46,0%201726,1%48,6%201625,8%48,6%18 more rows

Un W4 es un formulario del IRS que utilizan los empleadores para recopilar informacion sobre sus empleados. Cuando consigues un empleo , sea temporal o de trabajo remoto , una de las partes del proceso de reclutamiento es completar el W4.

El Formulario W-4 (SP) le indica a usted, como empleador, el estado civil, los ajustes por multiples empleos, las cantidades de creditos, otros ingresos y deducciones del empleado, ademas de toda cantidad adicional a retener de la paga del empleado.

El Formulario W-4 indica a su empleador que tantos impuestos le van a retener a usted de sus cheques de pago y enviarlos directamente al IRS (la oficina de los impuestos) y al estado. Esta retencion de cada uno de sus cheques de pago, paga parte de los impuestos sobre sus ingresos anuales.

Estados Unidos - Impuestos sobre la renta de los trabajadores FechaTipo medio: Individuo SMTipo maximo201923,9%46,0%201823,8%46,0%201726,1%48,6%201625,8%48,6%18 more rows

Con un salario anual de $ 120,000 en Mexico, usted sera gravado $ 16,453. Es decir, su salario neto sera de $ 103,547 al ano o $ 8,629 al mes. Su tasa impositiva promedio es de 13.7% y su tasa impositiva marginal es de 21.4%.

El porcentaje de Seguro Social (OASDI, por sus siglas en ingles) es 6.20% que se aplica a los ingresos hasta la cantidad maxima sujeta a impuestos (vea la tabla a continuacion).

Si eres soltero y estas en la categoria del 22% para el 2022, no pagaras 22% sobre todos tus ingresos tributables. Pagaras el 10% sobre el ingreso tributable hasta $10,275, el 12% sobre el monto entre $10,275 y $41,775, y el 22% sobre el ingreso por encima de ese nivel (hasta $89,075).

Como revisar y entender el formulario W-2 Casilla a: Numero de seguro social (SSN) del empleado. Casilla b: Numero de identificacion del empleador (EIN). Casilla "c": Nombre del empleado, domicilio, y codigo postal. Casilla e: Nombre del empleado. Casilla "f": Direccion postal del empleado.

W2 vs W4: Comparacion W2 vs W4W4PropositoAyuda al empleador a determinar cuanto retener de los cheques de pago de los empleados para fines fiscales.Llenado y envioLo llena el empleado y se lo presenta al empleador.2 more rows