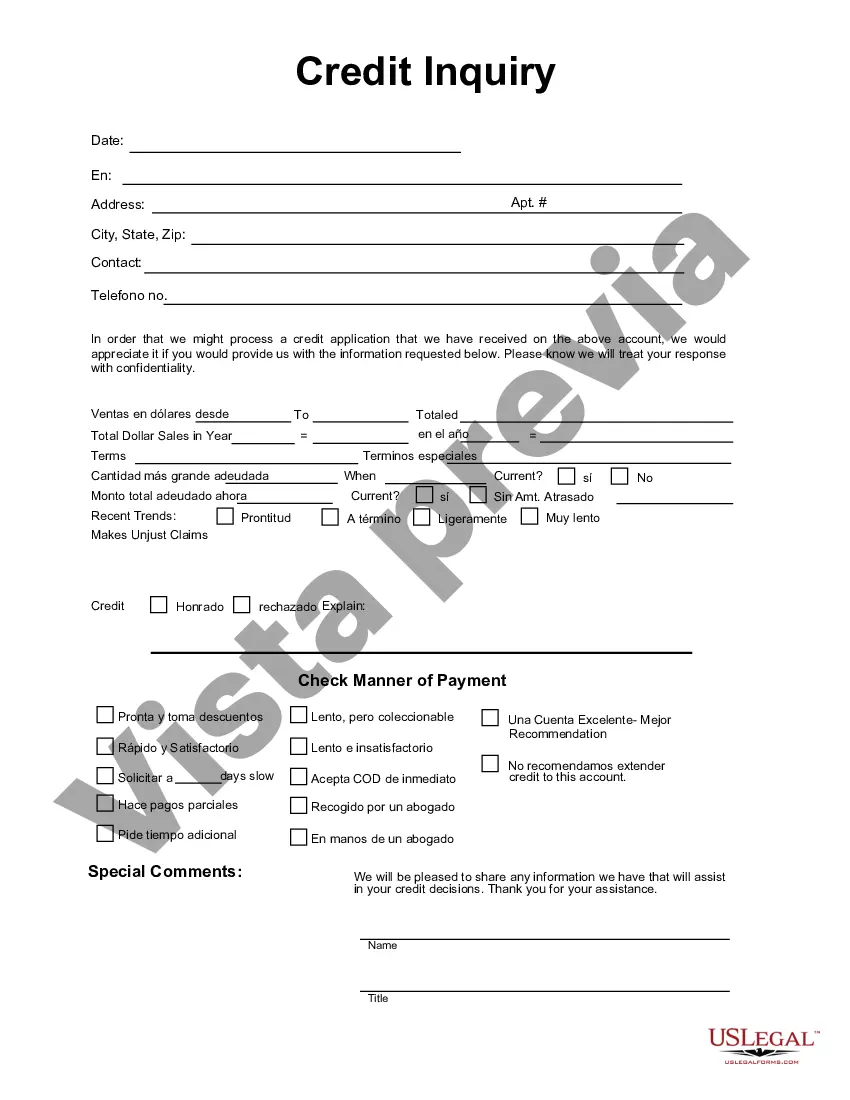

Chicago Illinois Credit Inquiry refers to the process through which financial institutions and lenders assess an individual's creditworthiness or evaluate the risks associated with providing them with credit or loans in the state of Illinois. It involves requesting and reviewing an individual's credit report, which summarizes their credit history and financial activities. In Chicago, Illinois, there are primarily two types of credit inquiries: hard inquiries and soft inquiries. 1. Hard inquiries: A hard credit inquiry occurs when a lender, such as a bank or credit card company, pulls an individual's credit report with their explicit consent, typically when they apply for credit. It is done to make a thorough assessment of the applicant's financial background and creditworthiness. Multiple hard inquiries within a short period can affect an individual's credit score negatively. 2. Soft inquiries: Soft credit inquiries occur when an individual requests their own credit report or when potential creditors or employers check their credit for pre-approval purposes. These inquiries do not impact the credit score and are often used for informational or background check purposes. Chicago, Illinois Credit Inquiry is crucial for individuals seeking to obtain loans, mortgages, credit cards, or any form of credit. By pulling an individual's credit report, lenders can determine their payment history, outstanding debts, credit limit utilization, and other factors that contribute to their creditworthiness. This information helps them assess the risk associated with extending credit to the applicant. Additionally, credit inquiries may also be conducted by landlords, insurance companies, or utility service providers in Chicago, Illinois, to evaluate the applicant's financial responsibility and determine whether they pose a risk in terms of payment defaults or non-payment. It is important to note that individuals in Chicago, Illinois, have the right to obtain a free credit report annually from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion). Monitoring credit reports regularly can help individuals identify any inaccuracies, detect fraudulent activity, and maintain good credit standing. In conclusion, credit inquiries are an integral part of the lending process in Chicago, Illinois. By evaluating an individual's credit history and financial activities, lenders can make informed decisions about extending credit. Understanding the different types of credit inquiries, such as hard and soft inquiries, can help individuals manage their credit and make responsible financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Consulta de crédito - Credit Inquiry

Description

How to fill out Chicago Illinois Consulta De Crédito?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the Chicago Credit Inquiry.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Chicago Credit Inquiry will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Chicago Credit Inquiry:

- Make sure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Chicago Credit Inquiry on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!