Collin Texas Credit Inquiry is a process that involves assessing an individual's credit history and financial background. It is conducted by financial institutions, lenders, or creditors to evaluate a person's creditworthiness when they apply for loans, credit cards, mortgages, or any other form of credit. This inquiry helps lenders determine the level of risk associated with lending money to a specific individual. In Collin Texas, there are primarily two types of credit inquiries: hard inquiries and soft inquiries. 1. Hard Inquiries: A hard inquiry occurs when an individual applies for credit, and the creditor conducts a thorough review of their credit report. These inquiries can impact the credit score and stay on the credit report for up to two years. Lenders typically perform hard inquiries when considering applications for significant loans like a mortgage or car loan. 2. Soft Inquiries: Soft inquiries occur when an individual's credit report is accessed without their explicit request. These inquiries do not affect credit scores and are merely used for informational purposes. Soft inquiries often occur when background checks are conducted by potential employers or when pre-approved credit offers are sent to individuals. Insurance companies and landlords may also perform soft inquiries. For those living in Collin Texas, it is essential to be aware of credit inquiries as they play a significant role in one's financial health. Applying for credit should be done strategically to minimize the number of hard inquiries, as multiple hard inquiries within a short period could potentially raise concerns about a person's creditworthiness. In conclusion, Collin Texas Credit Inquiry is a vital process for lenders and creditors to assess an individual's creditworthiness. It allows them to determine the level of risk associated with lending money. Understanding the different types of inquiries, such as hard and soft inquiries, is crucial when managing credit and making financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Consulta de crédito - Credit Inquiry

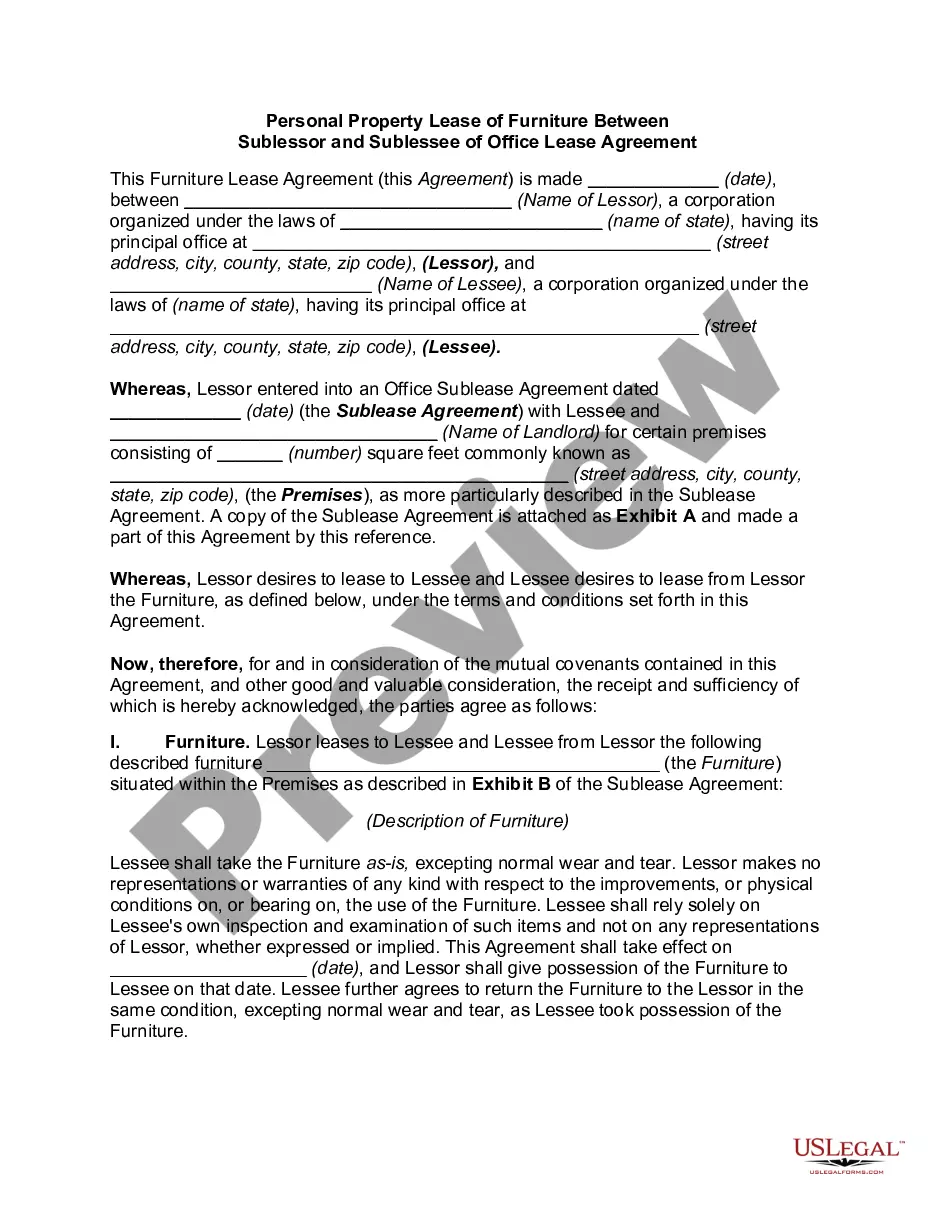

Description

How to fill out Collin Texas Consulta De Crédito?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Collin Credit Inquiry without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Collin Credit Inquiry on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Collin Credit Inquiry:

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a few clicks!