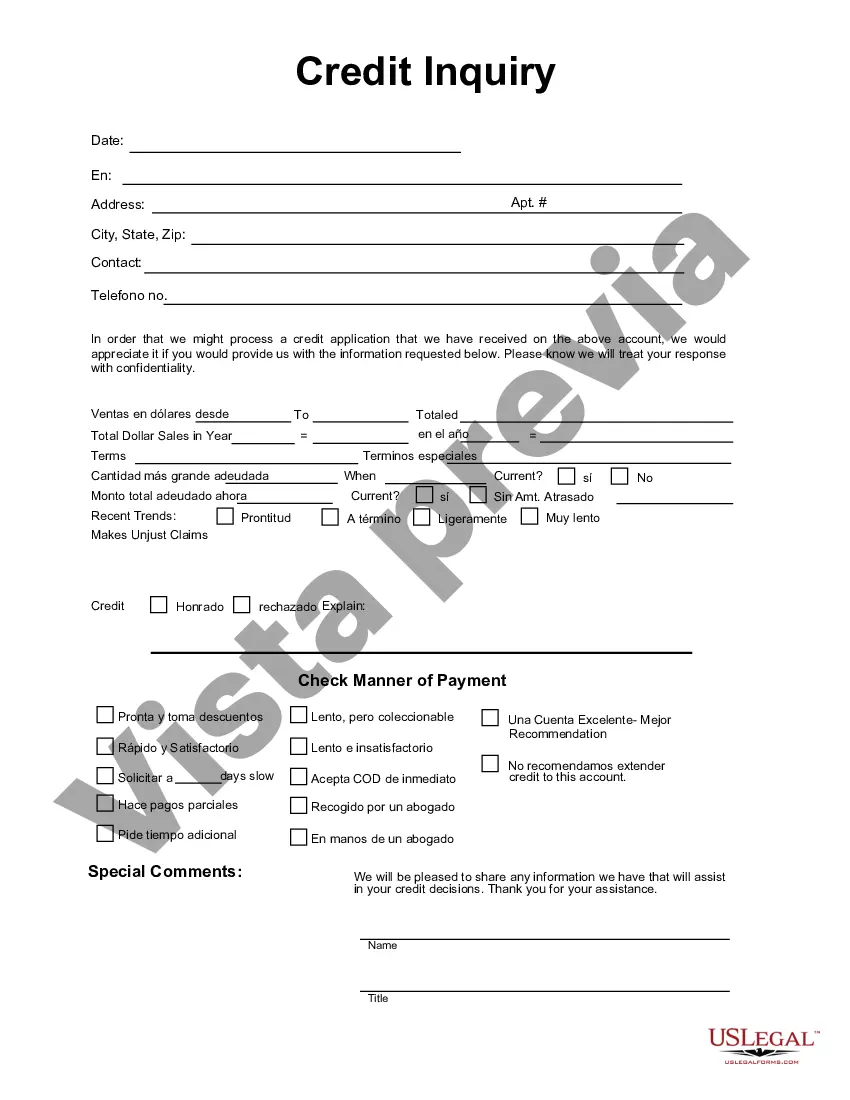

Fairfax Virginia Credit Inquiry refers to the process of reviewing an individual's or a business's credit history by a potential lender or creditor based in Fairfax, Virginia. This inquiry is crucial in determining the creditworthiness of an applicant for loan or credit approval. The results of the credit inquiry play a significant role in the decision-making process for lenders, landlords, and other entities that rely on credit information for assessing financial risk. Fairfax Virginia Credit Inquiry involves requesting and accessing credit reports from the major credit bureaus, such as Equifax, Experian, and TransUnion. These credit reports offer a comprehensive overview of an individual's credit history, including details about their payment history, outstanding debts, credit limits, recent credit applications, and public records such as bankruptcies or tax liens. There are two primary types of Fairfax Virginia Credit Inquiries: hard inquiries and soft inquiries. Hard inquiries occur when an individual applies for credit, such as a loan, credit card, or mortgage. These inquiries are typically initiated by the applicant and can impact their credit score momentarily. Excessive hard inquiries within a short period may raise concerns to lenders, as it indicates a potential risk of taking on additional debt. On the other hand, soft inquiries are credit inquiries that occur without an individual's knowledge or explicit permission. These inquiries are often initiated by entities looking to pre-approve individuals for credit offers, potential employers conducting background checks, or existing lenders monitoring their clients' credit profiles. Soft inquiries do not affect the credit score and are only visible to the individual when reviewing their own credit report. When individuals in Fairfax, Virginia are applying for credit, it is essential to understand which type of credit inquiry is being conducted. It is advisable to limit hard inquiries, as too many can negatively impact credit scores, while soft inquiries have no impact on creditworthiness. Being aware of the credit inquiry process and monitoring credit reports regularly can help individuals maintain a healthy credit profile and make informed financial decisions. In conclusion, Fairfax Virginia Credit Inquiry is a vital process that allows lenders and other entities to assess an individual's creditworthiness. It involves reviewing credit reports obtained from the major credit bureaus. Understanding the distinction between hard and soft inquiries is crucial to managing and maintaining a good credit score in Fairfax, Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Consulta de crédito - Credit Inquiry

Description

How to fill out Fairfax Virginia Consulta De Crédito?

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Fairfax Credit Inquiry, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the recent version of the Fairfax Credit Inquiry, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Credit Inquiry:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Fairfax Credit Inquiry and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!