Harris Texas Credit Inquiry is a comprehensive credit information service that operates in the state of Texas, providing individuals and businesses with access to their credit reports and credit scores. It is an essential tool for anyone looking to understand their financial standing and make informed decisions regarding credit. Harris Texas Credit Inquiry offers detailed credit reports that include information about an individual's credit history, including account balances, payment history, credit limits, and any negative items such as late payments or bankruptcy filings. Through this service, individuals can monitor and manage their credit profiles to ensure accuracy and identify any potential errors or fraudulent activities. The service also provides individuals with their credit scores, which are numerical representations of their creditworthiness. These scores help lenders and financial institutions determine an individual's creditworthiness when applying for loans, credit cards, or other forms of credit. The higher the credit score, the better the chances of obtaining favorable credit terms. There are several types of Harris Texas Credit Inquiry available, catering to different needs and preferences: 1. Standard Credit Inquiry: This is the most basic level of credit information service, providing individuals with access to their credit reports and credit scores. It helps users understand their credit standing and identify areas for improvement. 2. Credit Monitoring: This type of credit inquiry allows individuals to regularly monitor their credit profiles for any changes or suspicious activities. It provides real-time alerts for any significant alterations to the credit report, such as new accounts opened or inquiries made. 3. Identity Theft Protection: Harris Texas Credit Inquiry offers comprehensive identity theft protection services. These services actively monitor an individual's credit information and personal data to detect any signs of identity theft or fraud. In case of any suspicious activities, individuals are promptly notified and provided with guidance on necessary steps to resolve the issue. 4. Credit Counseling: Harris Texas Credit Inquiry also provides credit counseling services to individuals seeking expert guidance on improving their credit scores and overall financial health. Qualified professionals analyze credit reports, provide personalized advice, and create strategies for optimizing credit profiles. In conclusion, Harris Texas Credit Inquiry is a valuable credit information service that offers detailed credit reports, credit scores, credit monitoring, identity theft protection, and credit counseling. It caters to various needs and helps individuals and businesses in Texas gain better control over their financial well-being and make informed credit decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Consulta de crédito - Credit Inquiry

Description

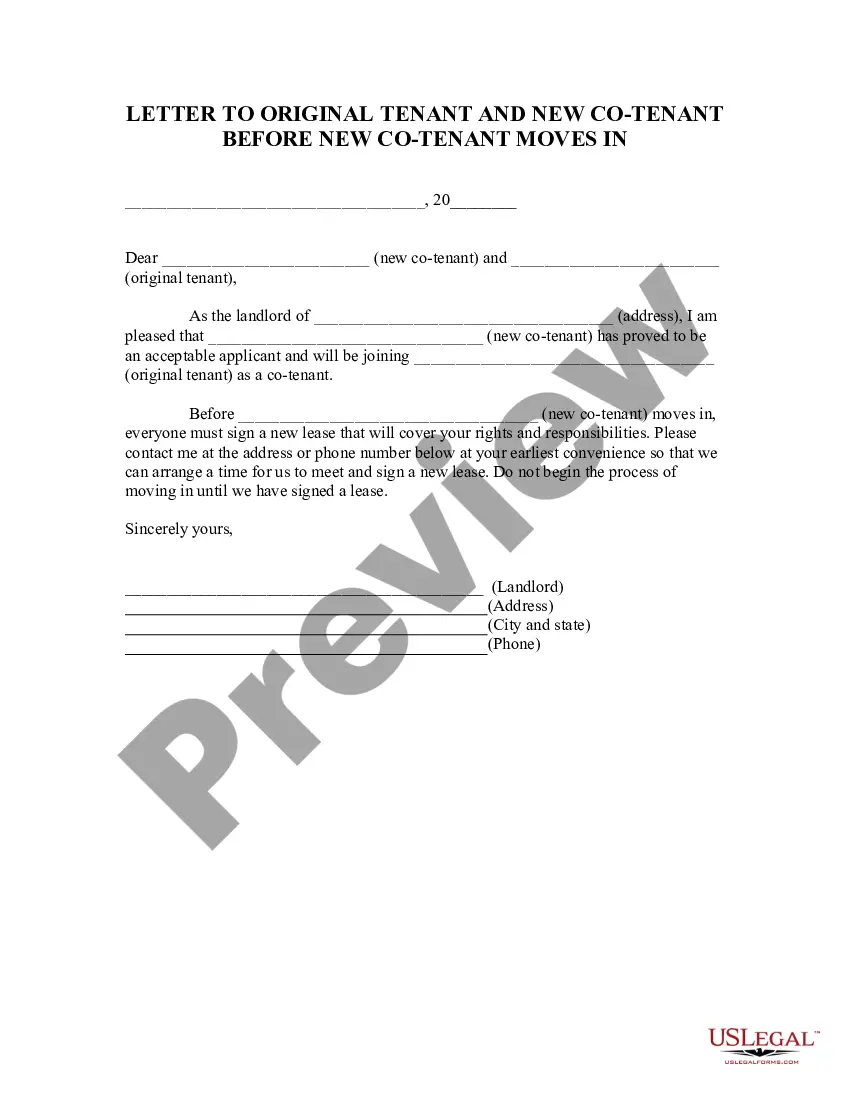

How to fill out Harris Texas Consulta De Crédito?

Are you looking to quickly create a legally-binding Harris Credit Inquiry or probably any other document to manage your personal or corporate affairs? You can go with two options: contact a professional to write a valid paper for you or create it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Harris Credit Inquiry and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Harris Credit Inquiry is adapted to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Harris Credit Inquiry template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the templates we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!