Middlesex Massachusetts Credit Inquiry is a process that involves assessing an individual's creditworthiness or financial history in Middlesex County, Massachusetts. It is an essential step taken by lenders, financial institutions, landlords, and others to make informed decisions regarding granting credit, loans, rental agreements, or other financial transactions. Credit inquiries help determine if an individual is reliable and able to meet their financial obligations. Middlesex Massachusetts Credit Inquiry can be categorized into two types: hard inquiries and soft inquiries. 1. Hard Inquiries: A hard inquiry is performed when an individual formally applies for credit, such as a loan, credit card, or mortgage. The lender or financial institution obtains a comprehensive credit report from a credit bureau, such as Experian, Equifax, or TransUnion, to evaluate the applicant's creditworthiness. Hard inquiries can have a temporary negative impact on a person's credit score, particularly if multiple inquiries are made within a short period. 2. Soft Inquiries: Soft inquiries are credit checks that do not impact an individual's credit score. They occur when someone, like a potential employer or landlord, wants to verify an applicant's credit history or when an individual checks their own credit report. These inquiries are mostly used for informational purposes and do not affect an individual's creditworthiness. Middlesex Massachusetts Credit Inquiry plays a vital role in assessing an individual's creditworthiness and financial stability. Lenders and financial institutions carefully evaluate various factors such as credit history, payment patterns, outstanding debts, and credit utilization ratios to determine the risk associated with extending credit to an individual. This assessment assists in determining the terms and conditions of credit, including interest rates, credit limits, and loan amounts. It is important for individuals to be aware of their credit history and regularly monitor their credit reports. This allows them to identify any errors, potential fraud, or discrepancies in their credit profile. Additionally, maintaining a positive credit history, paying bills on time, and keeping credit utilization low can improve an individual's creditworthiness and increase their chances of obtaining credit or loans at favorable terms. In conclusion, Middlesex Massachusetts Credit Inquiry is a crucial procedure used to evaluate an individual's creditworthiness and financial history. Hard inquiries are conducted when a formal credit application is made, while soft inquiries are informational checks that do not affect credit scores. Monitoring and maintaining a positive credit history can significantly impact an individual's ability to obtain credit or secure favorable financial transactions in Middlesex County, Massachusetts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Consulta de crédito - Credit Inquiry

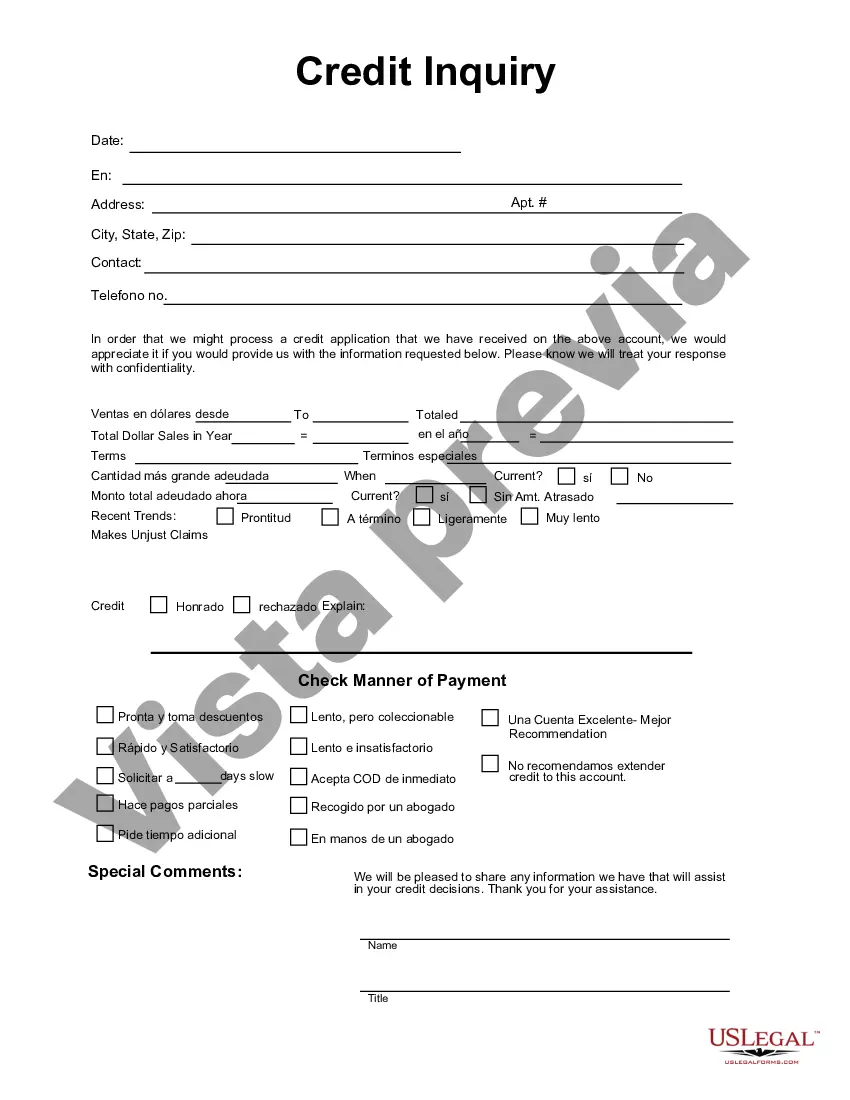

Description

How to fill out Middlesex Massachusetts Consulta De Crédito?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Middlesex Credit Inquiry, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Middlesex Credit Inquiry from the My Forms tab.

For new users, it's necessary to make several more steps to get the Middlesex Credit Inquiry:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!