Nassau New York Credit Inquiry refers to the process of accessing an individual's credit information in Nassau County, located in the state of New York. A credit inquiry typically occurs when a financial institution or lender requests to review a person's credit history and score to assess their creditworthiness before approving a loan, credit card application, or any other line of credit. This inquiry helps lenders evaluate the risk associated with extending credit to an individual and enables them to make informed decisions regarding loan approvals, interest rates, and other credit terms. In Nassau County, New York, there are primarily two types of credit inquiries — hard inquiries and soft inquiries. It is crucial to differentiate between these two types as they have different implications for an individual's credit score and creditworthiness. 1. Hard Inquiry: A hard credit inquiry occurs when a financial institution or lender performs a thorough review of an individual's credit report after the individual has applied for credit. This type of inquiry typically happens when applying for a mortgage, car loan, student loan, or credit card. Hard inquiries may negatively impact a person's credit score, albeit temporarily. Multiple hard inquiries within a short period can indicate to lenders that an individual is actively seeking credit, potentially raising concerns about financial stability. 2. Soft Inquiry: A soft credit inquiry, on the other hand, is a less invasive review of an individual's credit report. It often takes place when a person checks their own credit score, when a potential employer evaluates a candidate, or when a lender pre-approves someone for a loan offer. Soft inquiries do not affect credit scores and are usually only visible to the individual reviewing their credit report. They serve informational purposes and do not impact future credit decisions. It is important to note that while hard inquiries can impact credit scores, the effect is typically minor and short-lived. Lenders consider various factors such as payment history, credit utilization, and overall credit management when assessing an individual's creditworthiness. In summary, Nassau New York Credit Inquiry involves the process of assessing an individual's credit information in Nassau County, New York, to evaluate their creditworthiness. It encompasses both hard and soft inquiries, with hard inquiries typically occurring when applying for credit and soft inquiries serving informational purposes without affecting credit scores. By understanding the different types of credit inquiries, individuals can proactively manage their credit and make informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Consulta de crédito - Credit Inquiry

Description

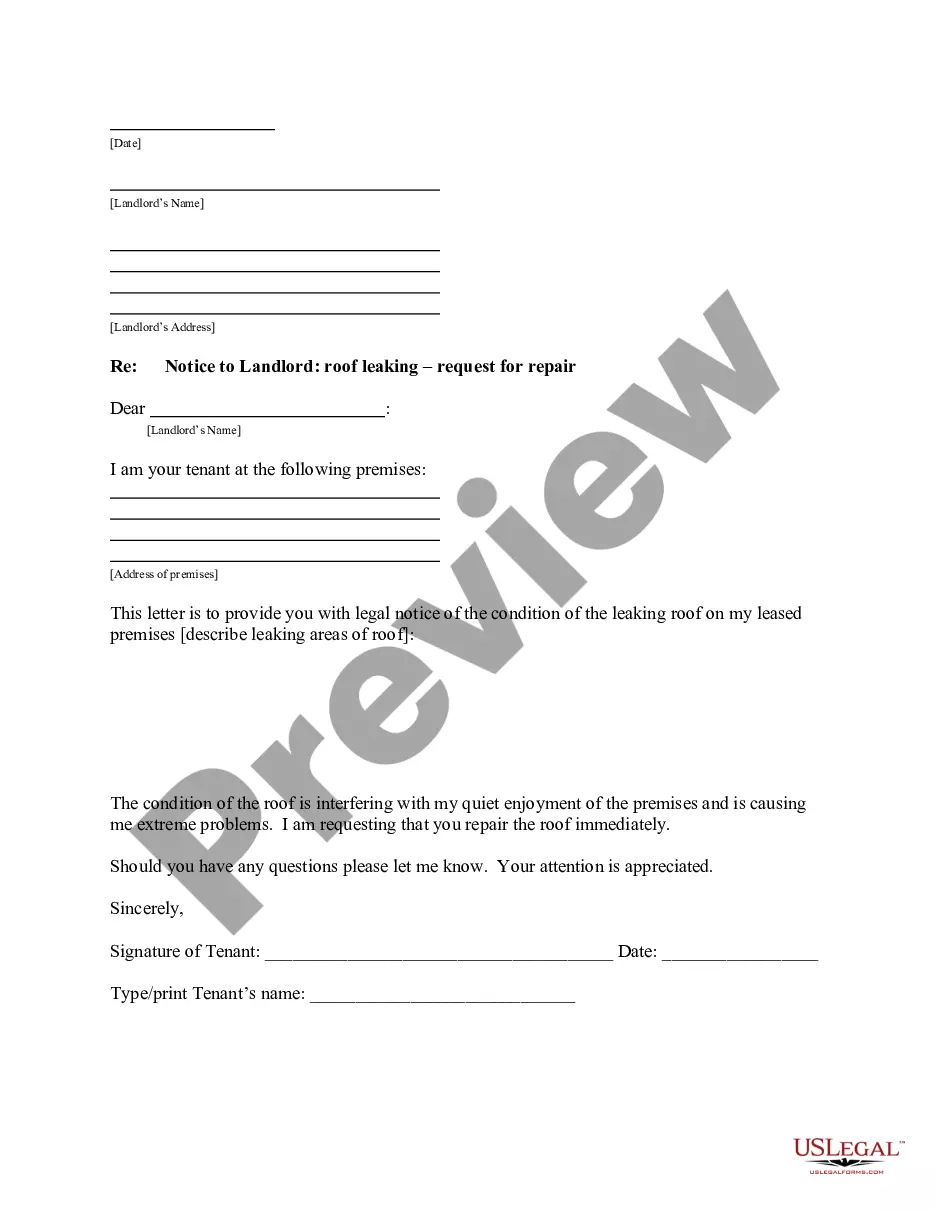

How to fill out Nassau New York Consulta De Crédito?

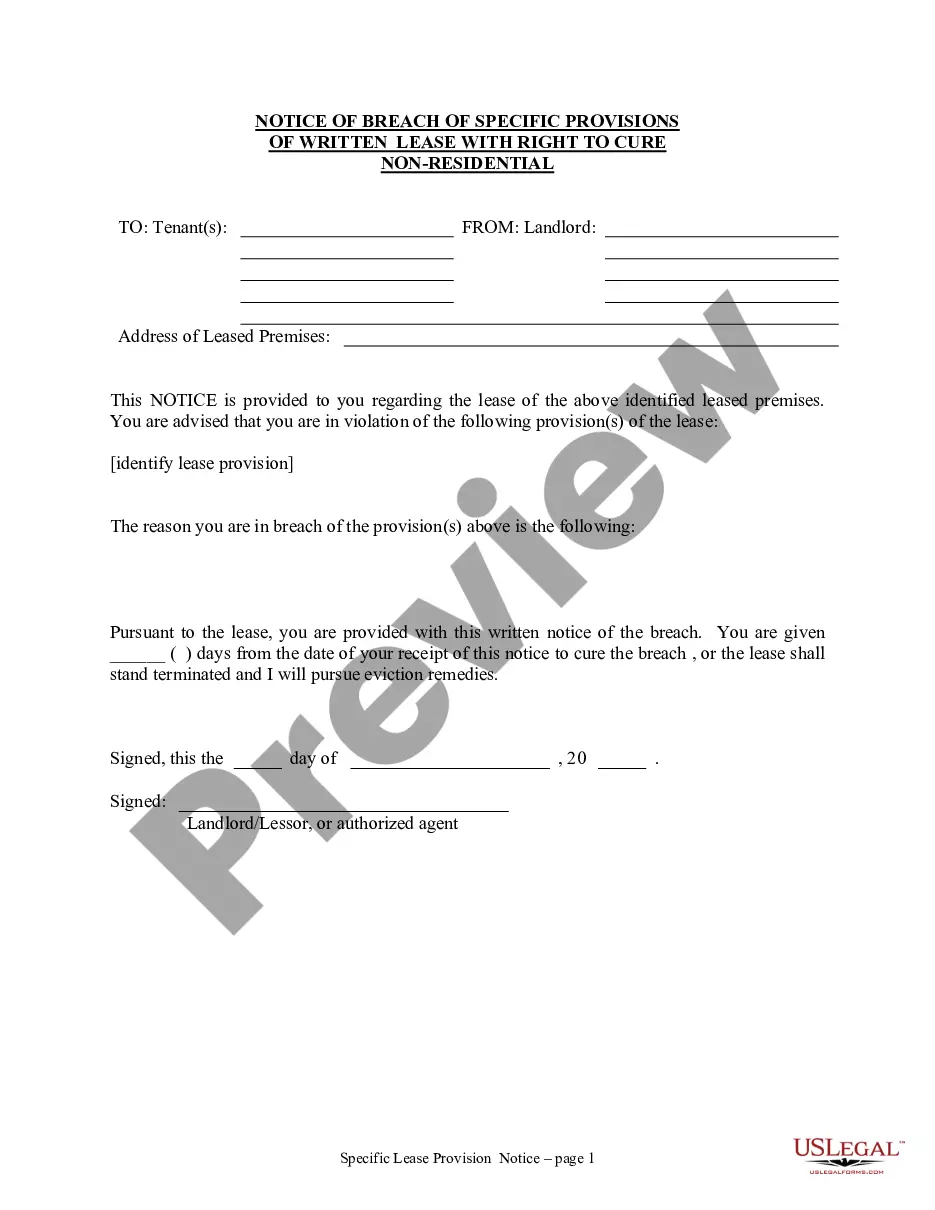

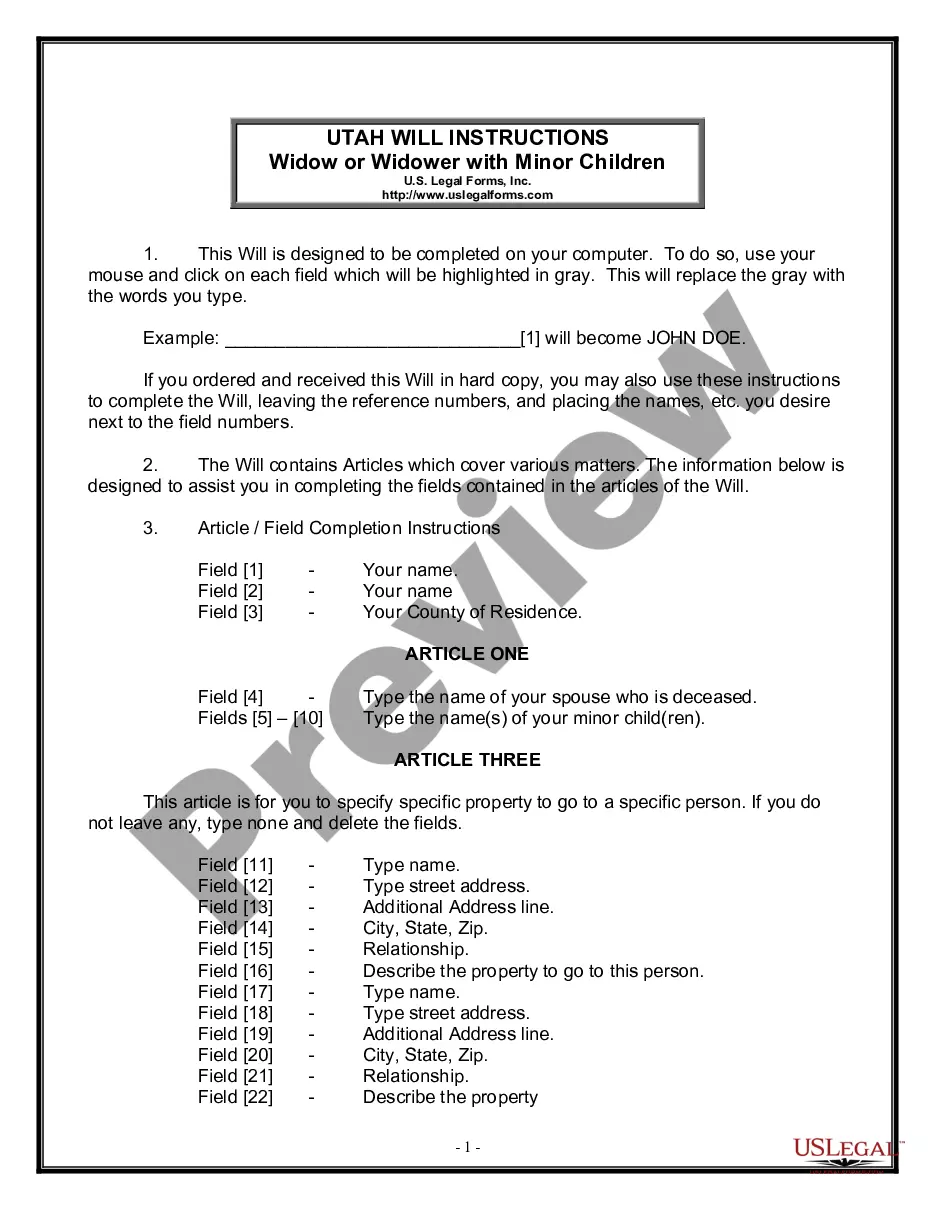

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Nassau Credit Inquiry, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Nassau Credit Inquiry from the My Forms tab.

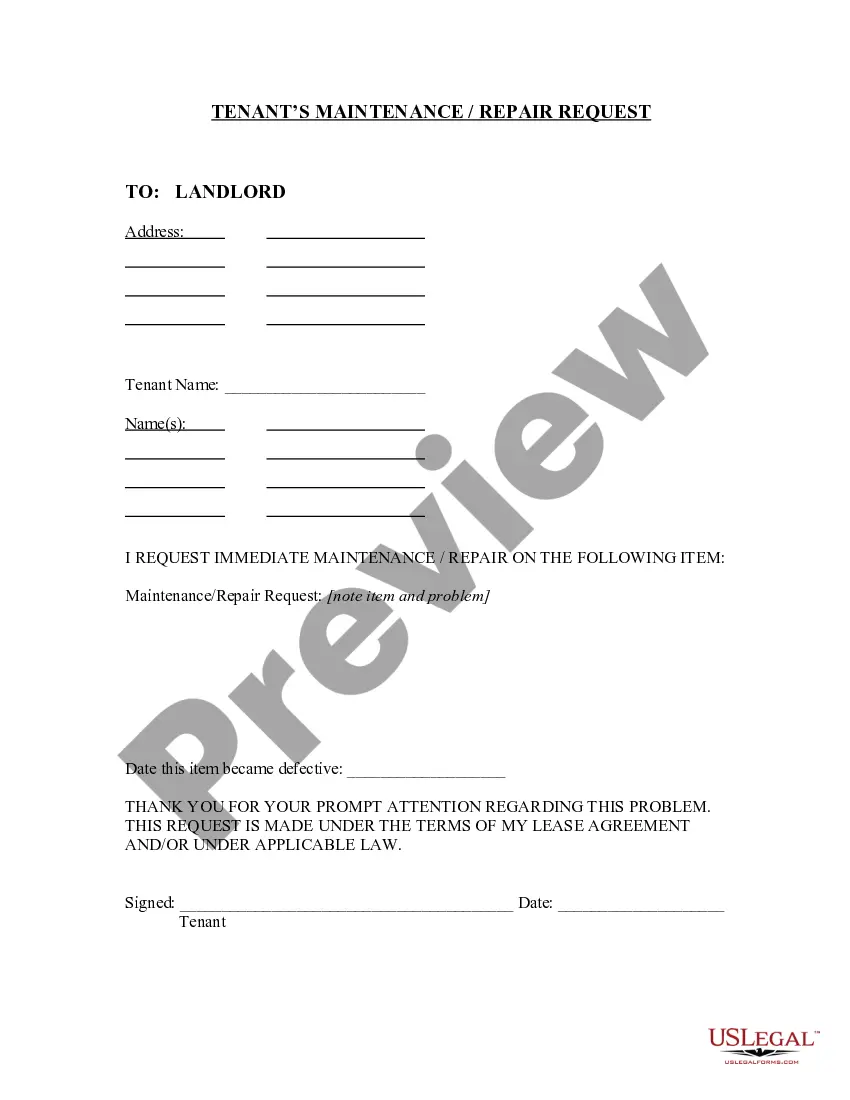

For new users, it's necessary to make some more steps to obtain the Nassau Credit Inquiry:

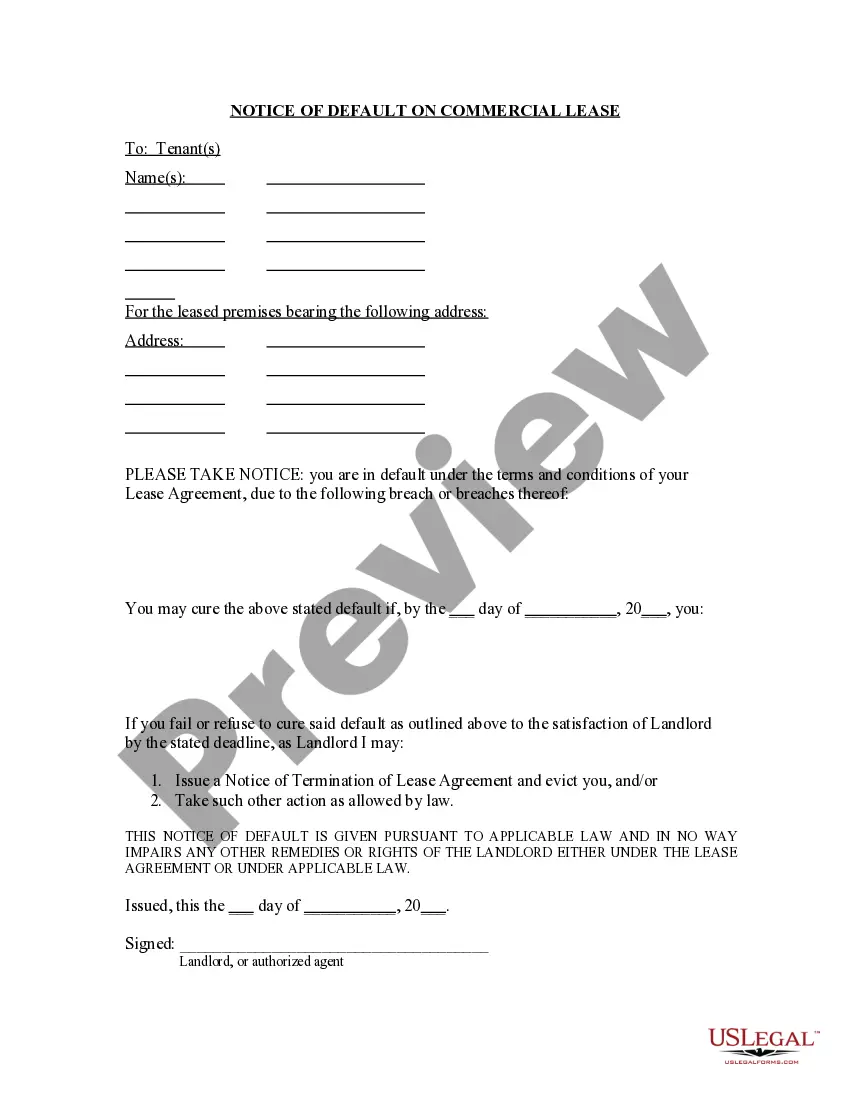

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!