Orange California Credit Inquiry is a process where individuals or businesses request access to an individual's credit report for evaluation purposes. This inquiry is crucial for lenders and other financial institutions to assess the creditworthiness of applicants before approving loans, credit cards, or other financial services. Conducting a credit inquiry helps lenders determine an individual's past credit history, payment behavior, outstanding debts, and overall credit management. There are generally two types of credit inquiries in Orange California: soft inquiries and hard inquiries. Soft inquiries are usually initiated by individuals themselves or by entities conducting background checks. These inquiries don't impact credit scores and are typically seen in situations such as reviewing one's credit report for personal reference or pre-approved credit offers. On the other hand, hard inquiries are triggered when a potential lender, such as a bank or credit card company, requests an individual's credit report during the loan application process. Hard inquiries can slightly lower credit scores and are recorded on credit reports, indicating that the individual has sought new credit. Orange California Credit Inquiry is an essential step for individuals planning major financial moves like applying for a mortgage, auto loan, or student loan. Lenders heavily rely on credit reports and scores to determine the interest rates, credit limits, or loan terms they can offer. By assessing an individual's creditworthiness through a credit inquiry, lenders mitigate risks associated with defaults or delinquent payments. When individuals are interested in monitoring their credit regularly, they can initiate soft inquiries by accessing their credit reports through reputable credit bureaus like Experian, Equifax, or TransUnion. These reports provide a comprehensive summary of the individual's credit history, including accounts, balances, payment history, and any negative or positive entries. By reviewing credit reports periodically, individuals can identify errors, fraud attempts, or areas that need improvement. Due to the potential impact on credit scores, it's crucial for individuals to limit hard inquiries. Applying for multiple loans or credit cards within a short timeframe may raise concerns about a person's borrowing behavior. Thus, it's recommended to carefully consider and research lending options before submitting formal applications. A high number of hard inquiries can not only bring down credit scores but may also give lenders the impression that the individual has financial difficulties or is seeking excessive credit. In conclusion, Orange California Credit Inquiry plays a significant role in evaluating an individual's creditworthiness for various financial services. It serves as an important tool for lenders to determine the likelihood of repayment and set appropriate loan terms. Understanding the different types of inquiries and their potential impact on credit scores is crucial for individuals seeking financial stability and making informed borrowing decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Consulta de crédito - Credit Inquiry

Description

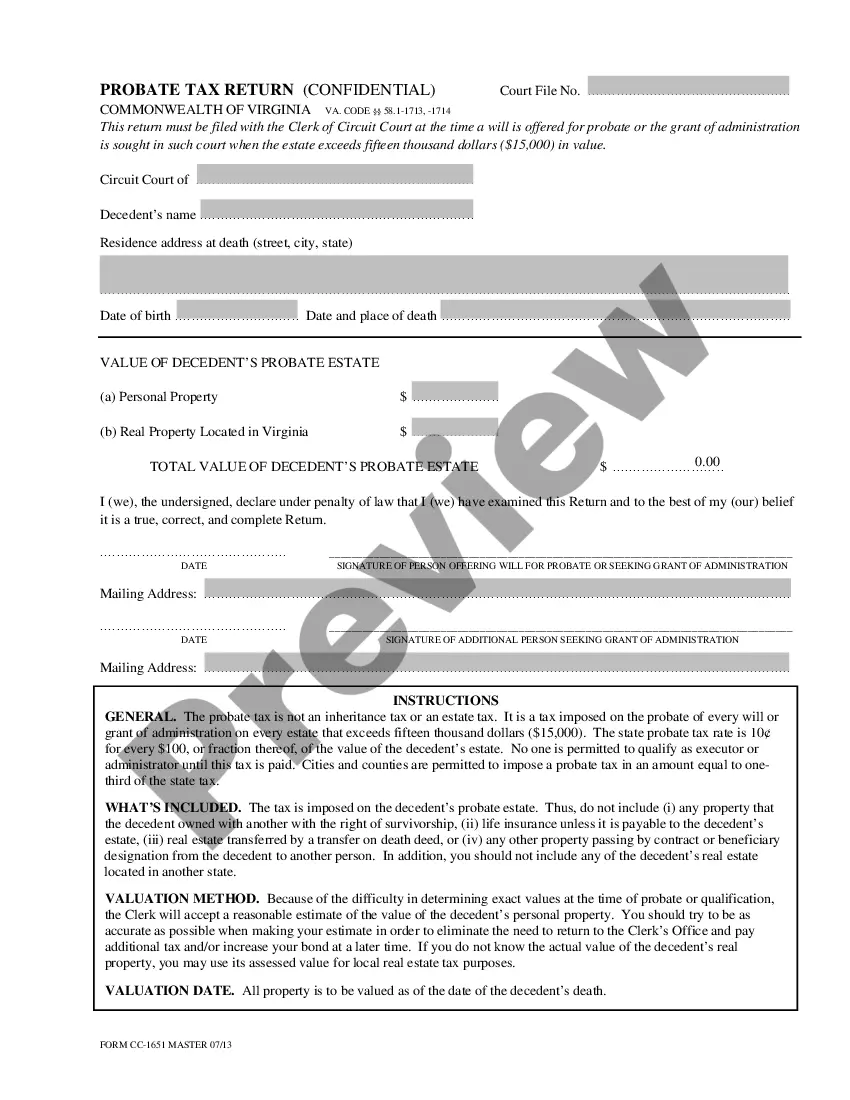

How to fill out Orange California Consulta De Crédito?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Orange Credit Inquiry, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Orange Credit Inquiry from the My Forms tab.

For new users, it's necessary to make several more steps to get the Orange Credit Inquiry:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!